Crypto Markets Whipsaw After Softer U.S. Inflation Data

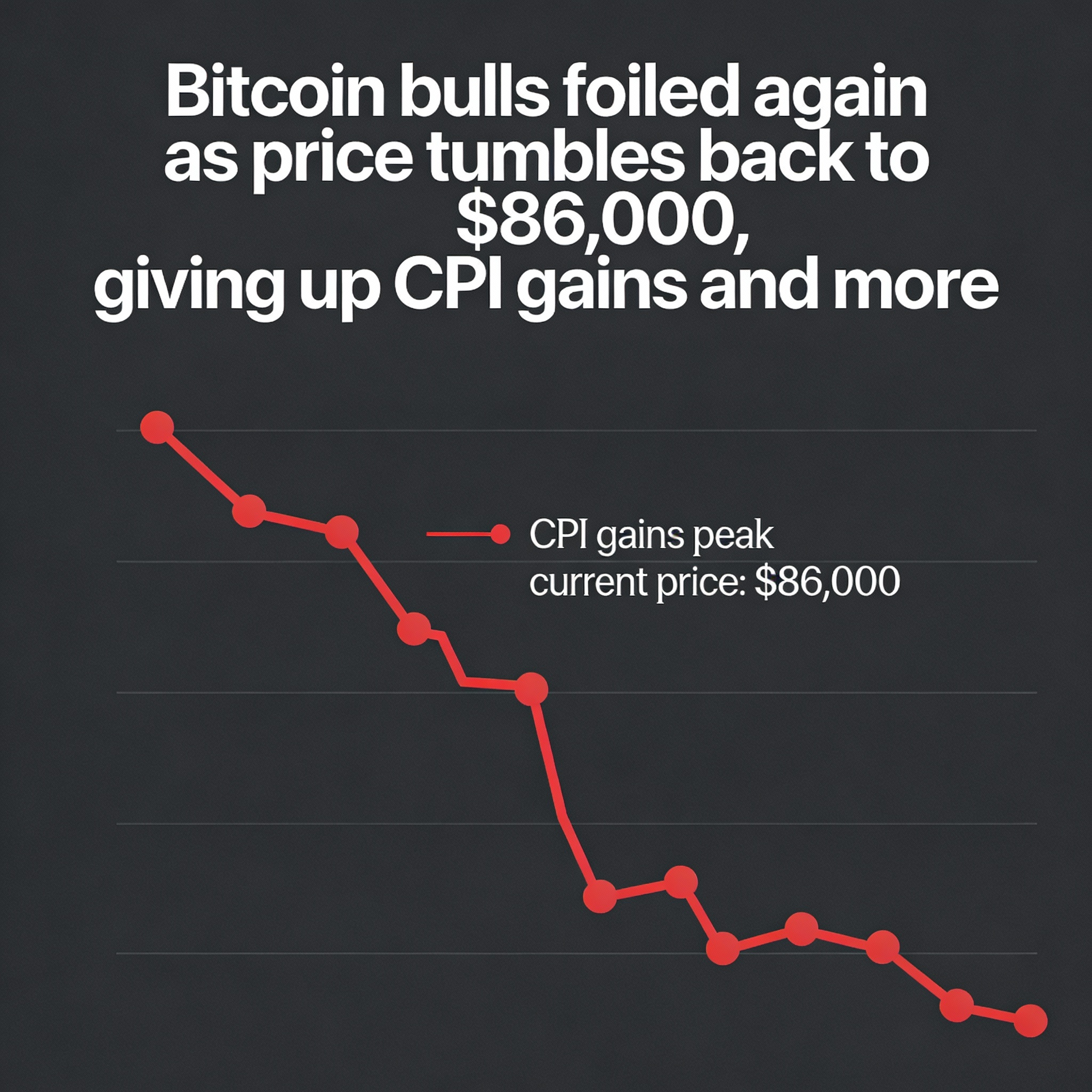

Crypto markets saw early gains Thursday following weaker-than-expected U.S. inflation data, only to reverse sharply within hours. Bitcoin (BTC) surged to $89,300 before dropping to $85,500, and was trading around $86,000 at press time, down 0.8% over 24 hours. The Nasdaq also pared gains, falling about 2% from session highs but remaining up 1.7% overall.

The November Consumer Price Index showed headline inflation cooling to 2.7% from 3% in October. The cooler numbers initially sparked speculation of a potential Federal Reserve rate cut in January, a scenario that typically supports risk assets like crypto.

Skeptics quickly questioned the data’s reliability. Economist Omair Sharif highlighted that the BLS zeroed out rent and owner’s equivalent rent (OER) in October, which could artificially lower year-over-year CPI readings through April. WSJ reporter Nick Timiraos criticized the move as “totally inexcusable,” calling into question the methodology.

Market expectations have reflected these concerns, with odds of a January rate cut holding steady at around 24%.

Bitcoin Stays Rangebound, Ether Traders Hedge

Crypto options activity shows Bitcoin and ether (ETH $2,981.53) diverging in trader sentiment. Bitcoin traders are selling downside protection below $85,000 while limiting upside exposure above $100,000, indicating confidence in near-term support but little expectation of a sustained breakout, according to Wintermute’s OTC desk.

Ether, by contrast, shows more hedging behavior. Support appears to be forming around $2,700–$2,800, but upside calls above $3,100 are being sold aggressively, signaling that traders are focused on risk management rather than betting on strong gains.