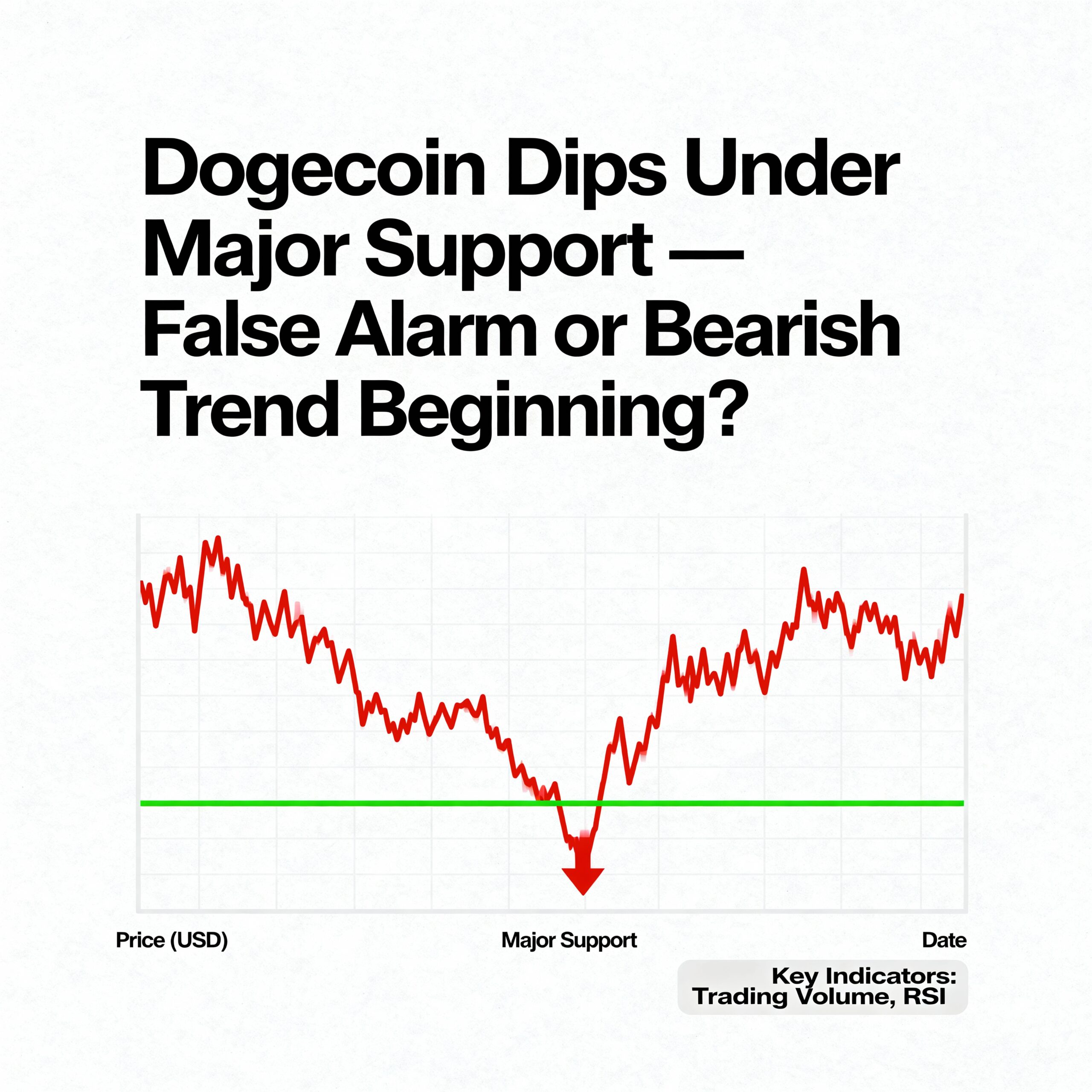

Dogecoin’s rebound remains unstable as the price continues to trade beneath the key $0.1362–$0.1386 resistance band — a zone that must be reclaimed for the market to shift back toward a bullish bias. The memecoin briefly lost the $0.1350 support on unusually heavy selling before snapping back, underscoring an increasingly volatile tug-of-war between sellers distributing into weakness and buyers stepping in at lower levels.

DOGE slid from $0.1387 to $0.1358 as risk sentiment deteriorated across the broader crypto market, triggering a wave of sell orders. The breakdown was accompanied by a dramatic spike in activity: volume surged to 854 million, nearly 180% above average, driving the token down to $0.1322. That low ultimately attracted aggressive dip-buying, helping DOGE reverse part of the decline late in the session.

Whale participation fell to a two-month low, leaving DOGE more influenced by chart structure than on-chain positioning. At the same time, rising market correlation amplified the initial drop as risk assets moved lower in unison.

The dip beneath $0.1350 confirmed a clear technical breakdown, completing a short-term bearish reversal after an extended period of consolidation above an ascending trendline. The move displayed classic distribution characteristics: a surge in sell volume, rapid candle expansion, and a lack of early buy support — placing DOGE in a weaker tactical stance below prior support.

Still, the forceful rebound from $0.1322 injected uncertainty into the trend. DOGE quickly recovered toward previous support and began carving out the early structure of a potential double-bottom formation. Mid-range momentum indicators flashed bullish divergences, and buy-side footprints within the $0.1327–$0.1350 band suggested accumulation by disciplined traders or institutions absorbing the capitulation wick.

Despite this recovery, the market’s footing remains fragile. DOGE must push through $0.1362–$0.1386 to re-establish bullish control. Until that happens, the broader setup retains a downside bias even with the recent bounce.

Throughout the session, DOGE traded within a $0.0065 band, dropping from $0.1387 before cascading toward $0.1322 on the 854M volume shock. A sharp reversal followed, with DOGE rallying 2.7% from $0.1327 to $0.1362, coinciding with another volume surge of 4.17M units at 02:11 during the retest of the broken support zone. The rebound, however, stalled at $0.1362, leaving price consolidating around $0.1358 and pressing against overhead resistance that continues to limit follow-through.