Bitcoin (BTC $87,557.18) recovered modestly Friday morning after a 10% overnight sell-off, following dovish remarks from New York Fed President John Williams that boosted expectations for a December rate cut.

Williams told the Wall Street Journal, “I still see room for a further adjustment in the near term to the target range for the federal-funds rate to move the stance of policy closer to the range of neutral. Looking ahead, it is imperative to restore inflation to our 2% longer-run goal on a sustained basis. It is equally important to do so without creating undue risks to our maximum employment goal.”

His comments contrasted sharply with those of Fed hawk Cleveland Fed President Beth Hammack, who focused on inflation and potential stock market bubbles, largely dismissing labor market concerns.

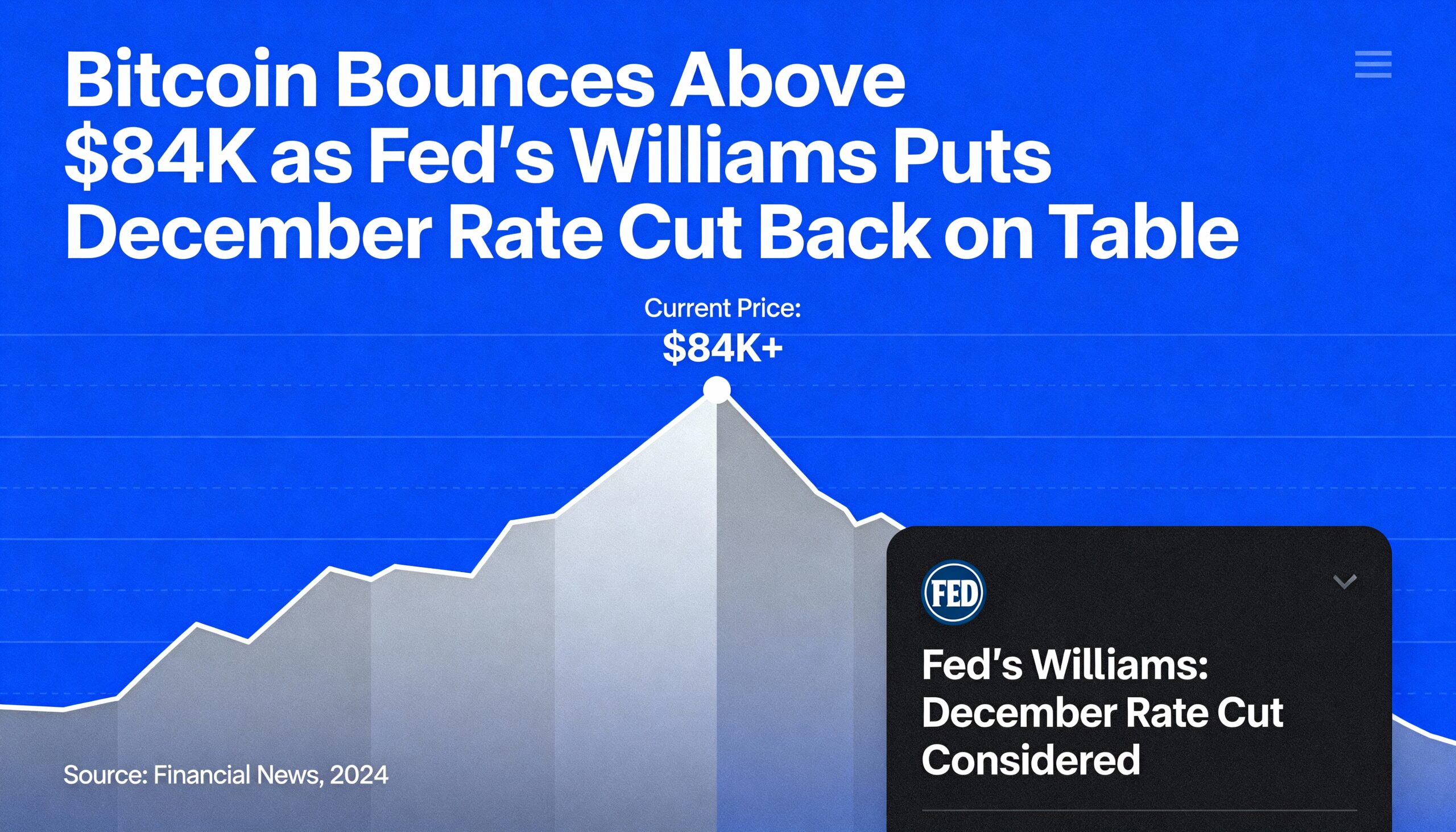

The market reaction was immediate: Bitcoin surged from around $81,000 to above $84,000, and was trading near $83,500 at press time, still down 9.5% over the past 24 hours. Nasdaq 100 futures gained 0.35%, rising from roughly flat before Williams’ statements.

Expectations for a 25 basis point Fed rate cut in December jumped to 70%, up sharply from 39% the previous day, according to the CME FedWatch Tool.