Bitcoin extended its retreat on Thursday, sliding deeper into correction territory after losing its grip on the closely watched $100,000 level. The cryptocurrency fell to $96,600 in early Asian hours, marking its lowest point since May as global risk sentiment deteriorated amid a sharp reversal in U.S. tech stocks and waning institutional appetite.

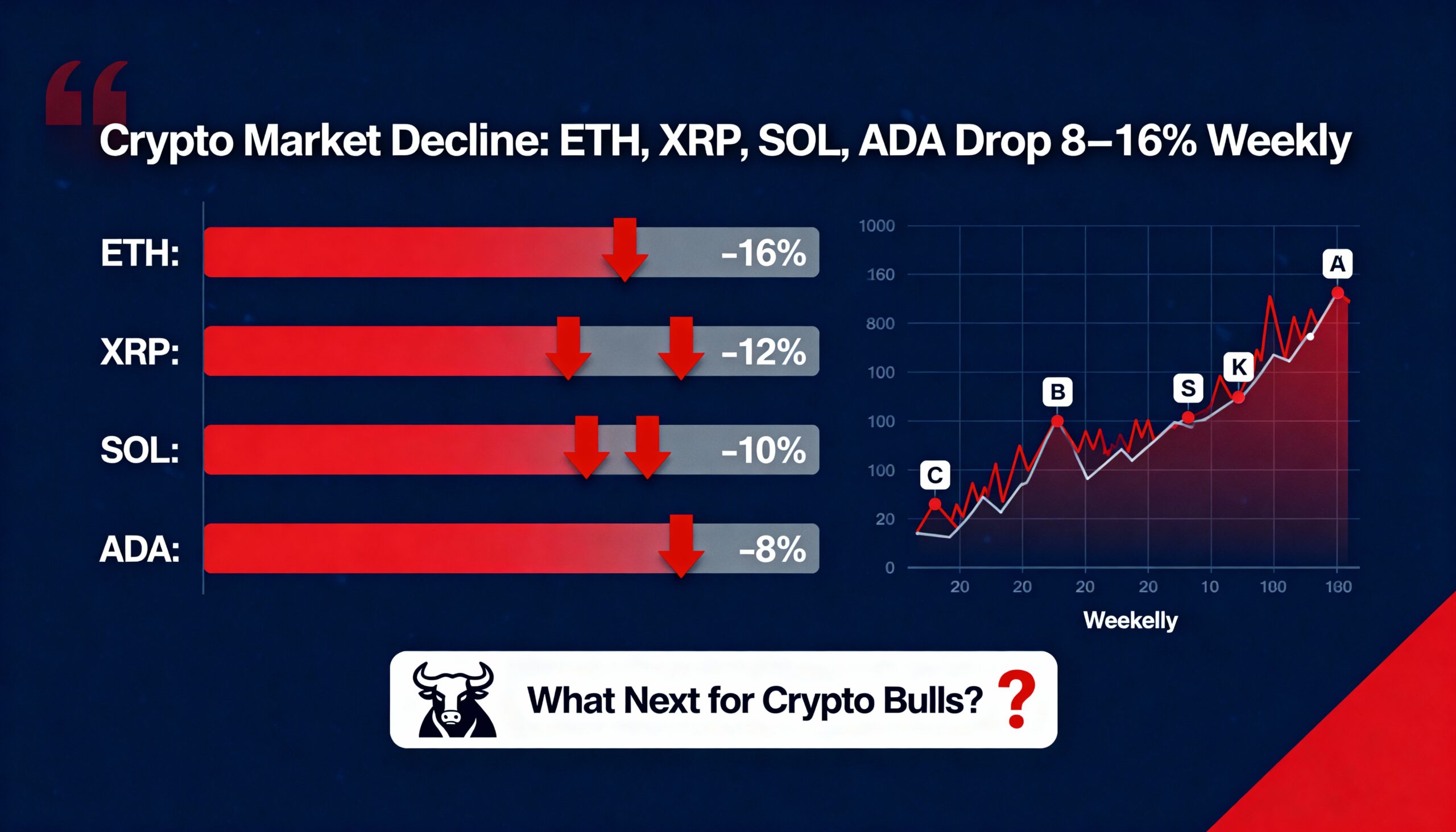

The weakness rippled across the broader market. Ether dropped to $3,182, down nearly 1% on the day and 12% for the week. XRP slipped to $2.25 after an 8.8% weekly decline, while BNB fell to $932, shedding almost 8% over the same period.

Market conditions have deteriorated quickly. ETF inflows have slowed for the second straight week, long-term holders are distributing coins at a faster pace, and retail engagement remains muted. Research firm 10x said the combination of fading fund flows, softer corporate demand and weaker ETF issuance signals that crypto has shifted decisively into a bearish phase.

From a technical standpoint, bitcoin’s breakdown below the monthly mid-range at $100,266 has cleared a major liquidity shelf, exposing the asset to an accelerated slide through thinner price regions. Analysts now identify the $93,000–$95,000 band as the next meaningful support. A failure to hold this area could invite a deeper move toward the $89,600 liquidity gap, derivatives exchange Bitunix told CoinDesk.

Any recovery is expected to face immediate resistance near $100,200, with a stronger ceiling around $107,300 — a zone BTC has struggled to reclaim in recent weeks. Liquidity across order books continues to trend lower, with no clear signs of stabilization.

Bitunix noted that a temporary base could form around $93,000, though a breakdown from that level would leave bitcoin vulnerable to a sharper downside extension. Nick Ruck of LVRG Research added that stabilization near $92,000 will likely depend on whether next week’s FOMC minutes offer any dovish relief. ETF outflows, a looming death-cross pattern and uncertainty tied to post-shutdown economic releases have continued to pressure sentiment.

Thursday’s decline has now wiped out bitcoin’s entire 30% gain from earlier in the year. The sell-off extends a month-long retreat from the Oct. 6 all-time high near $126,251, which was fueled by optimism around the Trump administration’s crypto-friendly stance. That momentum reversed after unexpected tariff remarks from the president unnerved global markets and triggered broad deleveraging across risk assets.

Bitcoin briefly dipped under $93,700 on Sunday before recovering to roughly $94,800 in early Monday trading.