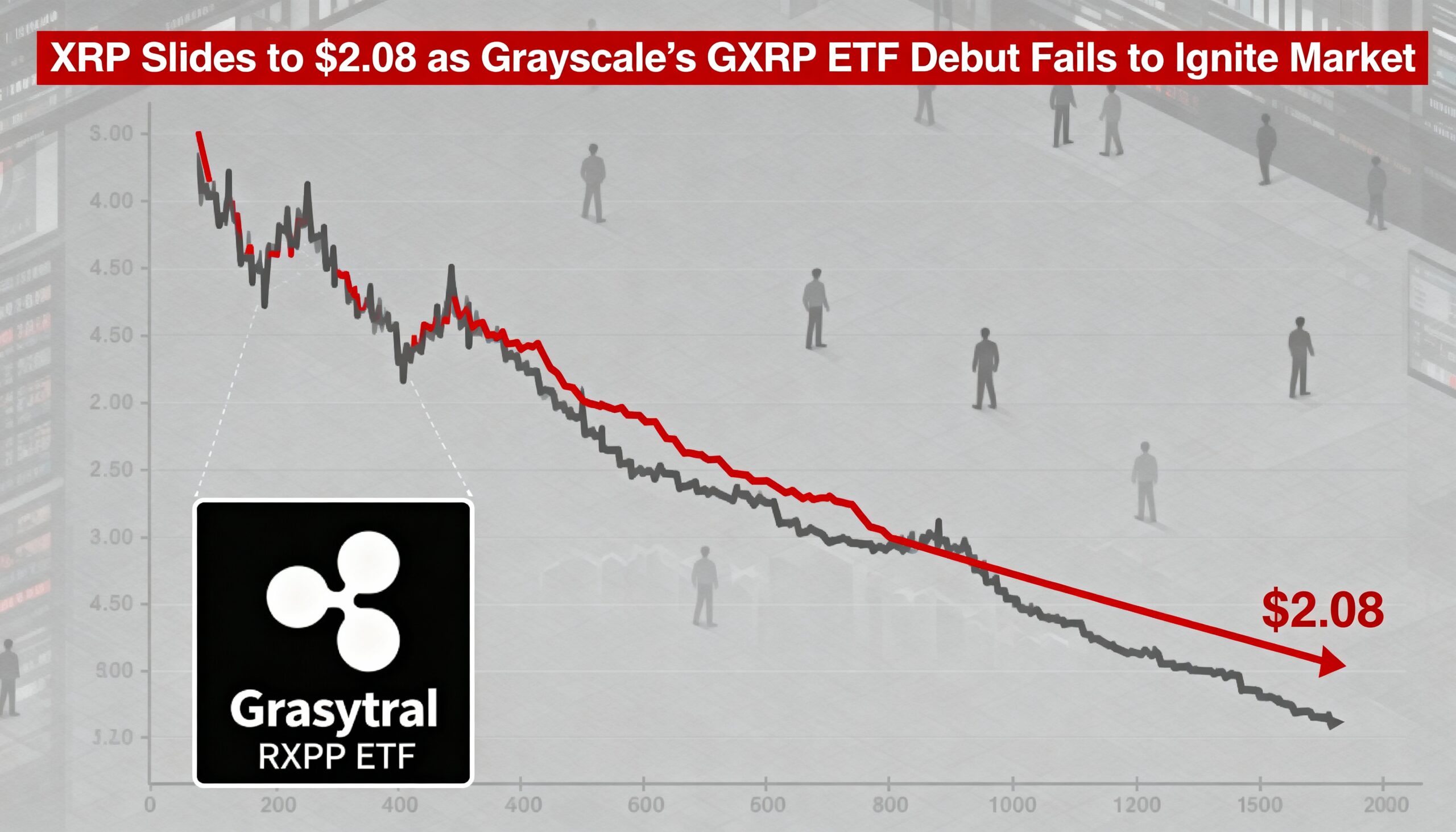

XRP Falls to $2.08 as Grayscale GXRP ETF Debut Fails to Lift Market

XRP dipped to $2.08 on Tuesday despite the launch of Grayscale’s Grayscale XRP Trust ETF (GXRP) on NYSE Arca, which offers investors direct exposure to the token. Traders are closely monitoring $2.03 support, with a breakdown potentially sending XRP toward $1.91.

Originally introduced as a private placement in September 2024, GXRP was converted into a spot ETF alongside Grayscale’s new Dogecoin offering. Krista Lynch, Grayscale’s Senior VP of ETF Capital Markets, described the launch as “a meaningful step in broadening access to the growing XRP ecosystem,” serving both institutional and retail investors.

GXRP joins a growing roster of XRP-based ETFs from Canary Capital, REX Shares, and other issuers seeking automatic approval under Section 8(a). The expansion reflects strong institutional demand for regulated XRP exposure, even as the token maintains its position as the fourth-largest cryptocurrency by market cap.

XRP’s regulatory history continues to influence market behavior. The SEC previously challenged Ripple over $1.3 billion in unregistered sales. A 2023 ruling clarified that programmatic exchange sales were compliant, though direct institutional sales were considered securities. This partial regulatory clarity has encouraged broader institutional adoption, though near-term price action remains heavily technical.

Tuesday’s trading saw XRP fluctuate between $2.03 and $2.15, as profit-taking and weak spot flows outweighed ETF optimism.

Key Levels:

- Breakdown below $2.03 targets $1.91 and potentially $1.78.

- Sustained ETF inflows are needed to support spot demand.

- Resistance near $2.20–$2.24 is critical for bullish momentum.

- Bitcoin weakness could pressure XRP below $2.00.

- Renewed whale inflows may trigger short-term downside.

Despite the ETF launch and growing institutional infrastructure, technical pressures continue to dominate XRP’s spot-market performance.