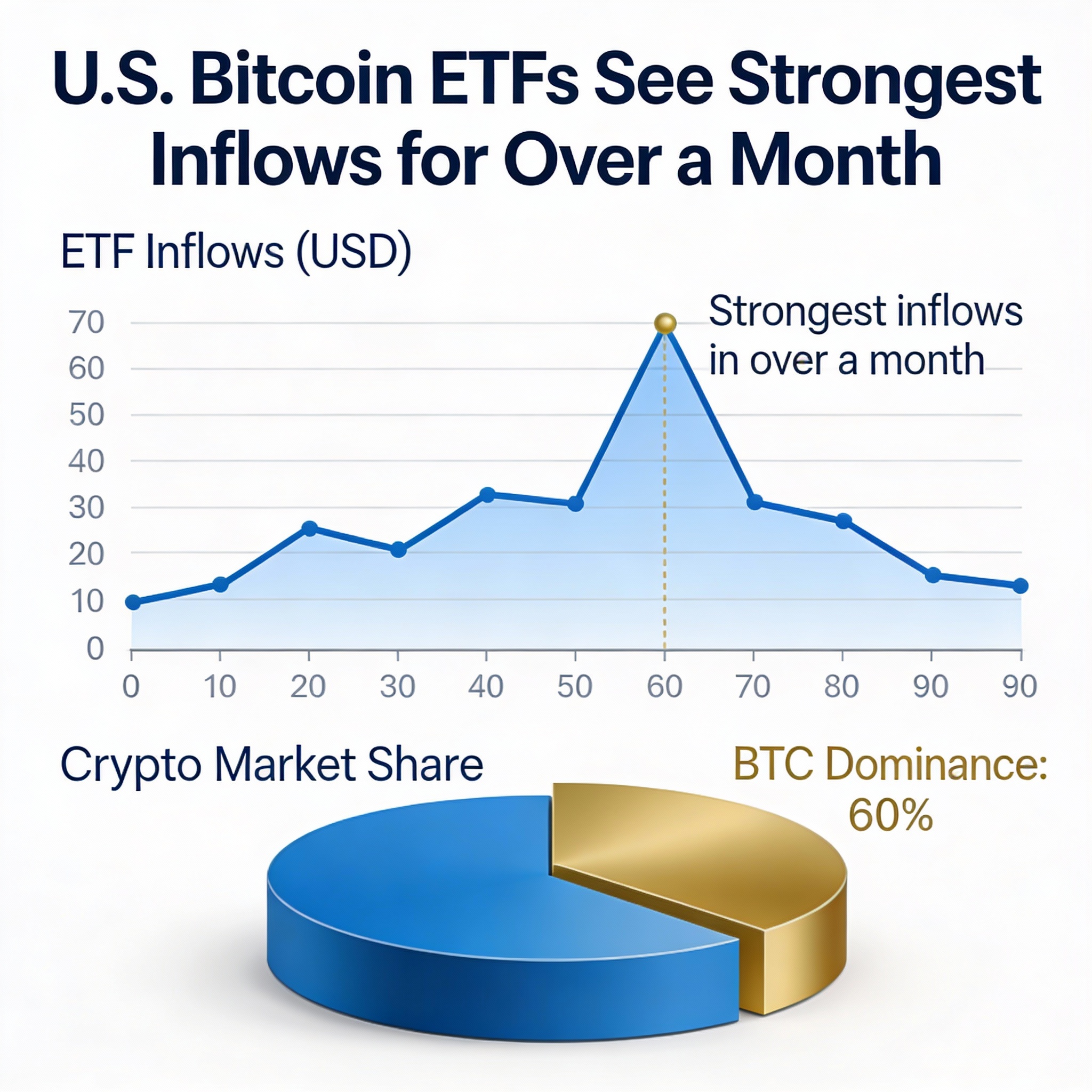

U.S. spot bitcoin ETFs saw their largest one-day inflows since November 11 on Wednesday, as bitcoin (BTC) oscillated between nearly $90,000 and below $86,000 amid heightened market volatility.

Total net inflows reached $457.3 million, with $391.5 million flowing into the Fidelity Wise Origin Bitcoin Fund (FBTC), marking one of its top five inflow days, according to Farside data. BlackRock’s iShares Bitcoin Trust (IBIT) also drew strong demand, posting $111.2 million in inflows.

Bitcoin dominance — BTC’s share of total cryptocurrency market capitalization — climbed to 60%, the highest since November 14 when bitcoin traded near $100,000. The largest cryptocurrency is currently around $87,000.

Upcoming macroeconomic events could further influence market swings. The Volmex Bitcoin Implied Volatility Index (BVIV) shows implied volatility just below 50, historically low for bitcoin despite recent price moves.

Investors will be watching the Bank of England, expected to cut rates by 25 basis points to 3.75%, while the European Central Bank is likely to keep rates at 2.15%. Later, inflation data from the U.S. and Japan could further stir volatility across global markets, including cryptocurrencies.