Bitcoin is experiencing one of the steepest momentum breakdowns of the current cycle, with on-chain metrics now flashing signals last seen during the market’s most extreme washouts.

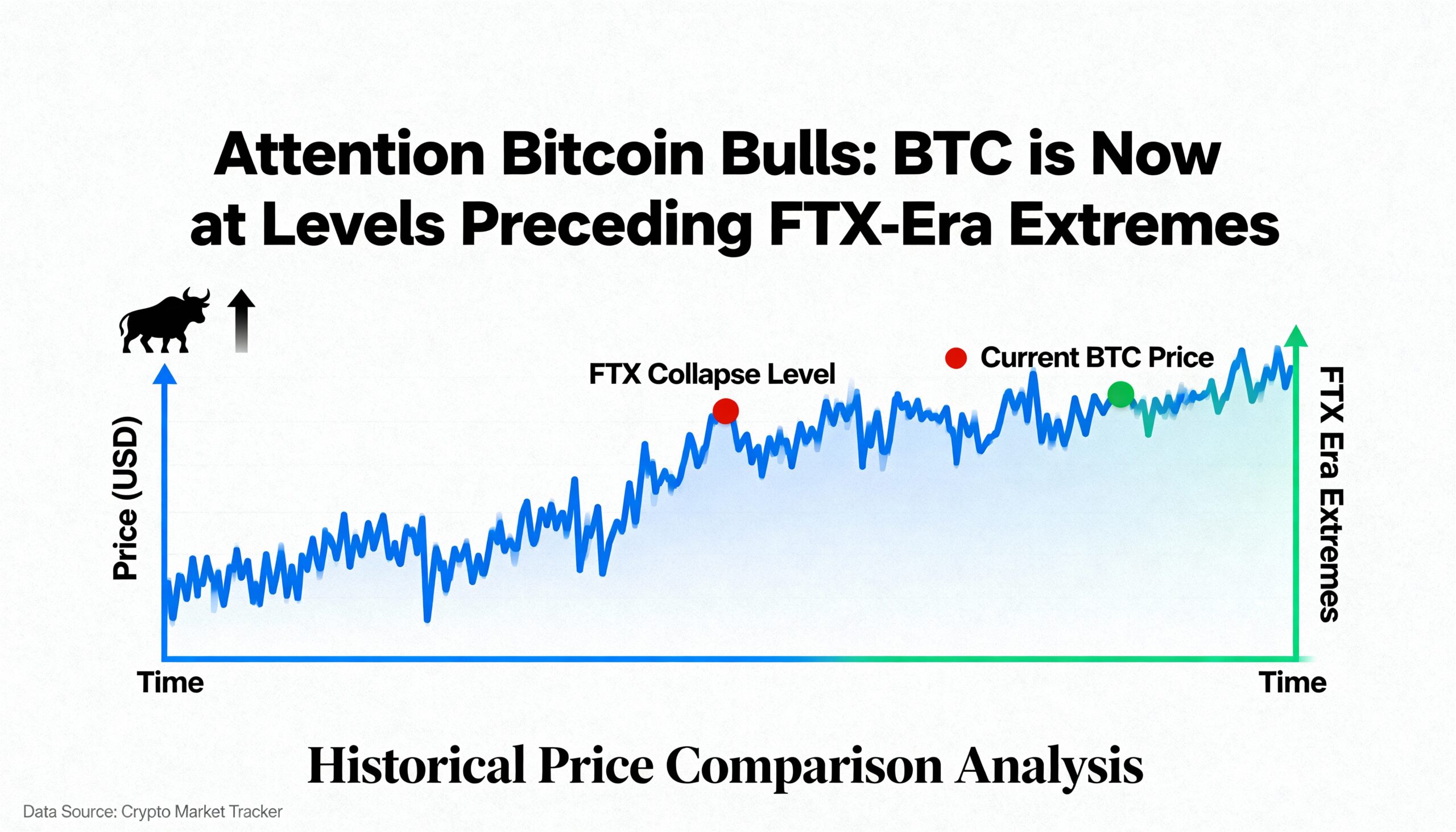

According to Glassnode, realized losses have surged to levels similar to the November 2022 capitulation around the FTX collapse. The spike is driven almost entirely by short-term holders—wallets that purchased BTC within the past 90 days—who are offloading positions as Bitcoin trades below its 200-day moving average.

While short-term realized-loss dominance is common in periods of market stress, the scale this week is notable. It marks the largest such cluster since early 2023 and is one of only a handful of instances in the past five years where daily realized losses have run between $600 million and $1 billion.

Market structure data paints a similarly extreme picture. Analyst MEKhoko notes that BTC is now trading more than 3.5 standard deviations below its 200-day moving average—a level reached only three times in the past decade: November 2018, the March 2020 pandemic crash, and June 2022 during the Three Arrows Capital/Luna crisis.

This week’s drawdown mirrors historical sell-offs: rapid expansion in spot selling, collapsing funding rates, and the retreat of marginal buyers who previously relied on momentum.

With Bitcoin stretched well below trend, short-term holders largely washed out, and sentiment pinned in extreme fear, market positioning is approaching levels historically associated with short-term bottoms.

However, analysts caution that without a clear macro catalyst, volatility is likely to remain elevated around these levels.