XRP Slips Below $2.15 Amid Heavy Selling, Bears Maintain Control

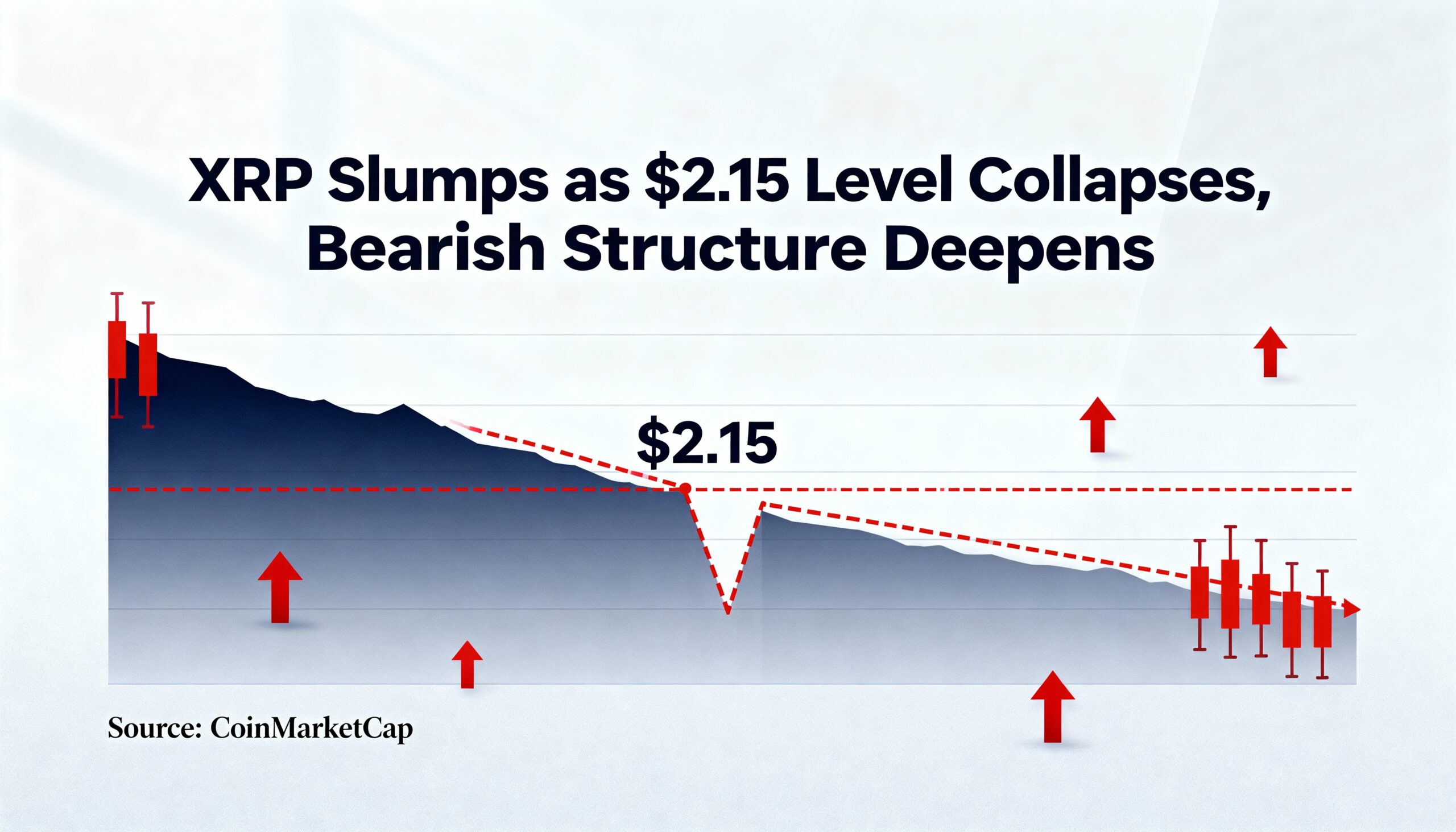

XRP fell 3.6% to $2.13 Tuesday as broader crypto weakness and Bitcoin’s looming ‘Death Cross’ weighed on the market. Institutional selling intensified beneath the key $2.15 support, pushing the token through a volatile $0.17 range with volume surging 76% above the 24-hour average to 177.9 million tokens—highlighting strong participation in the breakdown.

Evening trading saw XRP dip into the $2.04–$2.05 demand zone before buyers temporarily stepped in, lifting the price to $2.11–$2.12. However, the rebound lacked strength, and low volume toward the session’s close signals persistent bearish momentum. Technical charts now display a lower-high, lower-low pattern, confirming continued downside pressure.

