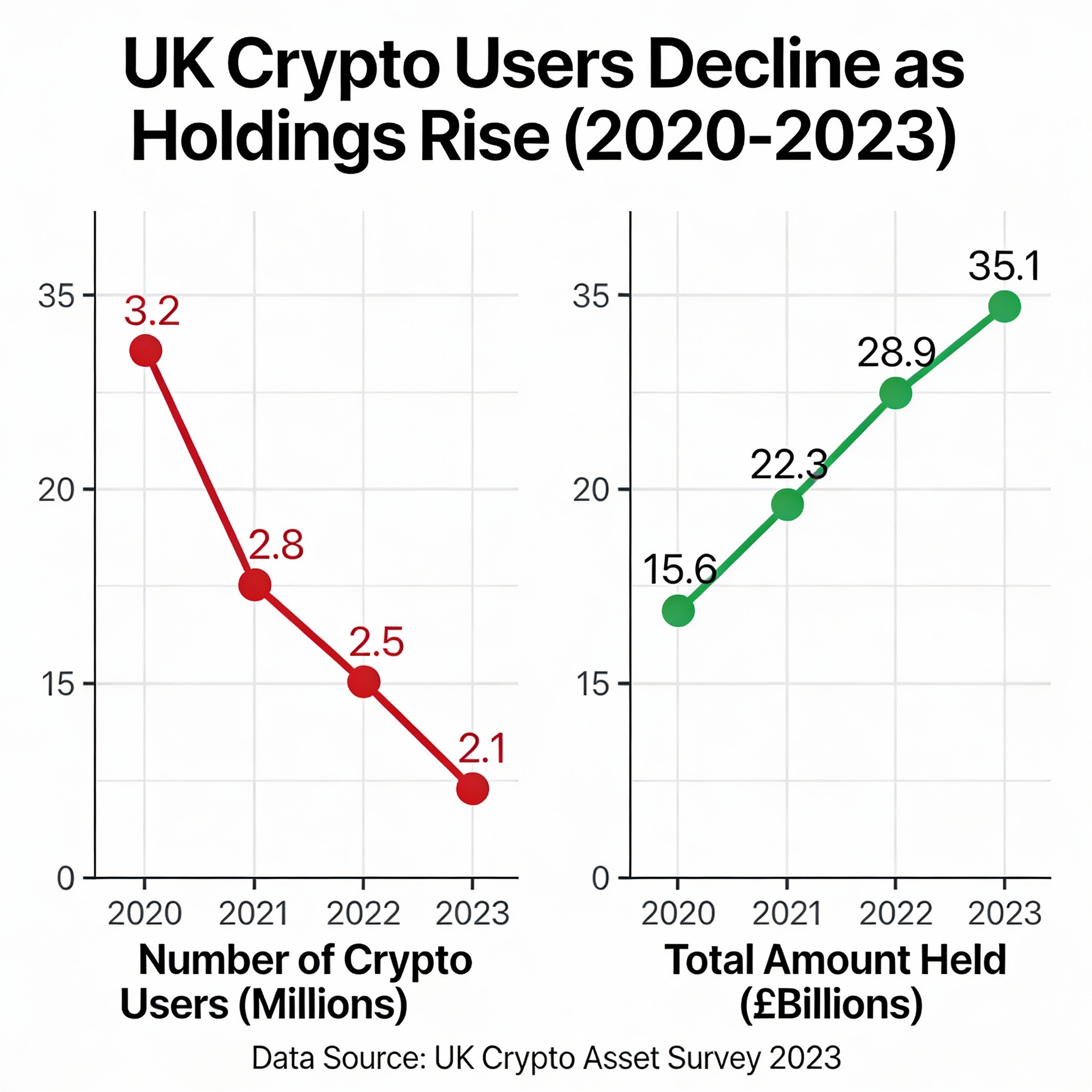

FCA Report: Fewer UK Consumers Hold Crypto, but Average Holdings Climb

Fewer people in the U.K. are holding cryptocurrencies this year, even as the average amount per investor has increased, the Financial Conduct Authority (FCA) said in its Cryptoassets Consumer Research 2025 report.

The number of crypto holders dropped from about 7 million in 2024 to roughly 4.5 million in 2025, though awareness of digital assets remains high at 91%. “The percentage of U.K. adults currently holding cryptoassets has declined from 12% in 2024 to 8% in 2025,” the FCA noted.

The findings come as the FCA launched a consultation on proposed crypto rules under a new regulatory framework, reflecting efforts to expand oversight of the sector. Despite the decline, ownership remains double the levels reported in 2021.

Investors who remain active are holding larger sums. About 21% of holders reported owning between £1,001–£5,000 ($1,345–$6,720), and the mean value per investor rose to just under $2,500, up from $2,300 last year. Total crypto holdings in the U.K. reached $17.3 billion, according to an October Financial Times report.

Bitcoin (BTC$88,255.74) and ether (ETH$2,949.94) remain the most widely held cryptocurrencies, with around 70% and 35% of investors holding them, respectively. Despite the drop in participation, holdings remain concentrated in the two largest digital assets.