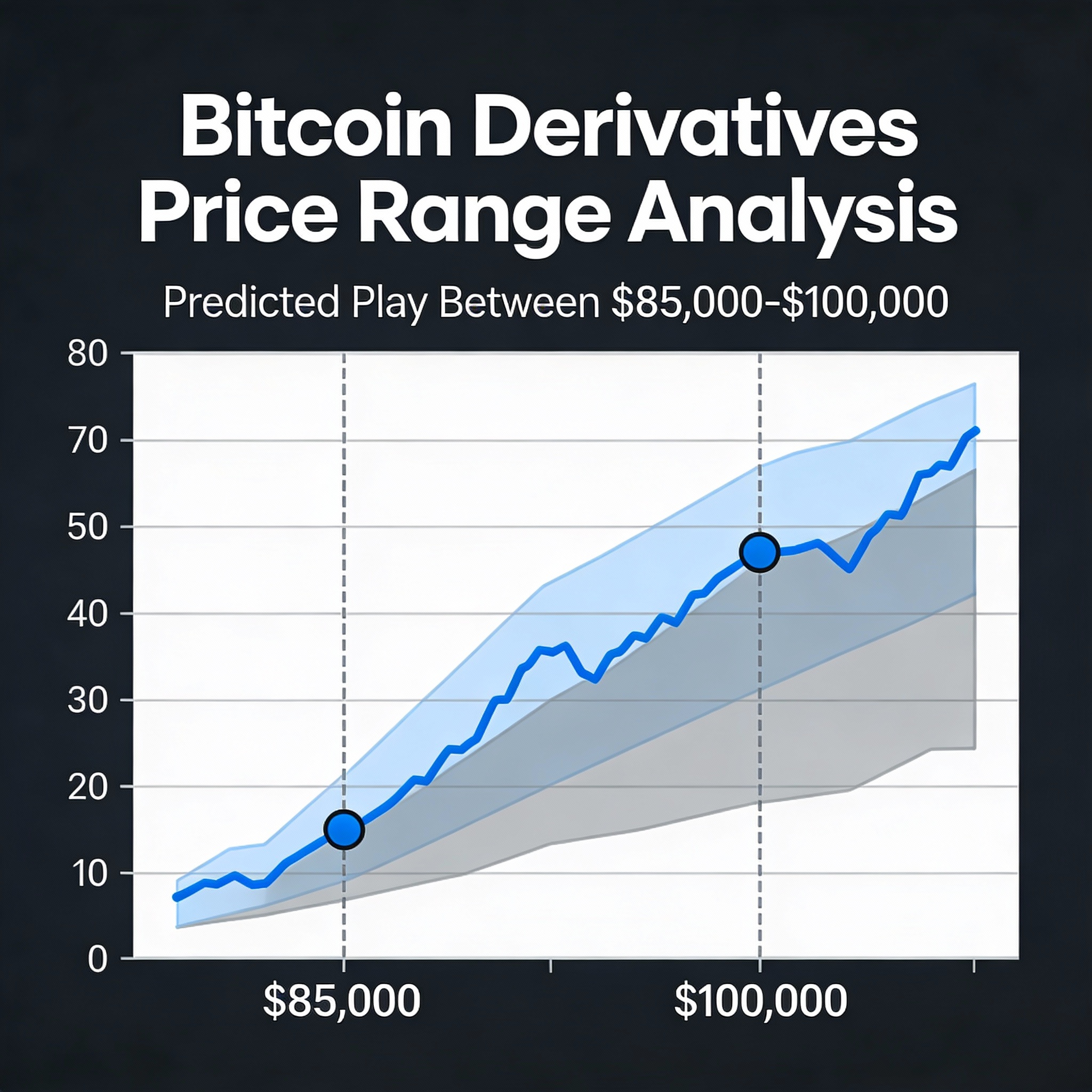

Bitcoin’s derivatives market is reinforcing expectations that prices will remain confined to a wide trading range, as options traders favor yield-generating strategies over directional bets.

Activity in Deribit-listed options points to solid downside support near $85,000, where traders have been aggressively selling put options. Market data tracked by liquidity provider Wintermute suggests this positioning reflects confidence that bitcoin is unlikely to sustain a move below that level in the short term.

The $85,000 strike has become a key anchor for the market, ranking as the second-largest options position across all maturities with more than $2 billion in notional open interest. When prices approach heavily sold put strikes, sellers often hedge by buying bitcoin in spot or futures markets, helping to reinforce support.

On the upside, resistance is forming between $95,000 and $100,000 as investors overwrite long spot holdings by selling call options at those levels. While the strategy generates premium income, it also creates potential selling pressure if bitcoin rallies toward six figures, making a breakout more difficult.

The $100,000 call currently carries the highest open interest on Deribit, totaling about $2.37 billion in notional terms, signaling muted expectations for an immediate surge beyond that level.

“Strong put selling around 85k, with additional buffers at 80k and 75k, while call overwrites cap upside around 95k to 100k. Volatility is being harvested within this range,” said Wintermute desk strategist Jasper De Maere in an email.

This pattern reflects a classic volatility-harvesting trade, where traders sell both puts and calls to collect premiums as long as price swings remain limited. If bitcoin continues to trade sideways, the options decay and expire worthless, allowing sellers to pocket the income.

Bitcoin was last changing hands near $87,400, according to CoinDesk data.