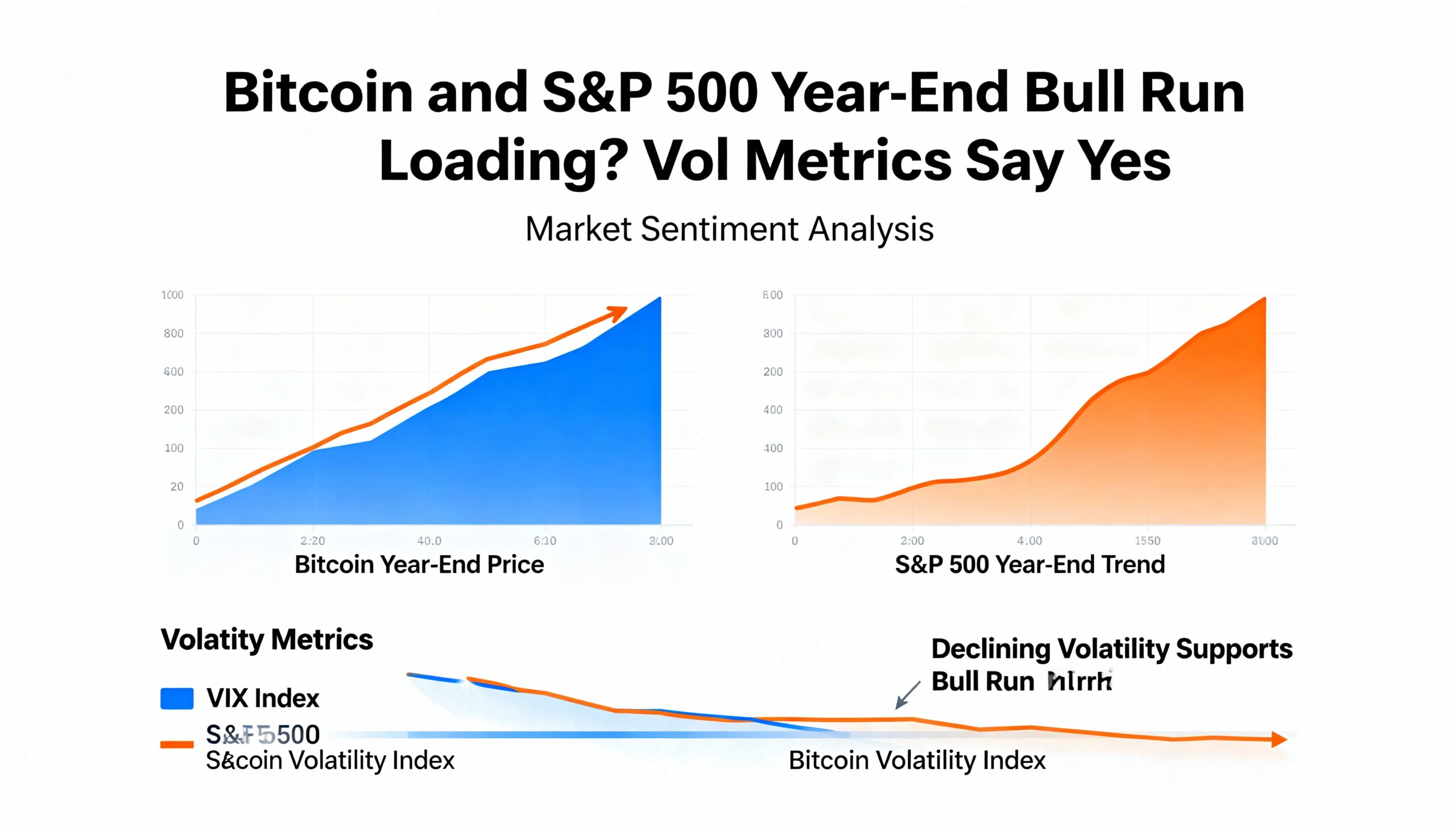

Bitcoin (BTC) and S&P 500 volatility metrics are cooling, signaling potential year-end bullish momentum.

Volmex’s 30-day Bitcoin implied volatility index (BVIV) fell to 51% annualized after spiking to nearly 65% during mid-November’s sell-off from $96,000 to $80,000. Deribit’s DVOL shows a similar pattern, while the VIX, tracking S&P 500 volatility, dropped from 28% to 17%, reflecting easing panic across markets.

The decline indicates fear is subsiding and bulls are regaining control. Bitcoin has rebounded above $91,000, showing a negative correlation with its volatility index — a trend increasingly aligning BTC with traditional assets.

The volatility pullback aligns with surging expectations for a December Fed rate cut, reducing demand for BTC puts. Dr. Sean Dawson of on-chain options platform Derive said:

“Markets are stabilizing as rate-cut odds jump from 39% to nearly 87%. Traders are still hedging, but far less than last week, reflecting growing confidence.”