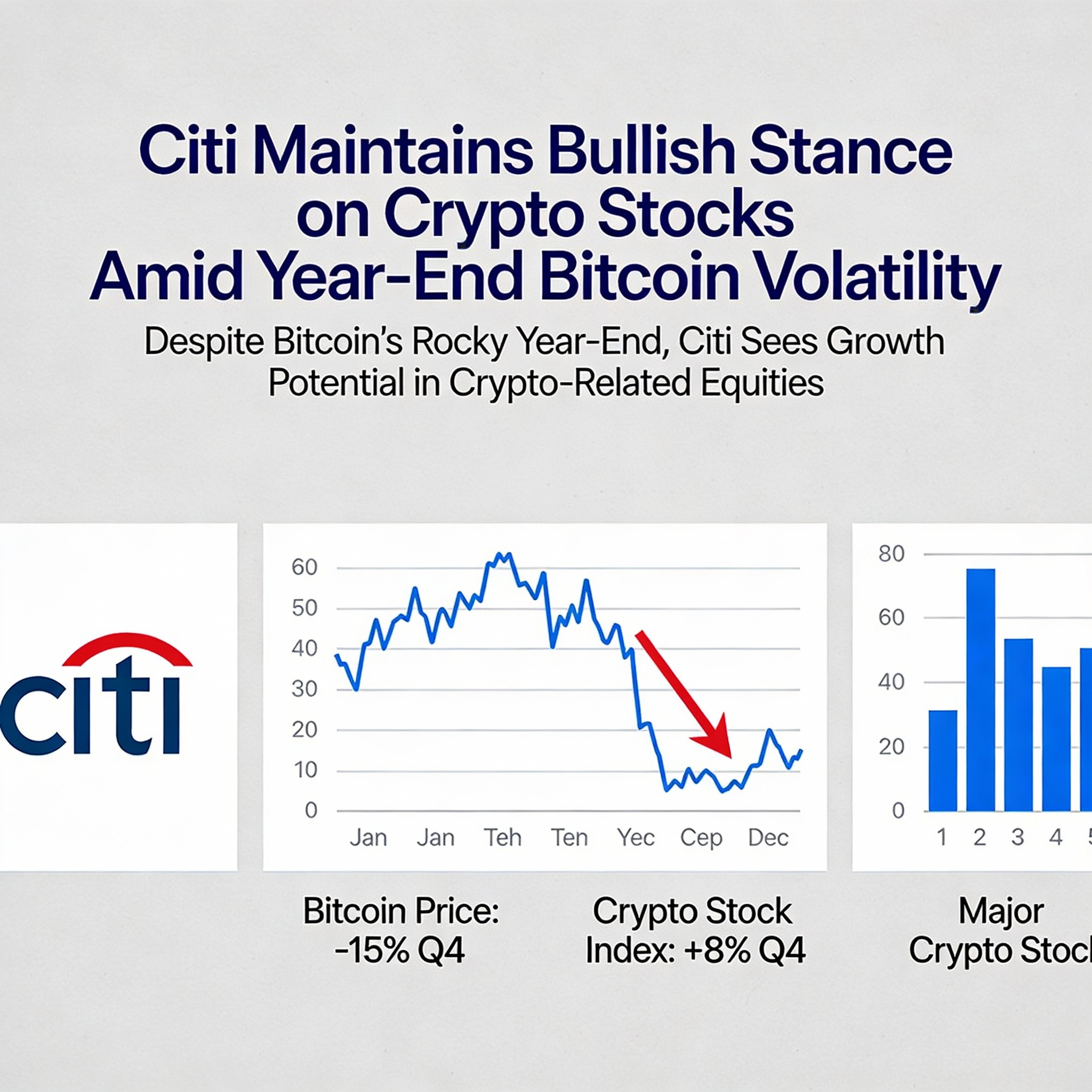

Citigroup updated its coverage of digital-assets stocks on Friday, reflecting recent market declines while maintaining a positive outlook on the sector.

“Despite recent token volatility, we remain bullish on digital assets stocks,” analysts led by Peter Christiansen wrote in their report.

Circle Financial (CRCL), the issuer of the USDC stablecoin, remains Citi’s top pick. The bank reaffirmed its $243 price target, even after the stock dropped sharply to $83.60.

Other top picks include Bullish (BLSH) and Coinbase (COIN). “BLSH is well-positioned to benefit from growing U.S. institutional and traditional finance participation,” Christiansen noted. While BLSH’s price target was lowered to $67 from $77, it still implies significant upside from its current $44. COIN’s target remains $505 versus a current price of $242.

Buy-rated MicroStrategy (MSTR) also saw its price target cut following its slide to the $160 range. The new target of $325, down from $485, still suggests roughly 100% upside potential.

Citi remains positive on bitcoin miner Riot Platforms (RIOT), though its target was reduced to $23 from $28. Riot was trading around $14.

Neutral-rated Gemini (GEMI) had its price target lowered to $13 from $16, citing “increasing competitive challenges,” with shares at approximately $11.

Overall, Citi’s refreshed coverage reflects caution amid recent volatility but reinforces the bank’s long-term confidence in leading digital-asset stocks.