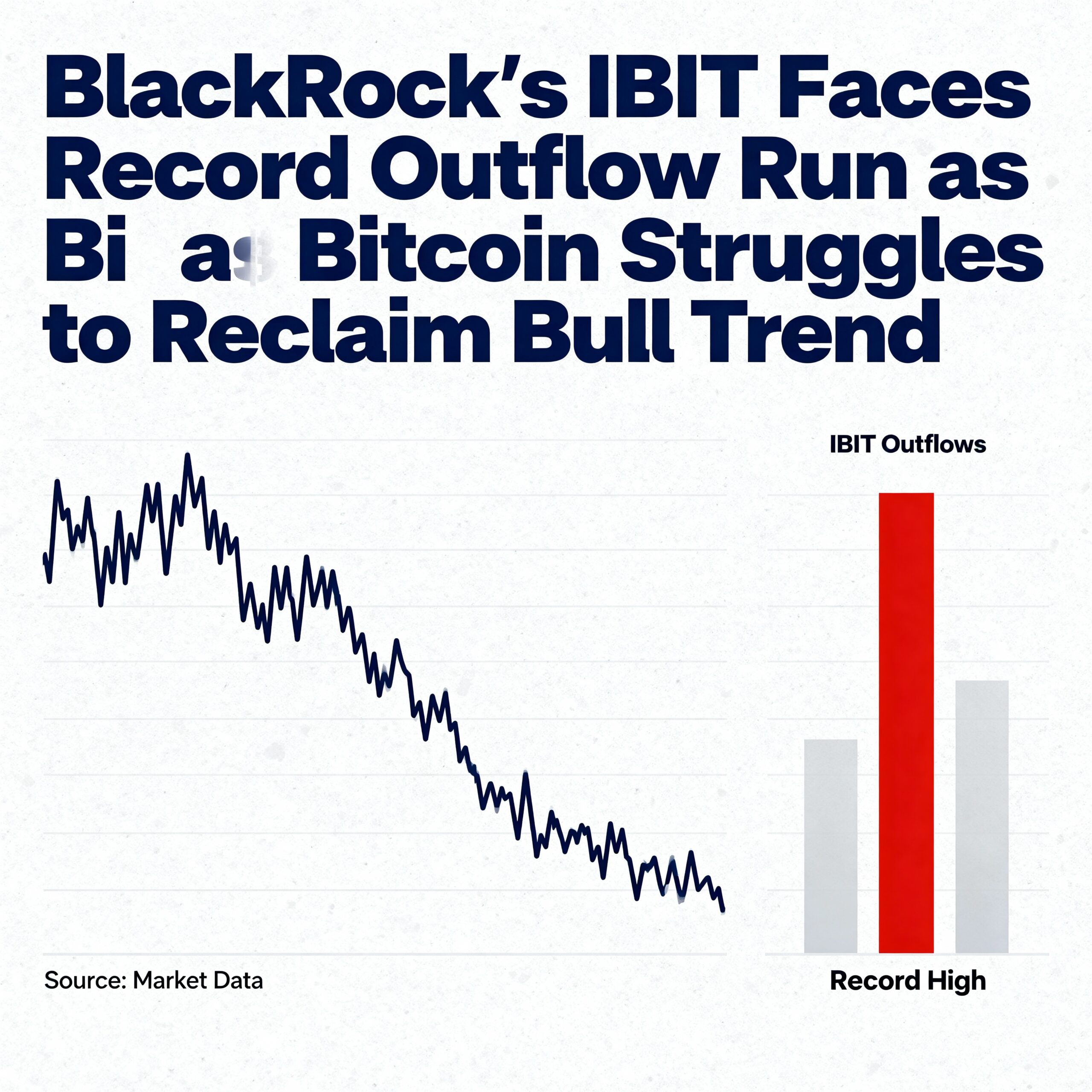

BlackRock’s leading Bitcoin ETF is now experiencing its most prolonged withdrawal phase since launch, with institutional investors pulling more than $2.7 billion over the past five weeks as year-end de-risking accelerates. The iShares Bitcoin Trust (IBIT)—which swelled to $71 billion in assets during Bitcoin’s surge to all-time highs—has posted five consecutive weeks of outflows through Nov. 28, according to Bloomberg data.

Redemptions continued on Thursday, when another $113 million exited the fund, setting IBIT up for a sixth straight week of net outflows, the longest stretch in its history since debuting in early 2024.

The withdrawals echo a broader pullback across crypto markets triggered by October’s aggressive washout, which wiped out more than a trillion dollars in digital-asset value and forced Bitcoin into a confirmed bearish structure. IBIT—once the dominant vehicle for institutional inflows earlier this year—has now flipped to steady outflows as managers lighten risk into bonus season and macro uncertainty deepens.

Bitcoin has recovered to the low $92,000s this week, but investor flows remain firmly negative. Analysts argue that trend carries greater significance for overall direction than short-term price moves. Glassnode highlighted that the ongoing redemption cycle marks a clear shift from the accumulation trend that supported Bitcoin’s run into October, framing it as a pause in new capital inflows rather than a wholesale exit from the asset class.

Even with its recent rebound, Bitcoin remains roughly 27% below its early-October record high, and IBIT’s flow behavior is increasingly viewed as a key indicator of broader U.S. demand for the cryptocurrency.