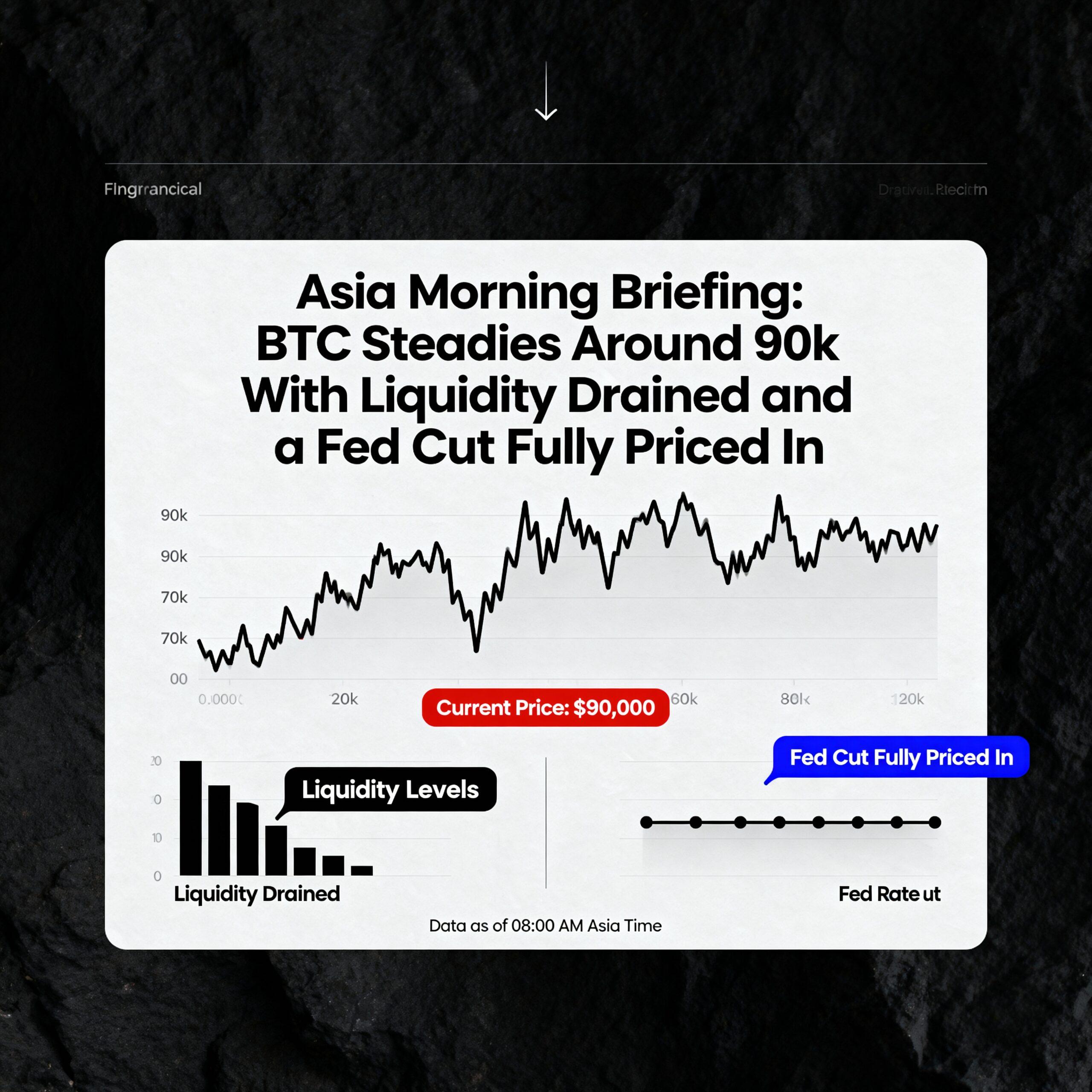

Bitcoin Holds Near $90K as Year-End Liquidity Drains Ahead of Fed Guidance

Bitcoin is trading around $90,000 after a weekend of sharp but fleeting swings, highlighting thin year-end liquidity. QCP reports that perpetual open interest in BTC and ETH has fallen nearly 50% since October, reducing the market’s capacity to absorb directional trades.

Polymarket data shows traders have fully priced in this week’s 25-basis-point Fed cut and expect a pause in January, signaling a shallow easing path rather than a full cycle. This combination explains why BTC remains range-bound, with outsized moves more likely to come from guidance surprises than the rate decision itself.

“The Fed’s cut may headline, but the bigger story is the widening divergence among major central banks,” said Gracie Lin, CEO of OKX Singapore. “The BOE is divided, the ECB is steady, and the BOJ is preparing to tighten at yields last seen in 2007, amid rising friction across key Asian economies.”

Lin added that recent clearing of leveraged positions has improved market structure, removing overcrowded trades and giving bitcoin room to push higher. BTC briefly touched $91,000 as global capital adjusts to uneven macro signals.

Market Snapshot:

- BTC: Slipped toward $90,000 after early U.S. trading erased weekend gains, pressured by higher bond yields and weaker equities.

- ETH: Slightly lower but outperformed BTC, hitting its strongest level against bitcoin in over a month.

- Gold: Edged down as traders awaited the Fed’s meeting and guidance on future policy.

- Nikkei 225: Asia-Pacific stocks fell, tracking Wall Street declines amid Fed-focused caution.