Jefferies says stablecoin leader Tether has rapidly become one of the most influential new forces in the global gold market, helping drive this year’s sharp rally in the metal.

Gold prices have surged more than 50% in 2025 and are now trading near $4,080 per ounce. But according to Jefferies, the move cannot be fully explained by traditional catalysts such as central bank purchases or macro hedging flows. Instead, the bank points to Tether’s aggressive bullion buying, which has tightened supply and added a new layer of demand. Attestation reports and on-chain data show the company has steadily increased its gold reserves in recent months.

Jefferies first became aware of Tether’s ambitions after meeting with miners and royalty firms in Denver last year. At the time, several investors said the company aimed to acquire roughly 100 tons of gold during 2024. Public comments from CEO Paolo Ardoino, along with a sudden $1,000-per-ounce spike in gold prices, reinforced those expectations.

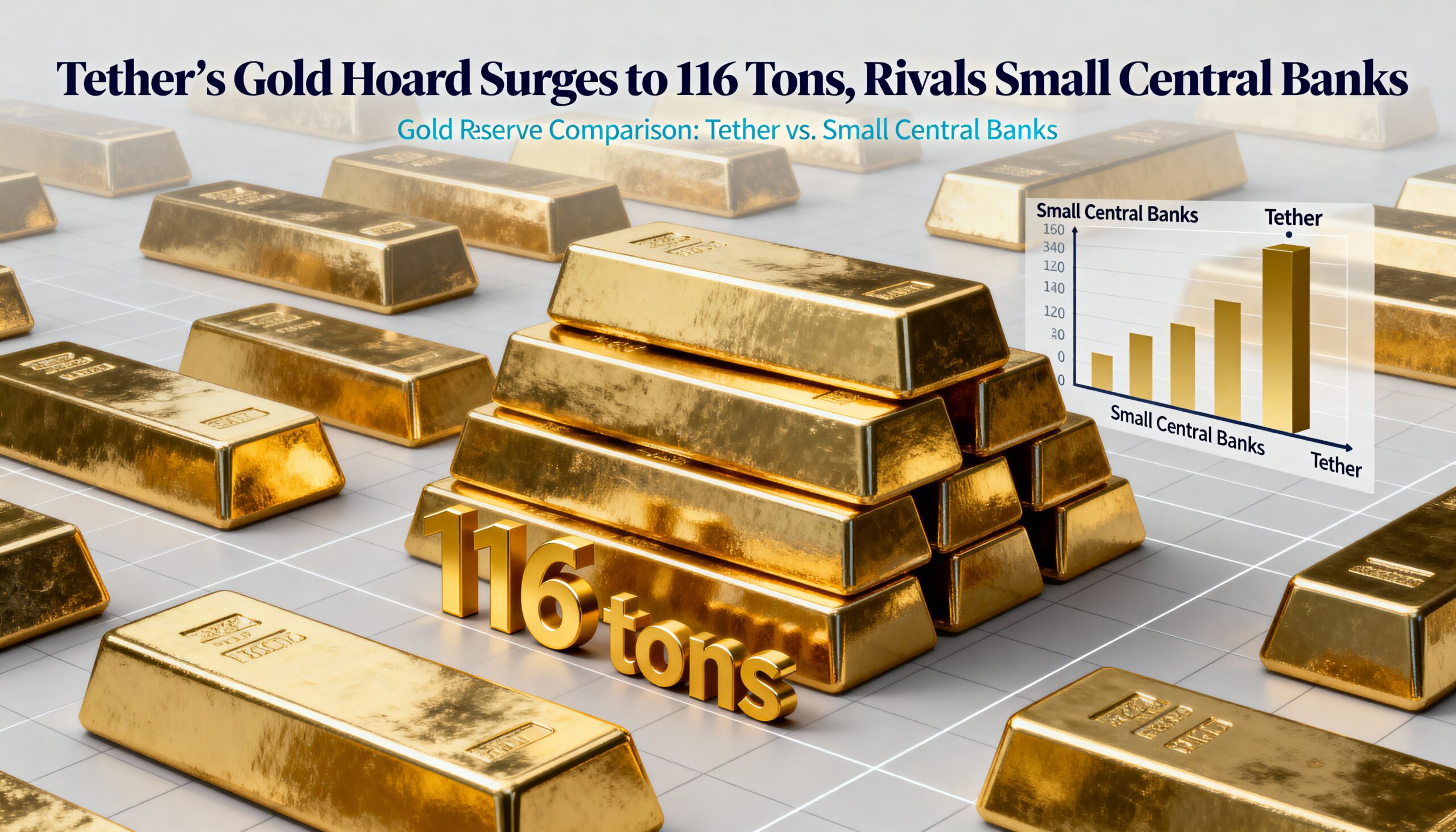

In updated estimates, Jefferies calculates Tether held at least 116 tons of gold by the end of the third quarter. Roughly 12 tons back its XAUt token (valued around $1.57 billion), while another 104 tons support the USDT stablecoin (worth approximately $13.67 billion). That puts Tether on par with smaller national central banks, making it the largest private holder of gold globally. XAUt’s current market cap stands near $1.5 billion, per CoinMarketCap.

The pace of buying has been striking. Tether accumulated roughly 26 tons in the third quarter alone—about 2% of worldwide quarterly gold demand, Jefferies said. While this does not overshadow central bank activity, it likely helped tighten supply and reinforced bullish sentiment during a period of heightened momentum.

Jefferies expects the company to continue adding gold as USDT grows and as the metal maintains its roughly 7% share of Tether’s reserve mix. Ardoino recently projected $15 billion in profit for 2025; if even half of that capital is allocated to gold, annual purchases could rise by nearly 60 tons.

The bank also notes that Tether’s forthcoming GENIUS Act–compliant stablecoin, USAT, will not require gold reserves, creating uncertainty around how it might influence long-term demand for USDT-linked bullion.

Beyond its buying spree, Tether is expanding across the wider metals industry. The company has invested more than $300 million in royalty and streaming businesses this year, and its recent hiring of two senior metals traders from HSBC suggests its push into the gold sector is accelerating.