Despite optimism around ETF inflows, XRP lagged broader crypto benchmarks, indicating supply dominates near-term fundamentals. The rejection at $2.21 and collapse below $2.15 underscore the market’s sensitivity to key levels. Short-term support at $2.05 offered a brief pause, but the rally lacks volume to sustain upward momentum.

Traders are watching whether XRP can reclaim $2.15. A successful recovery would ease near-term bearish bias, while failure keeps the downside open, particularly as supply clusters persist at $2.13–$2.15 without aggressive buying.

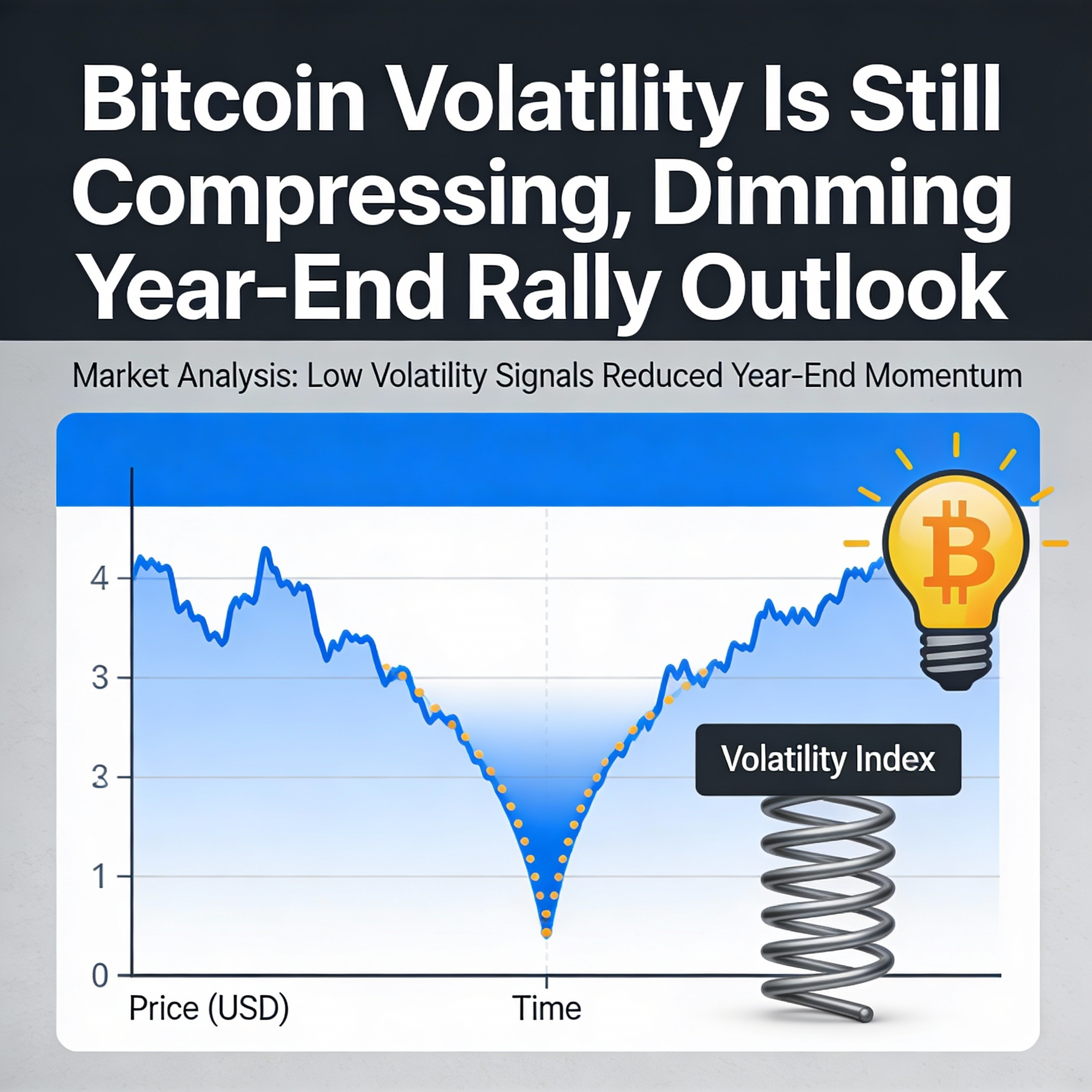

Macro factors continue to pressure the market. Bitcoin’s Death Cross, tightening liquidity, and risk-off flows across altcoins suggest continued volatility, leaving XRP—traditionally a high-beta asset—vulnerable to sector-wide selloffs.