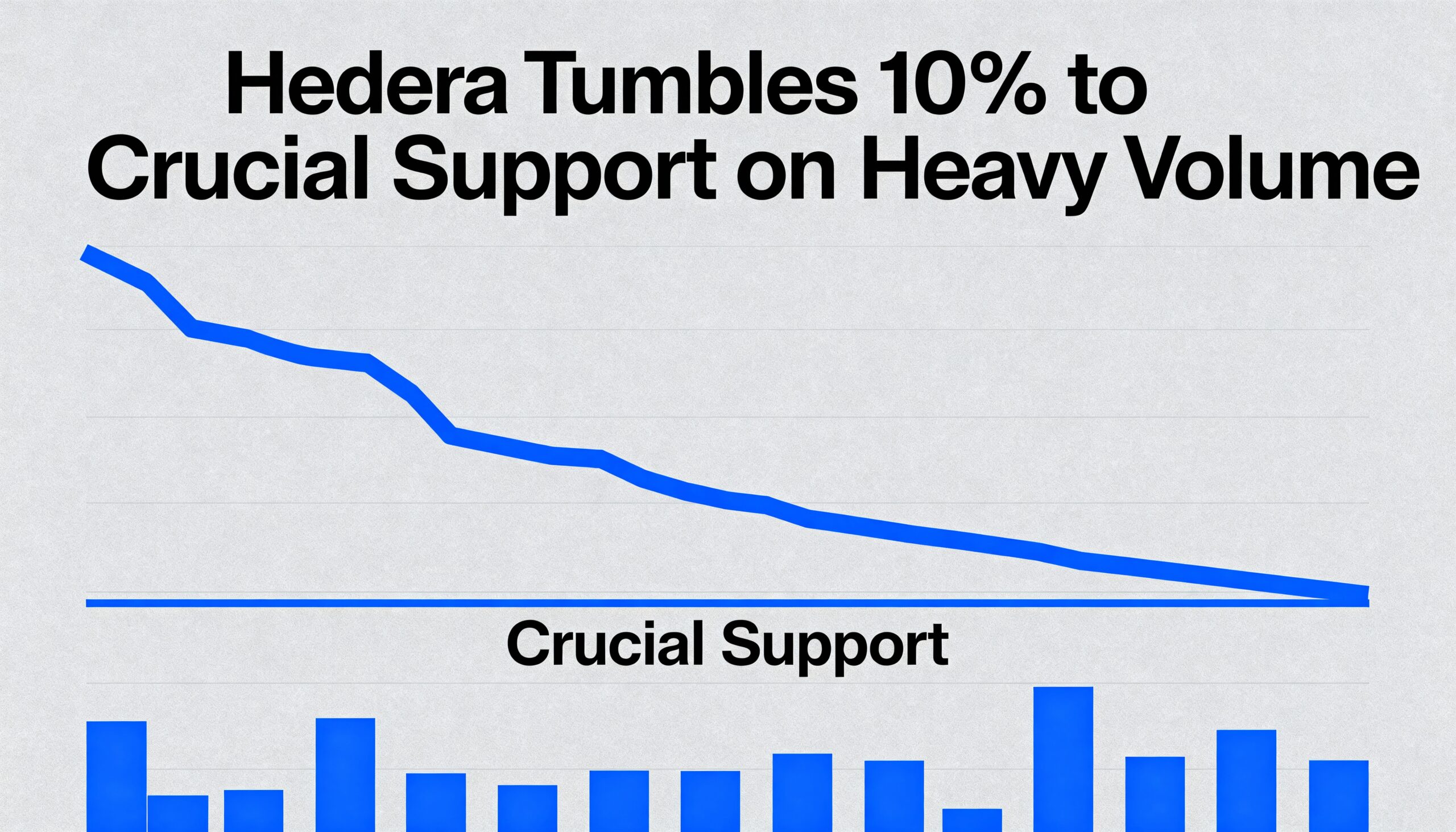

Hedera Drops 10% to Key Support Amid Institutional Selling

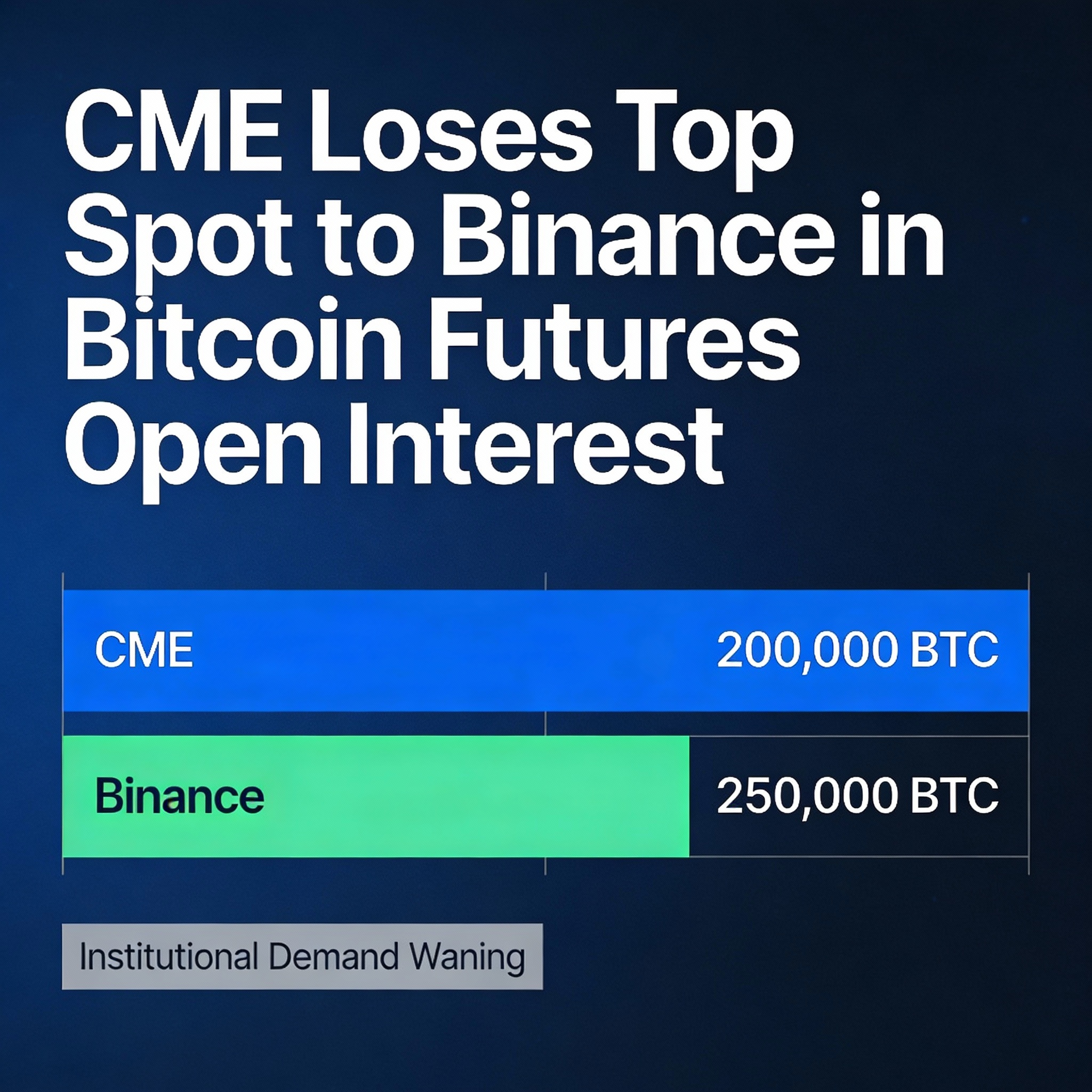

Hedera (HBAR) fell 10% on Dec. 1, retreating to a critical support level at $0.1308 as broader market weakness weighed on sentiment. The decline coincided with the daily candle open at 00:00 UTC and the start of CME Bitcoin futures trading, highlighting a mix of technical and market pressures.

Volume surged to 241.5 million HBAR — 338% above the 24-hour average — signaling heavy institutional selling. HBAR now underperforms the broader crypto market by 1.35%, reflecting a rotation toward stronger digital assets.

Consolidation vs. Breakdown

On 60-minute charts, HBAR trades between $0.1306 and $0.1325, consolidating near $0.1307 on lighter volume. Intermittent spikes above 3 million tokens suggest selective buying, but failure to hold above $0.1315 questions short-term momentum if institutional flows favor other assets.

Key Technical Levels

- Support & Resistance: Immediate support at $0.1307; resistance cluster at $0.1315-$0.1350 must be reclaimed for bullish continuation.

- Volume: The massive volume spike confirms institutional selling; subdued activity points to consolidation near support.

- Chart Patterns: Descending trendline breakdown complete; $0.1306-$0.1325 range indicates potential base-building.

- Targets & Risk: Upside capped at $0.1350 without catalysts; downside risk contained near $0.1306 due to institutional interest.

HBAR’s next moves hinge on whether $0.1307 support can hold or if selling pressure drives further losses.