Crypto-linked stocks moved lower as an early rally quickly lost momentum, tracking a sharp reversal in bitcoin after it briefly pushed above $90,000.

Bitcoin (BTC) slid to around $86,500, down roughly 3.9% over the past hour, pressuring the broader digital asset market. Ether (ETH) fell 5.3% to about $2,850, while XRP dropped 4.1% to near $1.89. The CoinDesk 20 (CD20) index was last down about 1.5% on the day.

Mining shares were hit particularly hard. MARA Holdings (MARA) erased earlier gains to fall 4.8%, while Core Scientific (CORZ) slid 6%. CleanSpark (CLSK), one of the session’s early outperformers, gave back its advance to trade 0.38% lower, and Riot Platforms (RIOT) declined 0.7%.

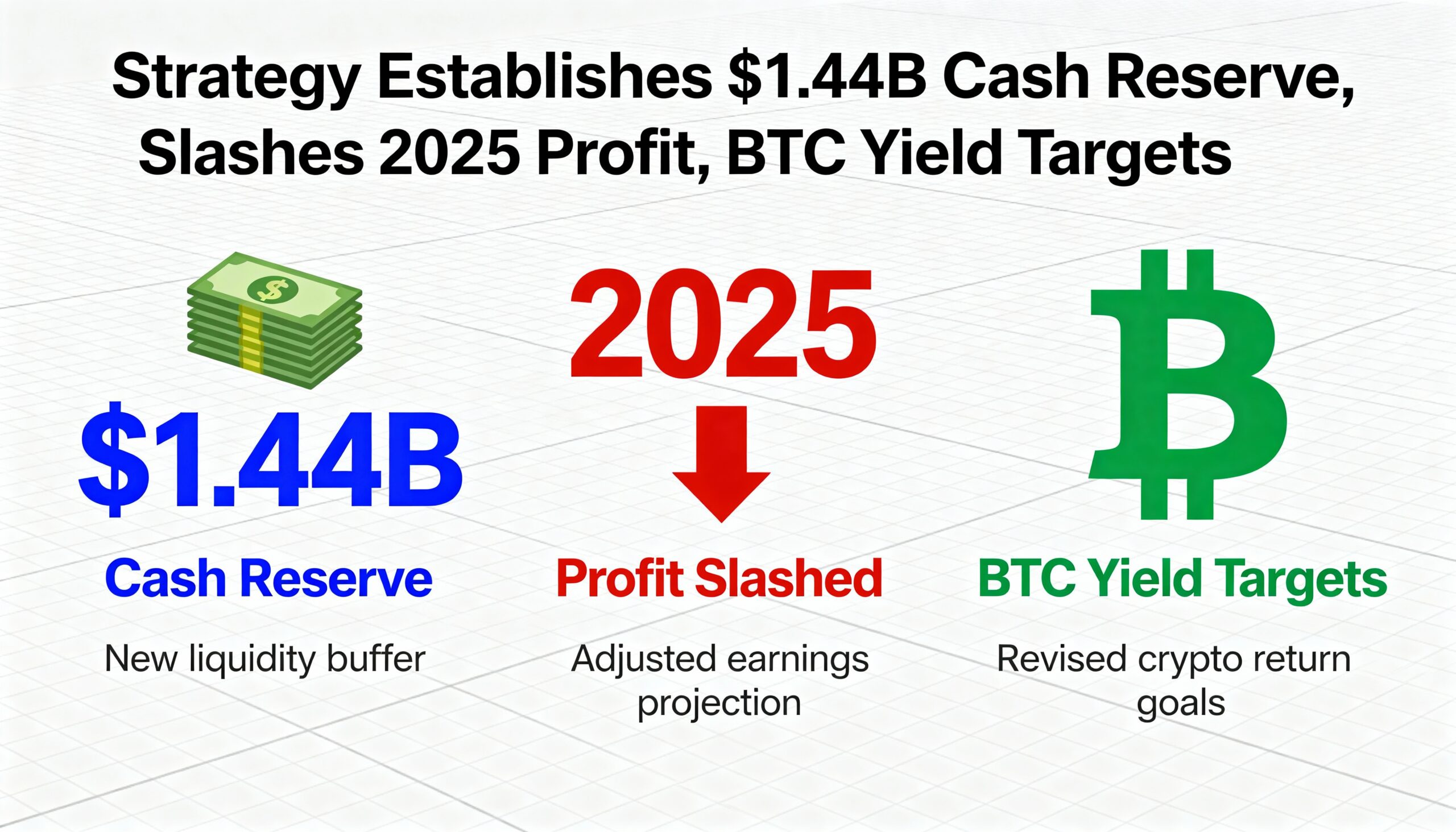

Crypto trading and services stocks also retreated. Circle Internet (CRCL), the issuer of the USDC stablecoin, dropped 3.2%. Strategy (MSTR), the largest corporate holder of bitcoin, fell 2%, while Galaxy Digital (GLXY) slipped 1.9%. Shares of crypto exchange Coinbase (COIN) dipped 0.55%.

Hut 8 (HUT) was a notable outlier, jumping as much as 20% earlier in the session after announcing a 15-year, $7 billion lease agreement with AI infrastructure firm Fluidstack. The stock remained up more than 12% on the day.

The reversal came even as Federal Reserve Governor Chris Waller — now a leading favorite in prediction markets to succeed Jerome Powell as Fed chair — played down the concept of a neutral interest-rate stance, noting that job growth appears close to zero.