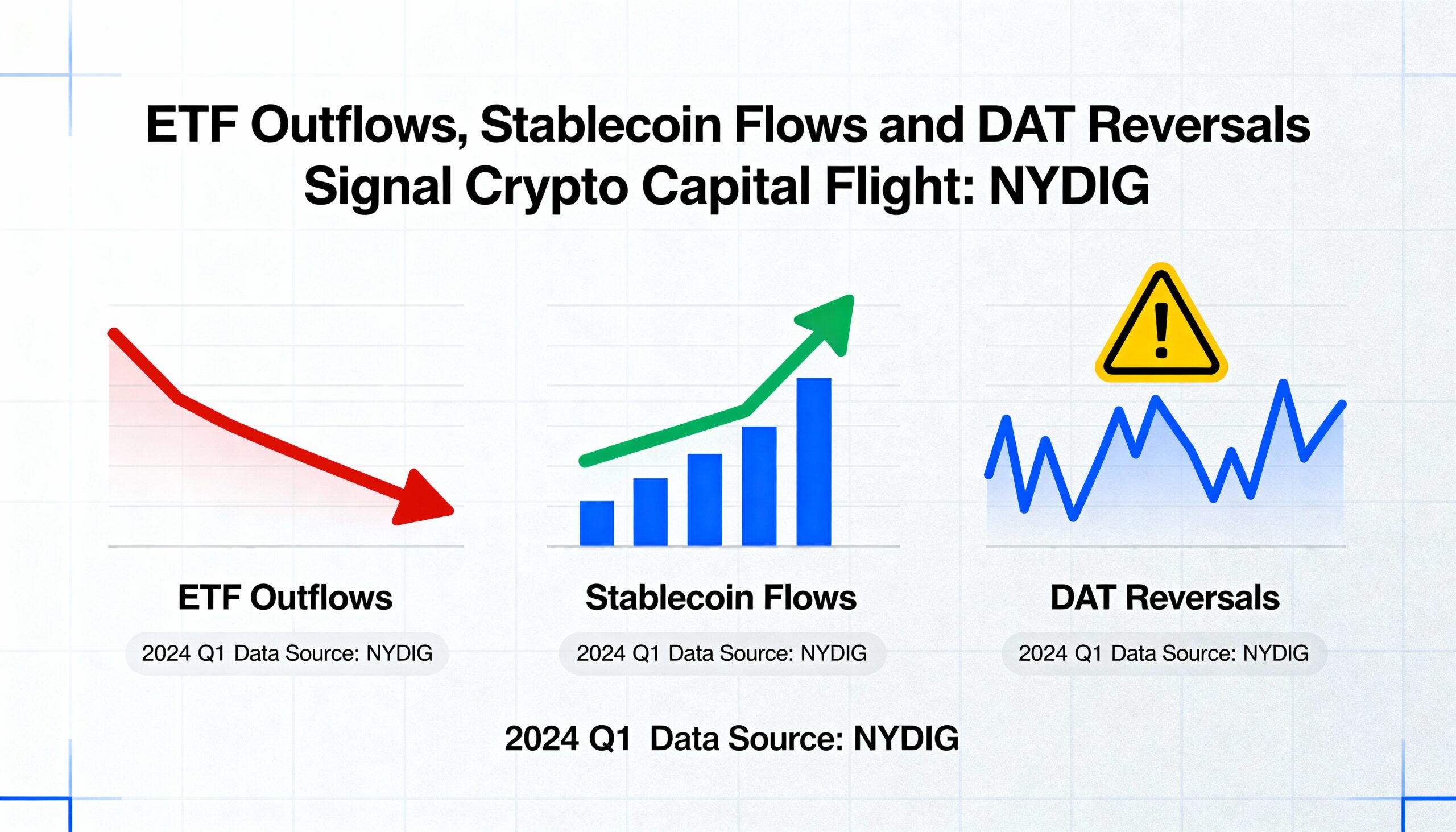

NYDIG: Outflows From ETFs, Stablecoins, and DAT Reversals Signal Bitcoin Capital Flight

Spot bitcoin ETFs have faced sustained outflows totaling $3.55 billion in November, while stablecoin supply has declined, signaling that capital is leaving the crypto market, according to NYDIG.

Greg Cipolaro, Global Head of Research at NYDIG, said bitcoin’s drop to $84,000 is being driven more by structural market mechanics than investor sentiment. In a recent report, he noted that the primary drivers behind the 2024–25 rally have now reversed.

ETF Redemptions Mount

Once a major source of demand, spot bitcoin ETFs are now experiencing steady redemptions. They injected billions into bitcoin in the first half of the year, but recent five-day flow data have turned negative. SoSoValue reports that November’s outflows may be the largest monthly withdrawal since these ETFs launched, nearly matching the $3.56 billion record seen in February.

Stablecoins Reflect Market Exodus

Stablecoin supply has also fallen for the first time in months. The algorithmic USDE token has lost nearly half its supply since the October 10 liquidation shock. Cipolaro noted this decline indicates funds are leaving the market rather than moving to the sidelines.

“USDE’s collapse to $0.65 on Binance highlights how aggressively capital has been withdrawn from the system,” he said.

DAT Reversals Intensify Pressure

Corporate treasury trades tied to DAT share premiums have shifted. As premiums flipped to discounts, companies that previously issued stock to acquire bitcoin are now selling assets or buying back shares. Sequans, for example, sold BTC this month to reduce debt.

“While these reversals mark a transition from a strong demand engine to a potential headwind, no DAT shows signs of financial distress,” Cipolaro said. “Leverage remains modest, interest obligations manageable, and many structures allow suspension of dividends or coupons if needed.”

Major Purchases Fail to Stabilize Prices

Even large purchases, including by Strategy and El Salvador, failed to stop the price decline. Cipolaro argued this underscores the structural nature of the selloff, a feedback loop triggered by the $19 billion liquidation event on October 10, where mechanisms that once lifted prices are now reinforcing declines.

Investor Takeaway

Cipolaro advised investors to “hope for the best, but prepare for the worst.” While the long-term thesis for bitcoin remains intact, near-term conditions are shaped by cyclical forces.

“History suggests volatility ahead, but long-term conviction remains a key asset for investors,” he concluded.