Crypto Liquidations Hit $514M as Longs Bear the Brunt

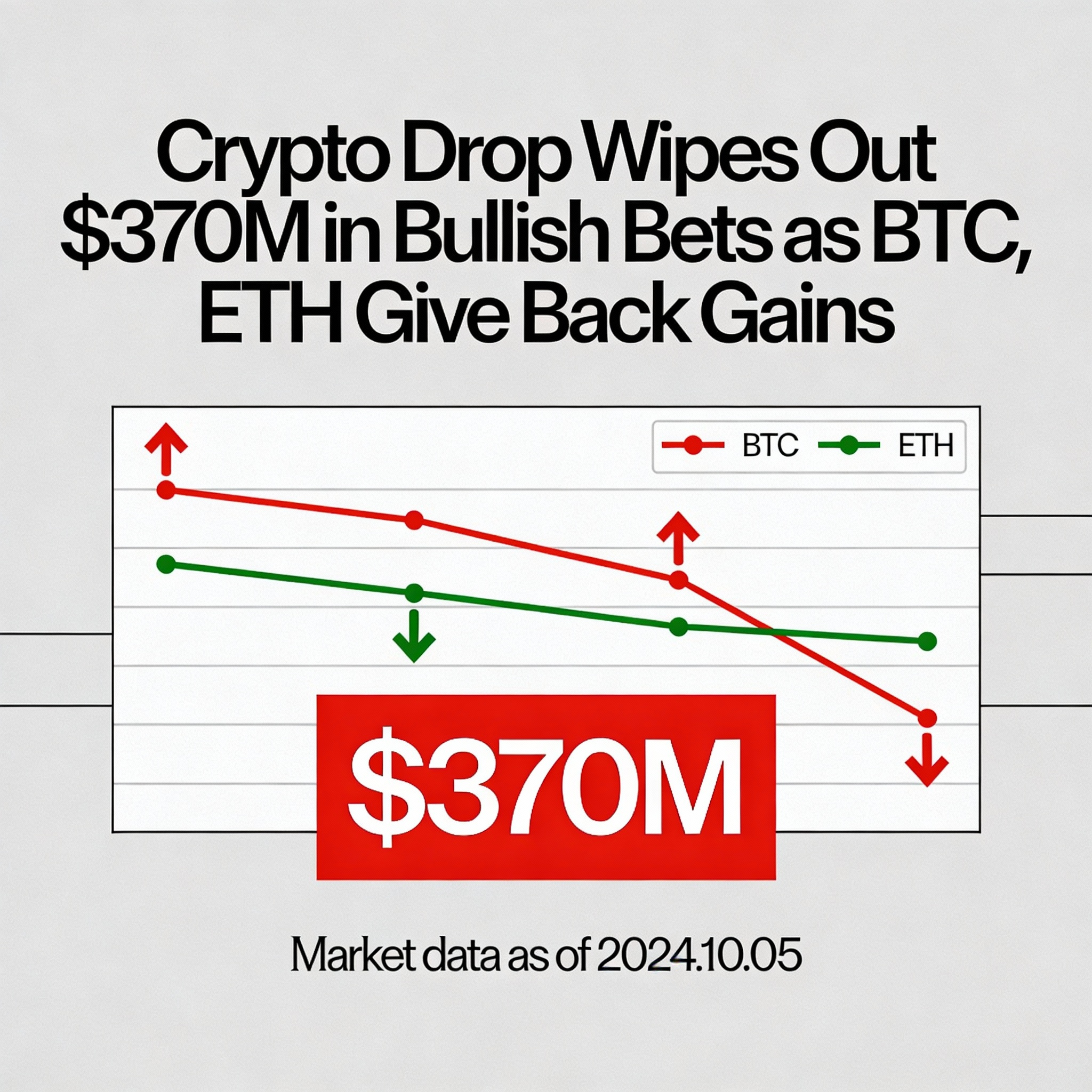

Crypto markets faced one of their largest leverage resets in weeks, with over $514 million in positions liquidated in the past 24 hours following a sharp intraday swing.

Data from CoinGlass shows long positions took the heaviest hit, totaling $376 million—nearly three times the $138 million in short-side liquidations—highlighting how traders had overextended on bullish bets. More than 155,000 traders were liquidated, including a single $23.18 million BTC perpetual position on Hyperliquid.

Exchanges Most Impacted

- Binance: $144.6M in liquidations, 76% long

- Hyperliquid: $115.8M, 83% long

- Bybit: $109.3M, 72% long

Together, these three exchanges accounted for roughly 72% of all forced unwinds.

The liquidation reflects a market that had grown one-sided following Bitcoin’s recent rebound, with traders heavily positioned for continued upside even amid patchy liquidity across BTC and major altcoins.

Rising open interest and elevated funding rates in preceding sessions set the stage for the sharp reset. Liquidation cascades amplify volatility by forcing underwater positions to close at market prices, increasing sell pressure during downturns.

Analysts note that long-side flushes can serve as healthy market-clearing events, removing excess leverage and stabilizing prices if key support levels hold.