Bitcoin, Tech Stocks Fall to Lows as Weak Jobs Data Sparks Rate Cut Bets, Safe-Haven Rally

Risk assets slumped late Friday, with bitcoin and major equity indices hitting session lows following a sharply weaker U.S. jobs report that reinforced expectations of a Federal Reserve rate cut in September.

The July payroll report showed softer-than-expected hiring, while previous estimates for May and June were revised significantly lower. The revised data marked the slowest three-month stretch for job creation since the COVID-era collapse in 2020, further pressuring the Fed to pivot back to monetary easing.

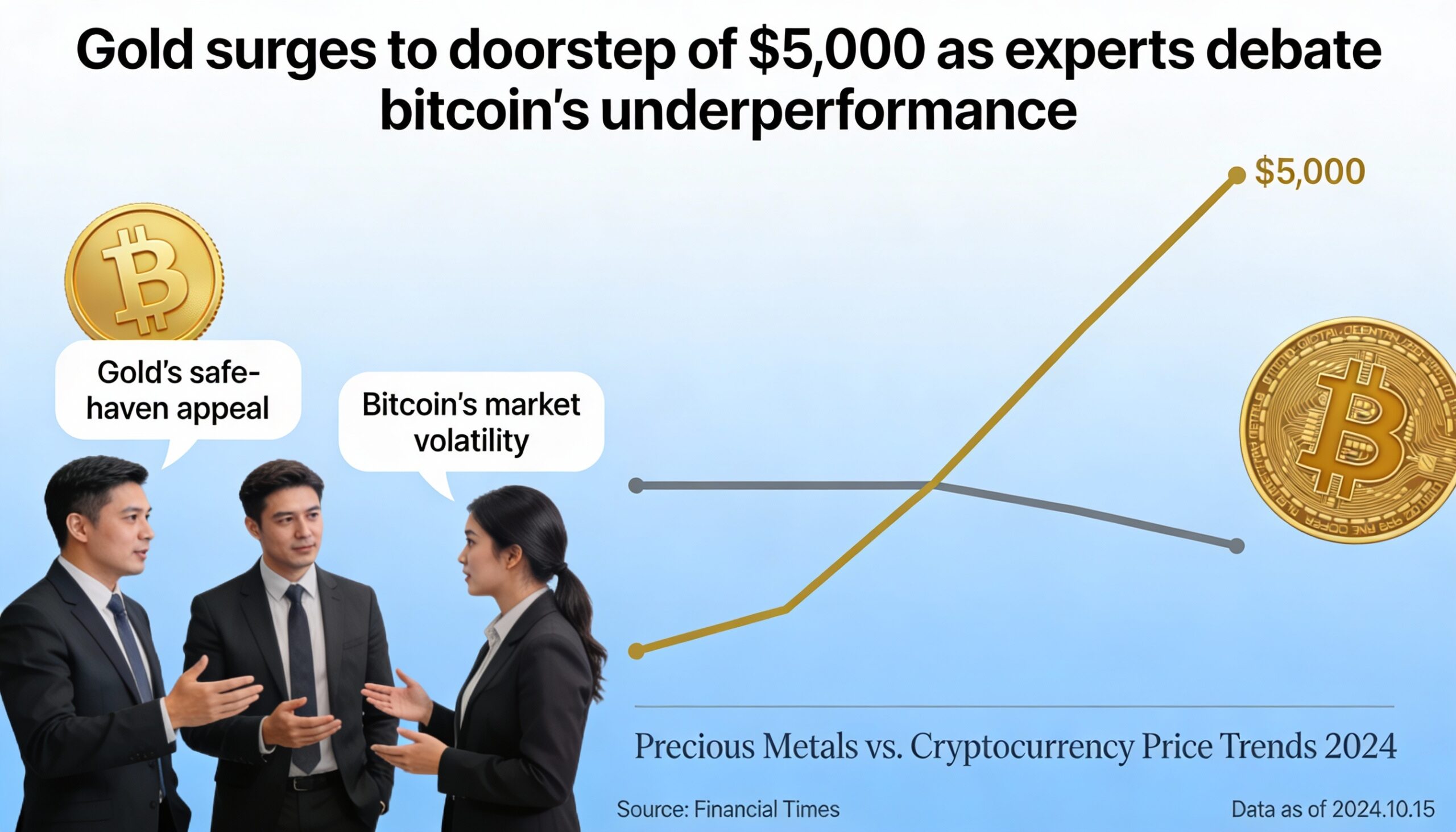

Markets responded swiftly: the 10-year U.S. Treasury yield dropped 14 basis points to 4.22%, and gold surged 1.5% to $3,400 — approaching record highs — as investors sought refuge in safe-haven assets.

Bitcoin, however, followed equities lower. With roughly 90 minutes left in the trading session, the Nasdaq had fallen 2.5%, while bitcoin slid more than 3% to $113,800. Among major digital assets, bitcoin remained one of the more resilient.

Ethereum (ETH), Solana (SOL), BNB, and Dogecoin (DOGE) each lost around 6% on the day. XRP fared better, down 2.9%.

Political Reactions Escalate

Shortly after the report’s release, former President Donald Trump took aim at Fed Chair Jerome Powell, posting on Truth Social: “Jerome ‘Too Late’ Powell is a disaster. DROP THE RATE.” He followed up by calling for the dismissal of Dr. Erika McEntarfer, Commissioner of Labor Statistics, accusing her of manipulating jobs data to favor the Biden administration.

Crypto Stocks Deep in the Red

Crypto-linked equities were among the day’s biggest losers. Coinbase (COIN) sank nearly 18% following a disappointing earnings report Thursday night and broad risk-off sentiment. Robinhood (HOOD), also reporting earnings, slipped 3.1%.

Bitcoin mining firms took a hit as well, with Riot Platforms (RIOT) down 17% and Marathon Digital (MARA) off 3%. Stablecoin issuer Circle (CRCL) declined 7.5%, mirroring the drop in MicroStrategy (MSTR), which maintains one of the largest bitcoin treasuries among public companies.

As the labor data reshapes expectations for Fed policy, investors appear to be retreating to traditional safe havens — while digital assets absorb the brunt of market volatility.