Hedera Pulls Back as Technical Selling Outweighs ETF Speculation

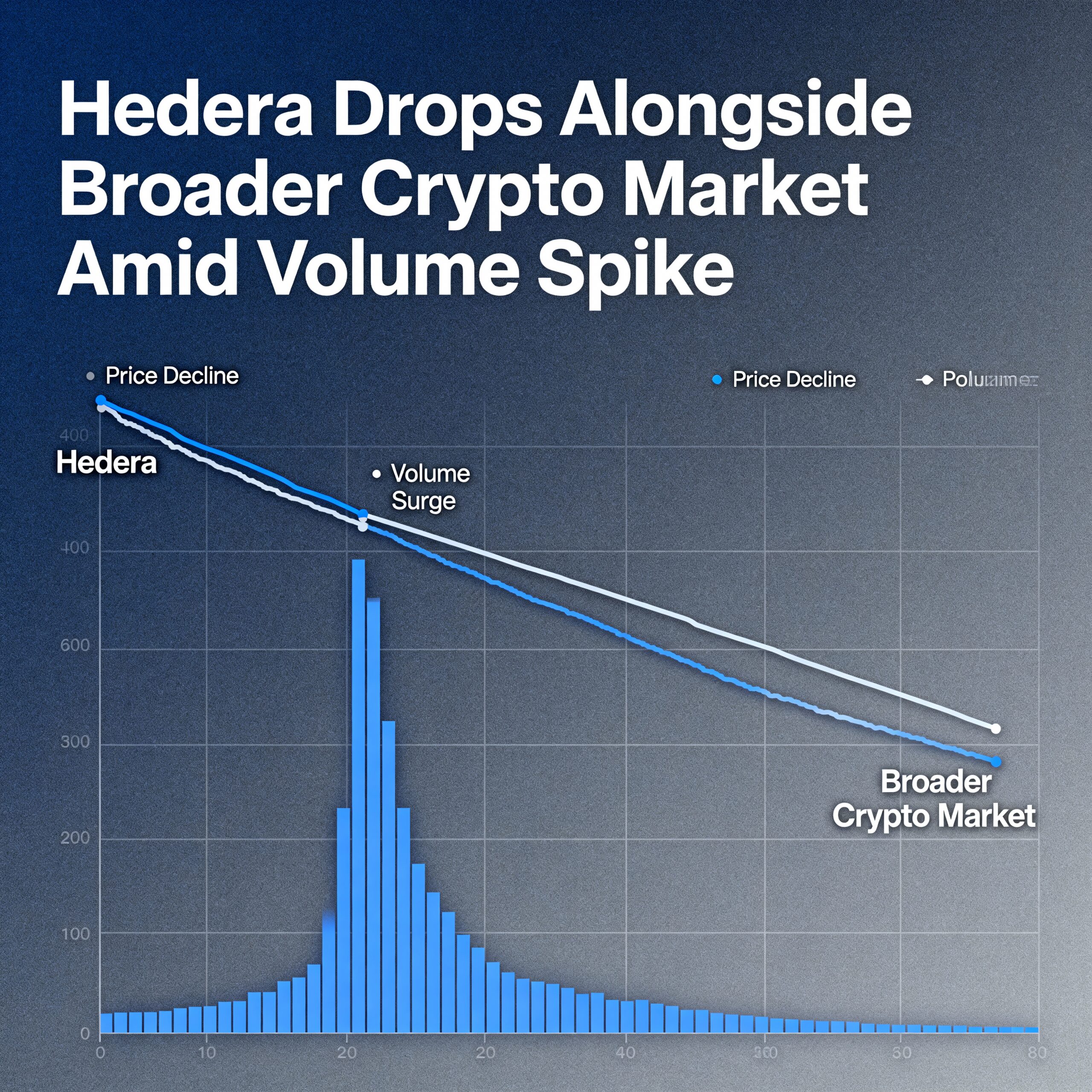

Hedera’s HBAR retreated 2.2% on Thursday, with technical pressures outweighing optimism from potential institutional products. The token broke below $0.1380 support as trading volume surged 47% above the daily average, peaking at 52.21 million HBAR around 09:00 GMT and driving session lows to $0.1367.

HBAR recently tested key support at $0.1354, briefly dipping below on 2.37 million tokens before bouncing back to around $0.1361. While oversold conditions are emerging, bearish momentum persists, leaving traders cautious.

Interest in Canary Capital Group’s HBAR ETF could provide longer-term demand, but short-term price action remains dominated by technical factors.

Technical Levels:

- Support/Resistance: Primary support at $0.1354; resistance between $0.1380–$0.1391; consolidation floor at $0.1357.

- Volume: Breakdown confirmed by high volume, with late-session decline hinting at exhaustion.

- Chart Patterns: Downtrend with lower highs; range-bound trading $0.1354–$0.1380.

- Risk/Reward: Recovery target $0.1380; breach below $0.1354 could trigger deeper retracements. Current levels may offer defensive entry points.