Crypto Market Rebounds as Solana and XRP Surge; Dogecoin Pulls Back After Brief Spike

The crypto market saw varied movements on Wednesday, with Bitcoin (BTC), Ether (ETH), and BNB Chain’s BNB each rising by less than 1%, while Solana’s SOL and XRP enjoyed impressive gains, surging by up to 7%, leading the market recovery.

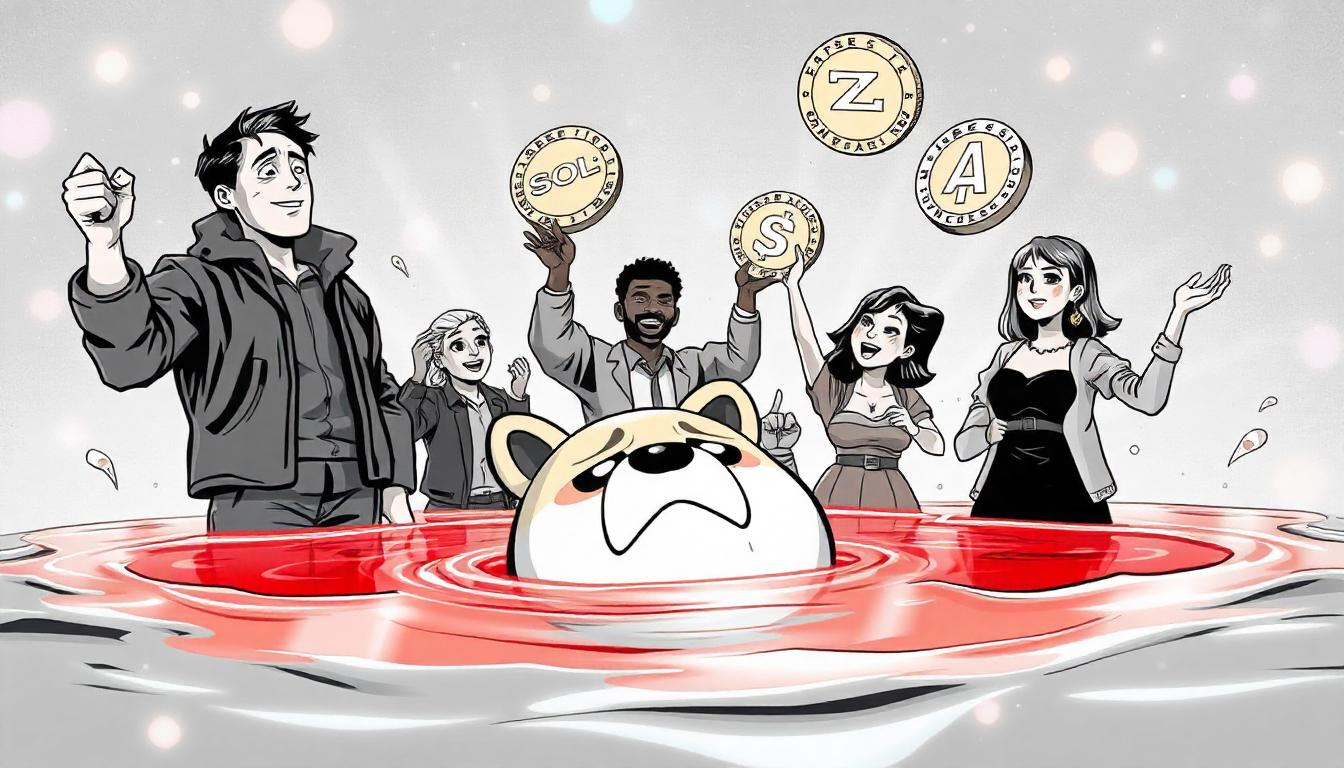

After a significant rally on Tuesday, Dogecoin (DOGE) retraced 7.5%, trading at 36 cents during the European afternoon. It had surged from 34 cents to 38 cents the previous day after the DOGE token logo appeared on the Elon Musk-led Department of Government Efficiency website. However, the website was quickly updated, first featuring an animated dog image, and later just the dogecoin name along with a dollar sign, triggering some profit-taking and market volatility.

Meanwhile, Solana’s SOL saw an 8% increase, contributing to a broader crypto market rebound. The CoinDesk 20 (CD20) index, a benchmark for major cryptocurrencies, posted a 2.57% return.

In the large-cap token space, Hyperliquid’s HYPE led the way with a 13% jump, outperforming other tokens with a market cap above $5 billion. This strong performance has brought traders’ attention to Donald Trump’s executive actions and potential tariff decisions, with the expectation that these could influence market dynamics further.

“Crypto markets have seen some profit-taking as traders await updates on potential tariffs on Mexico and Canada, which could impact the stock market when it opens tomorrow,” said Jeff Mei, COO of BTSE, in a message to CoinDesk. “Despite the current volatility, we remain optimistic that Trump will issue executive orders that roll back some of the Biden administration’s anti-crypto policies. The appointment of Caroline Pham to the CFTC is a positive development.”

Alex Kuptsikevich, an analyst at FxPro, also shared his insights, noting in an email to CoinDesk, “Bitcoin’s quick recovery near $105K shows continued interest in risk assets. When it dropped to $101K, the market quickly bought back in, but as it reached $107K, selling pressure increased. The market is optimistic, but it will require additional catalysts to maintain momentum.”