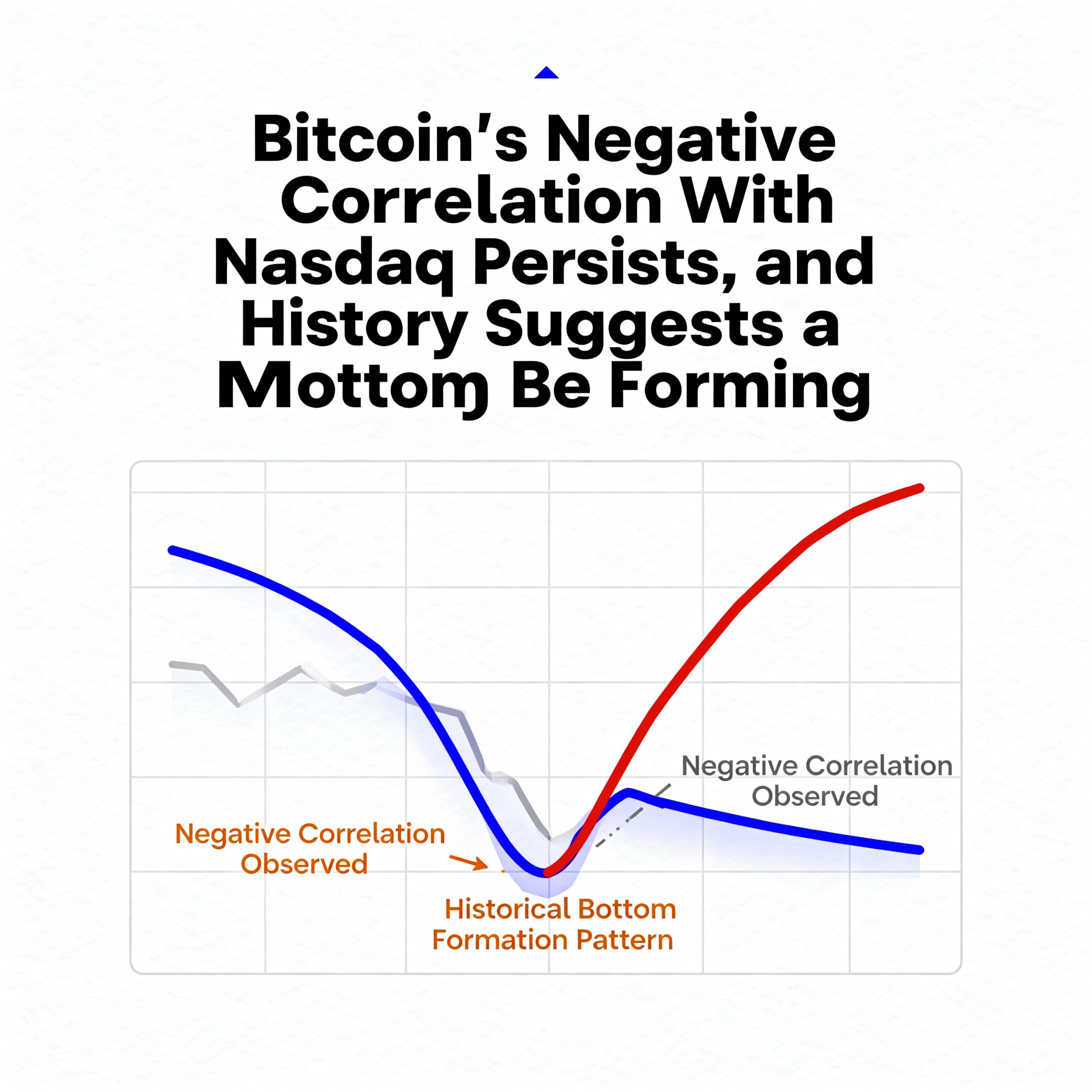

Historical data shows that bitcoin often establishes key bottoms when its correlation with the Nasdaq 100 breaks down—a pattern that has now emerged for the fourth time in five years.

Bitcoin is once again moving independently of the broader risk asset complex, and this latest divergence could be signaling an important shift in market behavior. In previous cycles, stretches of negative correlation between bitcoin and the Nasdaq 100 have frequently aligned with major lows for the cryptocurrency, and the current backdrop echoes those earlier turning points.

The 20-day correlation between the two has dropped to -0.43, marking the fourth instance since 2020 of the pair slipping into negative territory. Similar episodes in mid-2021 and August 2024 coincided with significant bitcoin bottoms. Although bitcoin is often described as a high-beta asset that tends to track tech-sector momentum, today’s divergence stands out as unusually pronounced.

The disconnect is also clear in recent performance. Bitcoin has fallen as much as 36% from its October peak, while the Nasdaq 100’s drawdown has been limited to 8% and the index now sits just 2% below its record high. Bitcoin, meanwhile, remains 27% below its own all-time high.

Each previous period of negative correlation has surfaced during moments of market strain. The latest occurred during the yen carry trade unwind, which pushed bitcoin down to roughly $49,000 before marking a local low. A similar breakdown in September 2023 saw bitcoin dip just under $30,000 ahead of a rally to $40,000 by year-end. The earliest example appeared in May 2021 amid China’s mining crackdown, when bitcoin tumbled from $60,000 to $30,000 before later recovering to new highs.

Taken together, these episodes suggest that negative correlation between bitcoin and the Nasdaq 100 often emerges around important inflection points for bitcoin. While the present setup hints that another bottom may be forming, the timing and durability of any rebound remain unclear.