Outflows observed on decentralized perpetual exchange Lighter following its recent airdrop are not unusual, according to Bubblemaps CEO Nicolas Vaiman, as users rebalance positions and chase the next yield opportunity.

On-chain data from Bubblemaps showed roughly $250 million withdrawn from Lighter after it distributed $675 million worth of its native token, LIT, on Tuesday. In an X post, Bubblemaps noted that users pulled approximately $201.9 million on Ethereum and $52.2 million on Arbitrum, questioning whether “all the (yield) farmers were leaving.”

Vaiman told CoinDesk that the outflows represent around 20% of Lighter’s total value locked (TVL), which stands at $1.4 billion per DeFiLlama. He added that while the amount is large, similar withdrawals are common following token airdrops, as users rebalance hedging positions and rotate capital to other farming opportunities.

“Outflows like this were also seen after Hyperliquid and Aster launched their tokens,” Vaiman said. “It will likely happen again with future airdrops such as PERP DEX or Paradex Extended.”

CertiK senior blockchain security researcher Natalie Newson noted that large withdrawals following token generation events (TGEs) are typically driven by early participants and airdrop farmers. “This pattern is not unique to Lighter. Without transparency in token distributions, a few insiders can capture outsized gains shortly after launch,” she said.

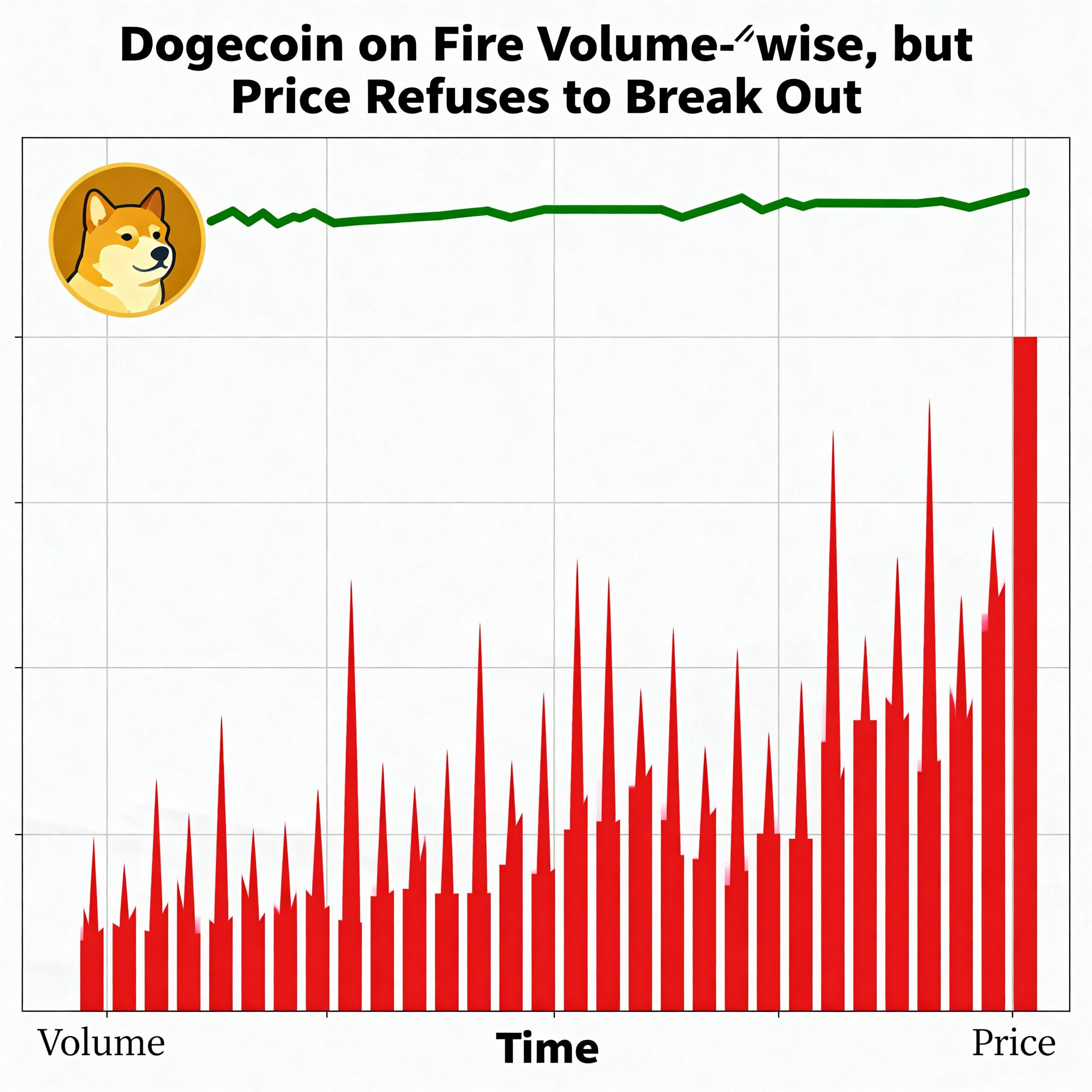

Prior to the airdrop, LIT trading volume had been relatively stable, ranging from $8 billion to $15 billion in November. In recent days, it fell to as low as $2 billion, according to DeFiLlama, while the price of LIT has dropped nearly 23% since Dec. 30, from $3.37 to roughly $2.57.