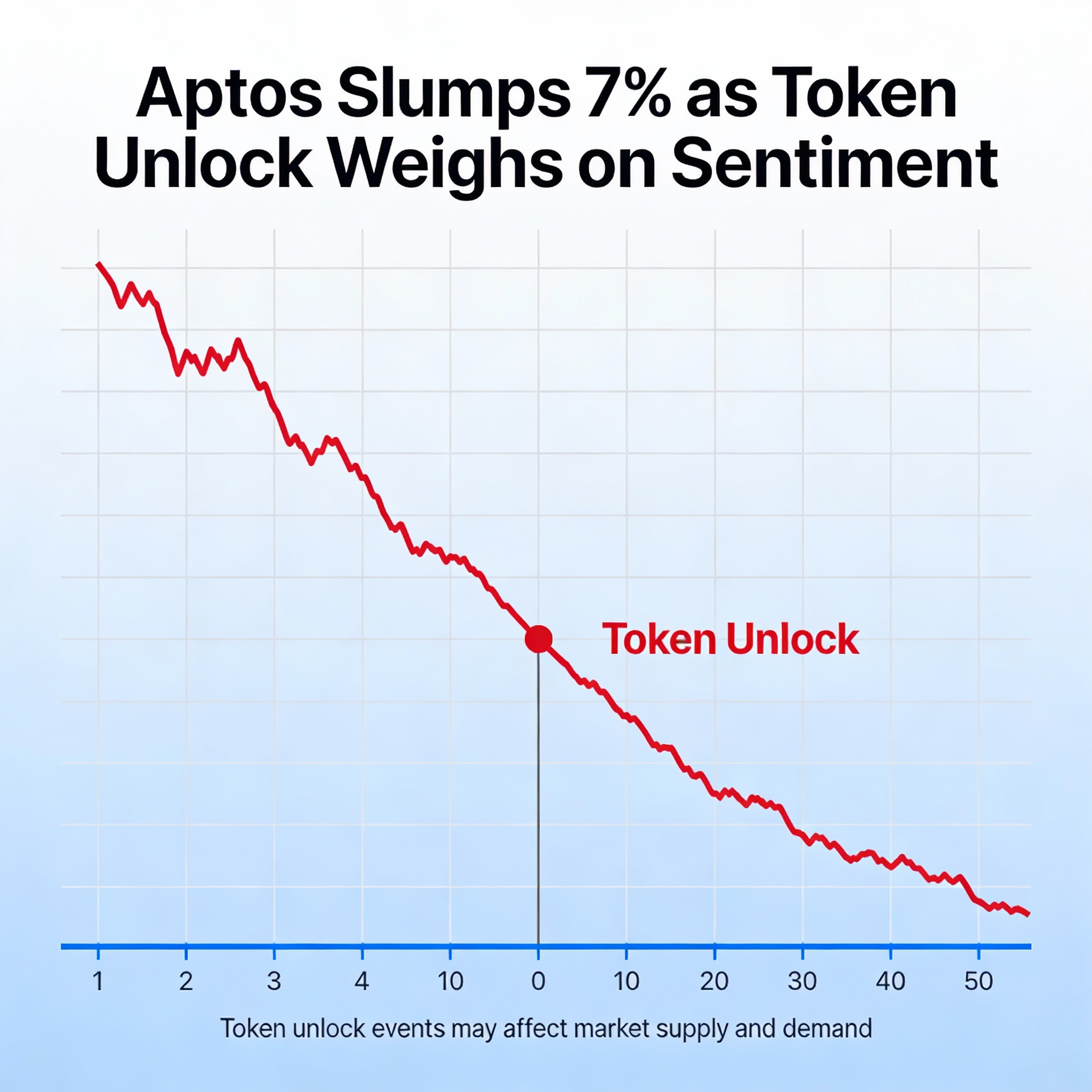

APT fell 7% over the past 24 hours to $1.6852 as investors repositioned ahead of a scheduled token unlock. Broader crypto markets also softened, with the CoinDesk 20 index down 4.2%, according to CoinDesk Research’s technical analysis.

Trading activity surged 38% above the 30-day average, highlighting institutional involvement. The token retreated from an early peak of $1.90, where 6.81 million APT changed hands — nearly triple the usual volume. Selling intensified ahead of the planned release of 11.3 million tokens, roughly 1.5% of total supply, set for early investors and core contributors.

Following the $1.90 peak, APT formed a series of lower highs and lower lows, signaling short-term weakness. Support has emerged near $1.69 after multiple tests, though high-volume patterns suggest continued distribution by larger holders.

Technical Snapshot:

- Support: $1.69–$1.70, defended on three occasions

- Resistance: $1.91, marked by heavy trading volume

- Volume: 38% above 30-day average, confirming institutional participation

- Peak trading: 6.81M tokens at $1.90, validating distribution

- Pattern: Descending from $1.90, with lower highs indicating near-term bearish bias

- Upside: A move above $1.71 could challenge $1.90 resistance

- Downside: Breach of $1.69 may trigger further declines toward prior consolidation zones