Bitcoin remained pinned near $92,000 on Friday, struggling to gain traction after another failed overnight push above the $93,000 level. The muted action extends the sideways, indecisive trading range that has dominated the market for several sessions.

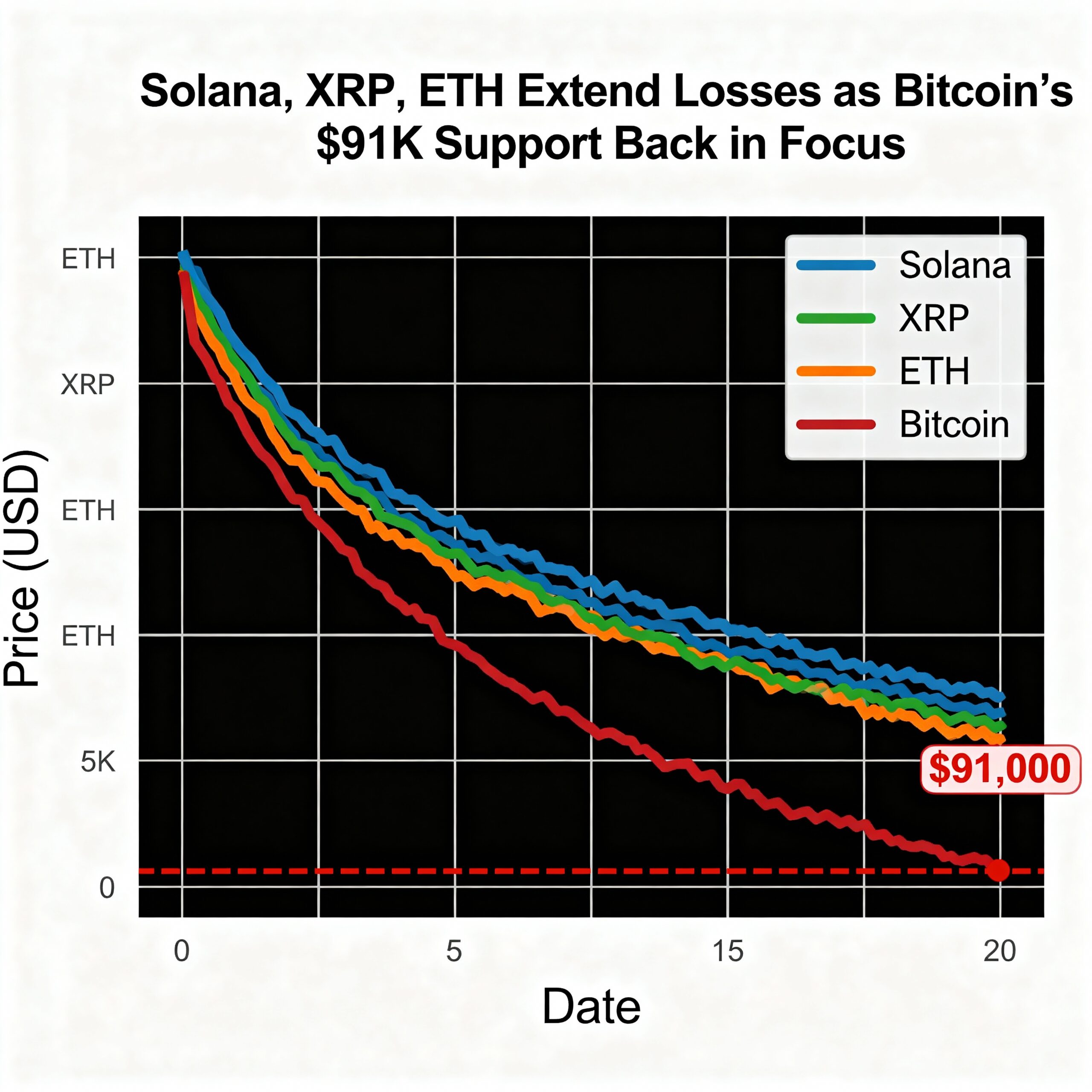

The broader structure has shown little change since late November: sellers continue to defend the mid-$93,000 area, while buyers repeatedly step in around $91,000. Neither side has generated enough conviction to force a breakout. On the one-month chart, BTC remains confined within a descending trend pattern that began after early November’s peak. This week’s rebound stalled at $93,500, marking yet another lower high and keeping the corrective trend intact.

Momentum remains soft, with intraday rallies losing steam almost immediately — a sign of thin liquidity at higher prices. A decisive move below $91,000 would open the door to $90,000–$90,500, while bulls need a recovery above $93,200 to flip the short-term momentum back in their favor.

Large-cap tokens were mixed heading into the weekend. ETH held around $3,150, down slightly overnight. Solana dropped about 4%, XRP nearly 5%, and Cardano slipped around 2%. Total crypto market capitalization inched up 1% to roughly $3.2 trillion, extending the gradual recovery that began two weeks ago after a prolonged seven-week correction. Over the past week, ether has led major assets, advancing more than 5%, while zcash posted a standout session earlier in the day.

ETF flows highlighted a split in investor appetite. Spot bitcoin ETFs registered $14.9 million in net outflows, contrasting with $140.2 million in inflows for ether ETFs, signaling a rotation of capital toward the Ethereum ecosystem. Liquidation data reinforced the divergence: BTC saw roughly $45 million in long liquidations and $50.7 million in shorts, while ETH traders absorbed over $103 million in short liquidations as volatility caught bearish positions off guard.

Macro developments added another layer of uncertainty. U.S. ADP payrolls declined by 32,000 in November, sharply missing expectations and indicating a faster-than-anticipated cooling in the labor market. Wage growth slowed, and futures markets now price in nearly a 90% likelihood of a December rate cut. The dollar index whipsawed as rate expectations shifted, and broader risk markets saw volatility rise.

FxPro analyst Alex Kuptsikevich noted that bitcoin’s brief move toward $94,000 met “not yet too aggressive” seller resistance, suggesting stronger pushback may not appear until the $98,000–$100,000 zone. The reaction there, he said, will help determine whether the market is forming a durable base or simply extending a corrective rebound.

Analysts at Bitunix described the current environment as a “composite phase” shaped by macro turning-point expectations and internal capital rotation in crypto markets, citing ETF trends and uneven liquidation flows. They anticipate continued, range-bound volatility until BTC firmly reclaims $93,000 or breaks below $90,500.

Institutional headlines added modest support to sentiment. Vanguard opened crypto ETF trading access to its clients earlier in the week, Bank of America suggested institutional portfolios may allocate 1%–4% to digital assets, and the CME rolled out a bitcoin implied volatility index, with similar gauges for ether, solana, and XRP set to follow.