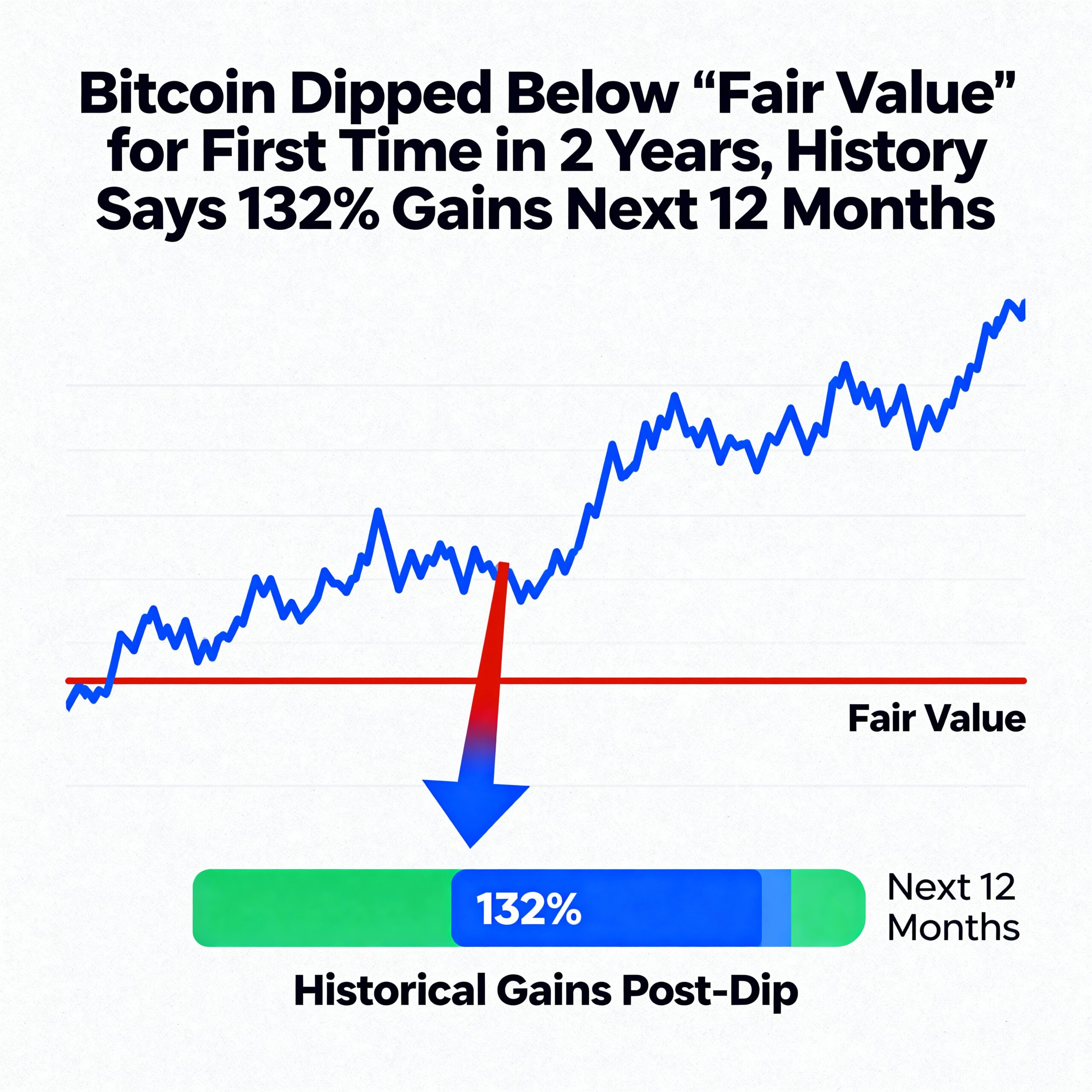

Bitcoin Dips Below Metcalfe Value for First Time in Two Years, Signals Potential Upside

Bitcoin briefly slipped below its network value, as measured by Metcalfe value modeling, for the first time in nearly two years, according to network economist Timothy Peterson.

“This does not necessarily mark a market bottom, but it shows that most leverage has been cleared and the ‘bubble’ has deflated,” Peterson said. Such dips often appear in the late stages of market resets.

Metcalfe value estimates a network’s fundamental worth using user activity and growth, historically offering insight during major market cycle turns.

The decline coincided with bitcoin’s steepest pullback of the current cycle, a 36% drop that pushed the price near $80,000, unwinding speculative excess and drained leverage. Bitcoin has since rebounded above $90,000 as buyers returned and network conditions stabilized.

During the 2022 bear market, bitcoin traded below Metcalfe value amid declining activity and sentiment. Since early 2023, the price had consistently stayed above this benchmark, supported by growing participation and capital inflows. The recent correction marked the first meaningful break in that trend.

Historically, trading below Metcalfe value has preceded strong gains. Over the following 12 months, returns have been positive 96% of the time, averaging 132%, compared with 75% and 68% for other periods, according to Peterson.

Adding to the bullish outlook, long-term holder (LTH) supply has risen by roughly 50,000 BTC in the past 10 days. LTHs—investors holding bitcoin for at least 155 days—have been a major source of selling pressure. As coins shift from short-term holders into LTH wallets, net accumulation increases, reducing sell-side pressure and supporting potential price gains.