Chainlink (LINK) Slides 11% as Technical Weakness Overshadows ETF Debut

Chainlink’s native token, LINK, fell below $12 on Monday, as a broader crypto market pullback outweighed anticipation for its U.S. spot ETF debut.

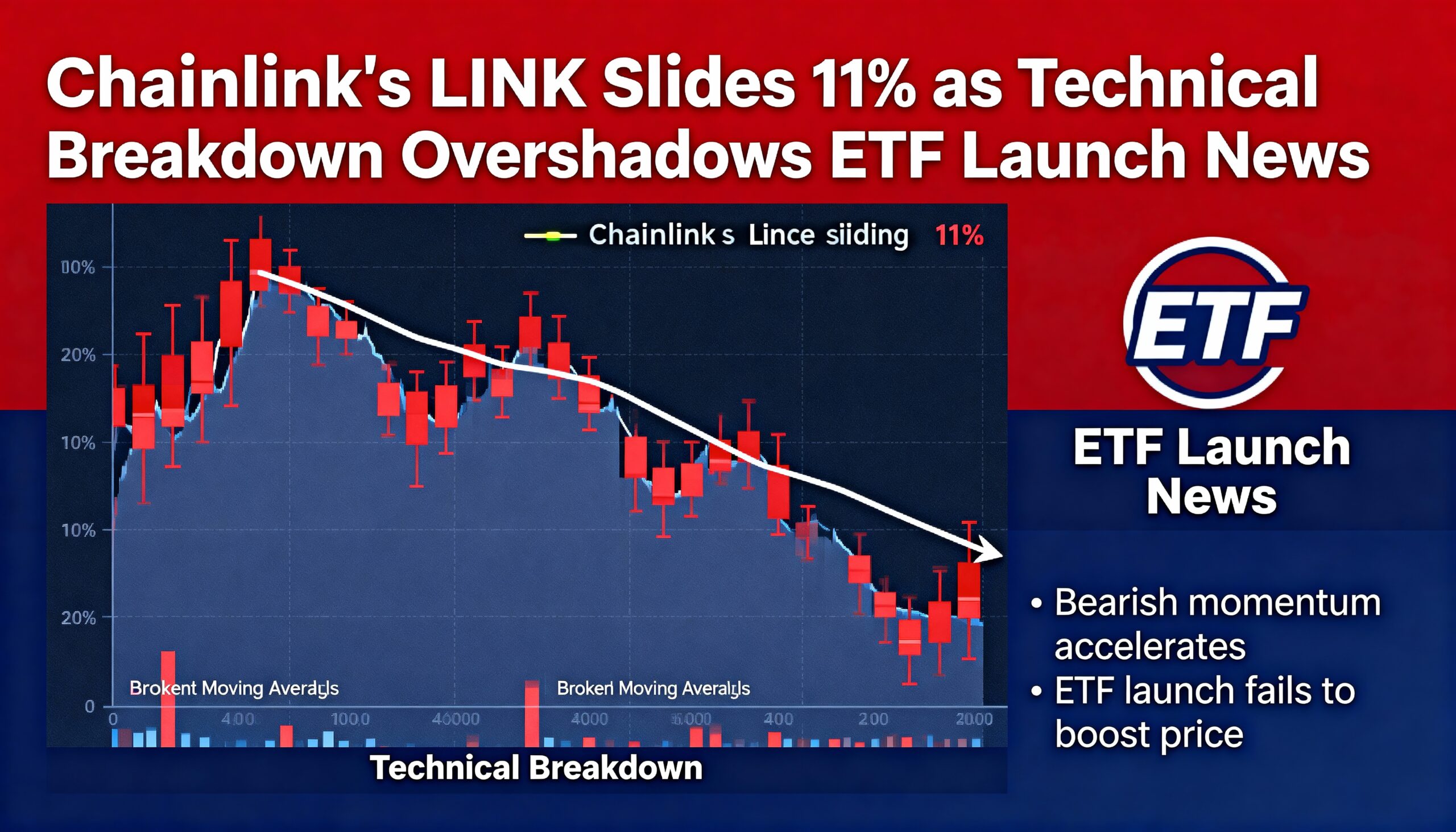

LINK dropped more than 11% over the past 24 hours, with CoinDesk Research’s technical analysis signaling a bearish breakdown. The decline occurred despite news that Grayscale plans to convert its closed-end LINK trust into an ETF, which ETF analyst Nate Geraci expects could begin trading this week on NYSE Arca.

Traders appeared more focused on technical factors than the regulatory milestone. A surge in volume to 7.14 million LINK—roughly 280% above the daily average—pushed the token below $13, driving prices down to $11.94 and forming a series of lower highs, confirming sustained downside momentum.

The weakness also reflects broader crypto risk sentiment, as bitcoin dipped toward $84,000 amid macro concerns and speculation over a potential Bank of Japan rate hike.

Technical Snapshot:

- Support/Resistance: Immediate support at $11.87; resistance at $12.26.

- Volume Analysis: 7.14M LINK traded, 280% above the daily average, indicating strong selling pressure.

- Chart Patterns: Break below descending trendline with an 11.7% decline across a $1.56 range.

- Targets: Potential downside toward $11.70–$11.80, with November lows at $11.39 as the next key level.