Bitcoin Shows Classic Bottoming Pattern as Short-Term Holders Exit at a Loss

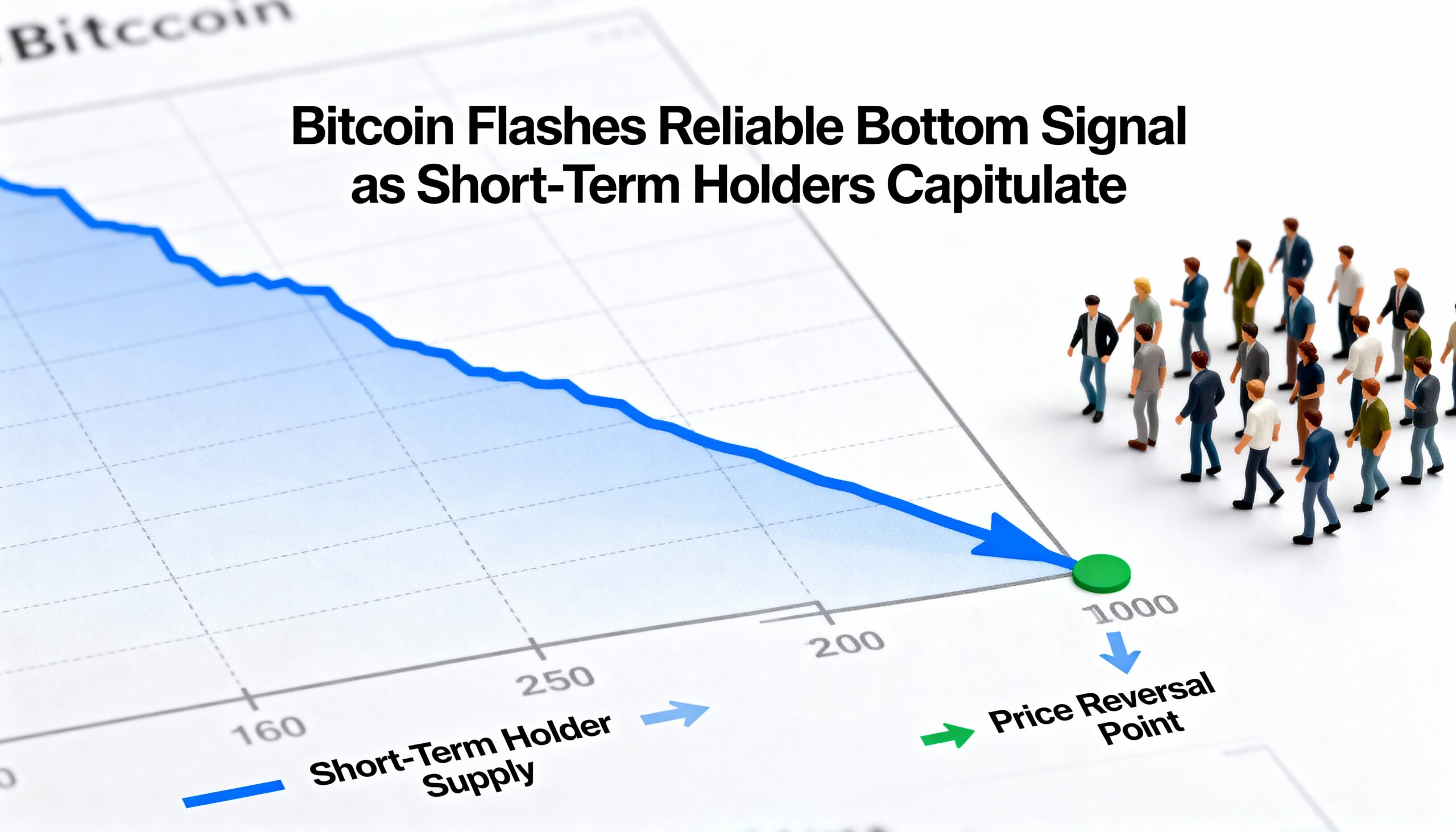

Bitcoin may be entering a key turning point as on-chain data points to a familiar late-cycle capitulation phase. According to CryptoQuant, short-term holders—including many newer investors—have begun selling their coins at a loss, a behavior that has historically coincided with market bottoms.

Analysts note that this pattern has repeatedly emerged near the end of Bitcoin’s downward swings. When weaker hands exit and realized losses spike, it often clears the way for stronger buyers to re-enter and stabilize the market. While this doesn’t guarantee an immediate reversal, it has typically signaled that selling pressure is nearing exhaustion.

With Bitcoin consolidating after recent volatility, the current capitulation from short-term addresses may indicate the market is preparing for its next structural move—potentially setting the stage for a more constructive trend in the weeks ahead.