Bitcoin Trails Equities Despite Bullish Catalysts

Bitcoin BTC has struggled recently, both in absolute terms and relative to U.S. equities. Adrian Fritz, chief investment strategist at 21Shares, attributes the gap to macro pressures, investor sentiment, and what he calls a “panda market”—a bearish phase short of a full crypto winter.

“Technically, we’ve entered a bear market,” Fritz told CoinDesk. Bitcoin has fallen over 30% from its highs, breaching the 50-week moving average, a key technical level signaling shifts in momentum. Altcoins have been hit harder, with many down 50% or more.

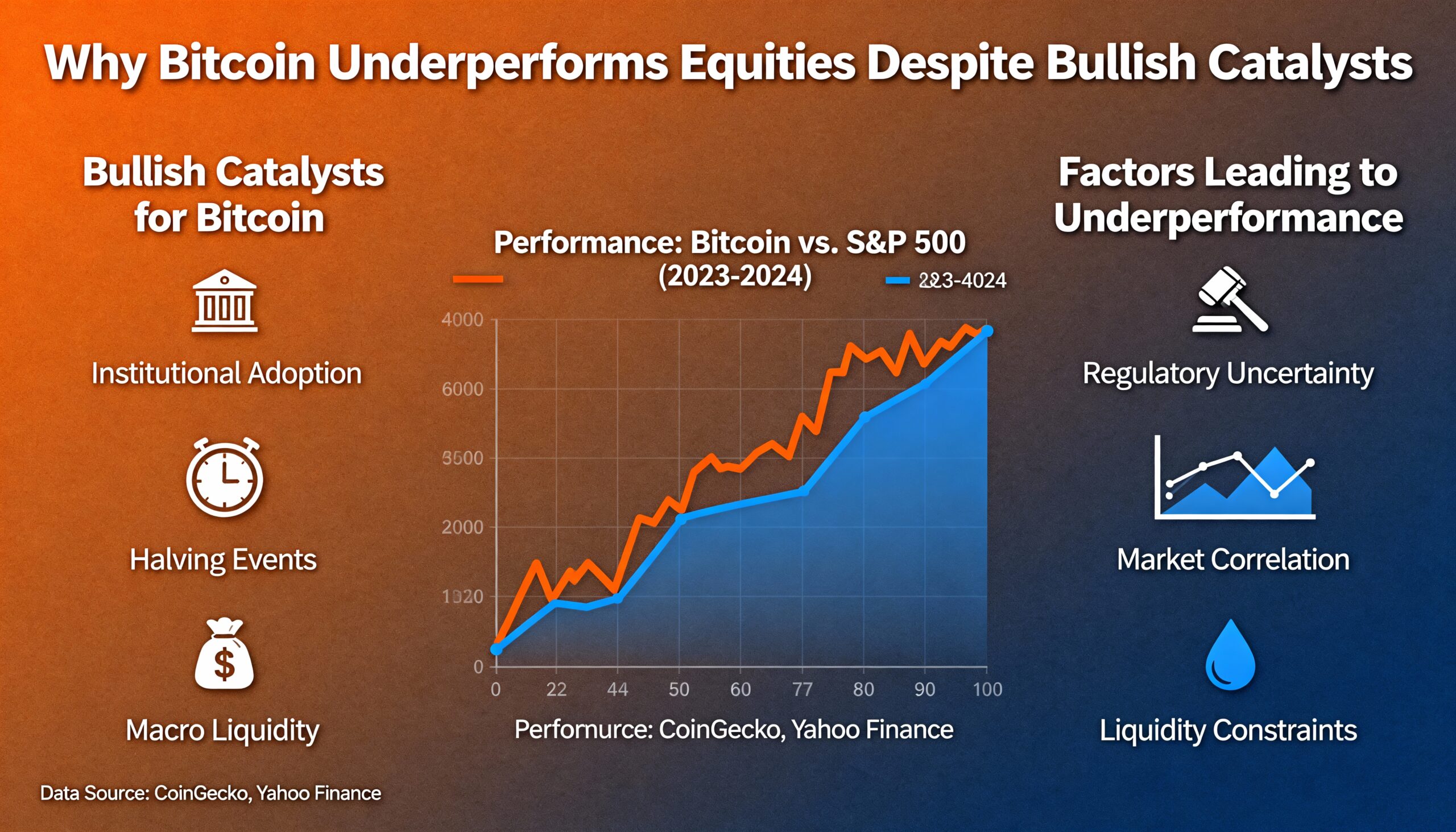

In the past month, Bitcoin has dropped 22%, compared with 2.5% for the S&P 500 and 4% for the Nasdaq, historically more correlated with BTC. Fritz points to the outsized impact of artificial intelligence on equities. “Exclude the Magnificent Seven, and the S&P isn’t up much. But AI is driving sentiment—it’s the shiny new toy on Wall Street.”

This focus on AI may be diverting capital from crypto. While blockchain-AI convergence has been anticipated—such as verifying content authenticity—the real overlap in investment cases is limited. “People feel AI every day. Blockchain hasn’t delivered that moment,” Fritz said.

Leverage has also weighed on the market. The October correction began with $20 billion in liquidations, with daily liquidations of $500 million now common. Fritz says the decline reflects excessive risk-taking, not fraud or hacks. Even long-term holders have booked profits.

Gold continues to serve as a safe haven, though it’s down 10% from recent highs. “Bitcoin trades like a risk-on asset,” Fritz noted, “reacting quickly due to 24/7 liquidity despite its gold-like properties.”

Technically, a bounce is possible, but failure to reclaim $102,000 could open the path to further downside, with the 200-week moving average near $55,000 as a potential floor. Looking ahead, Fritz expects continued volatility through year-end but sees regulatory clarity and falling interest rates supporting a Bitcoin rebound in 2026. “Bitcoin is solid. Altcoins need fundamentals—revenue or staking yields. AI-blockchain hybrids may gain traction, but for now, crypto lags equities.”