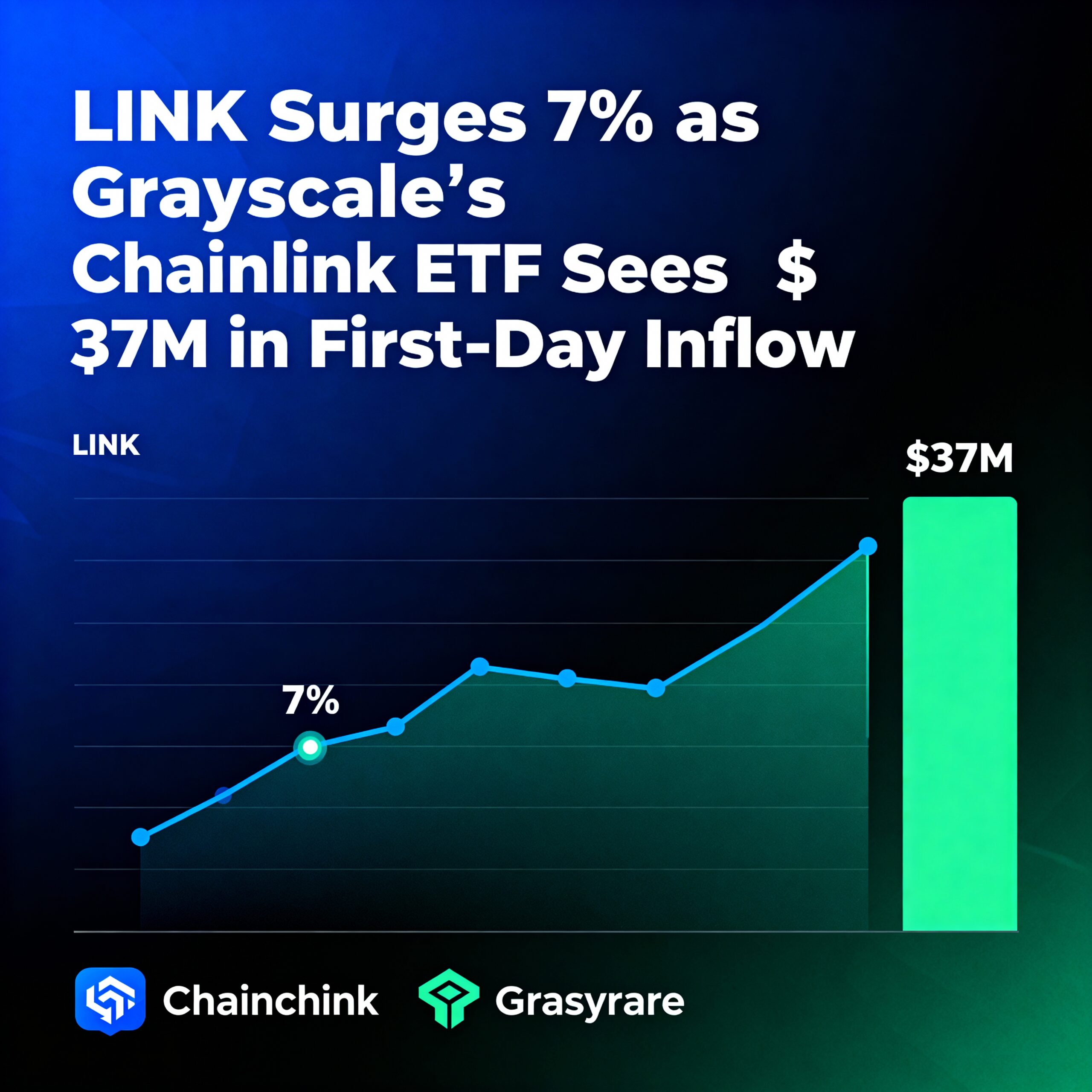

Chainlink (LINK) Rallies 7% on U.S. Spot ETF Launch

Chainlink’s LINK surged 7% in the past 24 hours, outpacing most major cryptocurrencies as U.S. investors gained access to the first U.S.-listed spot Chainlink ETF.

The Grayscale Chainlink Trust ETF (GLNK), converted from a closed-end fund and listed on NYSE Arca, attracted $37 million in net inflows on its first trading day, according to SoSoValue. The ETF provides traditional investors with direct exposure to LINK, marking a key milestone for institutional adoption.

Trading volume spiked 183% above the 24-hour average, peaking at 6.71 million tokens traded at 14:00 UTC, with LINK briefly reaching $14.63. Despite pulling back slightly, the token maintained an ascending trendline from $13.35, recording higher lows and preserving a bullish structure, CoinDesk Research noted.

LINK’s gains were supported by the ETF debut and broader rotation into tokens with strong utility narratives. The CoinDesk 5 Index rose 3.3% on the day, while LINK outperformed the benchmark by over four percentage points.

Technical Snapshot:

- Support/Resistance: Support at $14.28, psychological backing at $14.40; resistance at $14.63

- Volume: 183% surge indicates institutional participation

- Chart Patterns: Consolidation between $14.395–$14.445 may set up a breakout

- Targets & Risk/Reward: Near-term target at $14.63; potential upside if support holds above $14.28