Fidelity’s global macro director, Jurrien Timmer, remains a long-term Bitcoin bull but is cautious about what lies ahead in 2026.

Recently, some leading voices in crypto have questioned Bitcoin’s four-year cycle. Bitwise’s Matt Hougan and ARK Invest’s Cathie Wood argue that with ETFs, institutional adoption, and regulatory acceptance, Bitcoin has become part of the mainstream financial system and may no longer follow the historical boom-and-bust pattern.

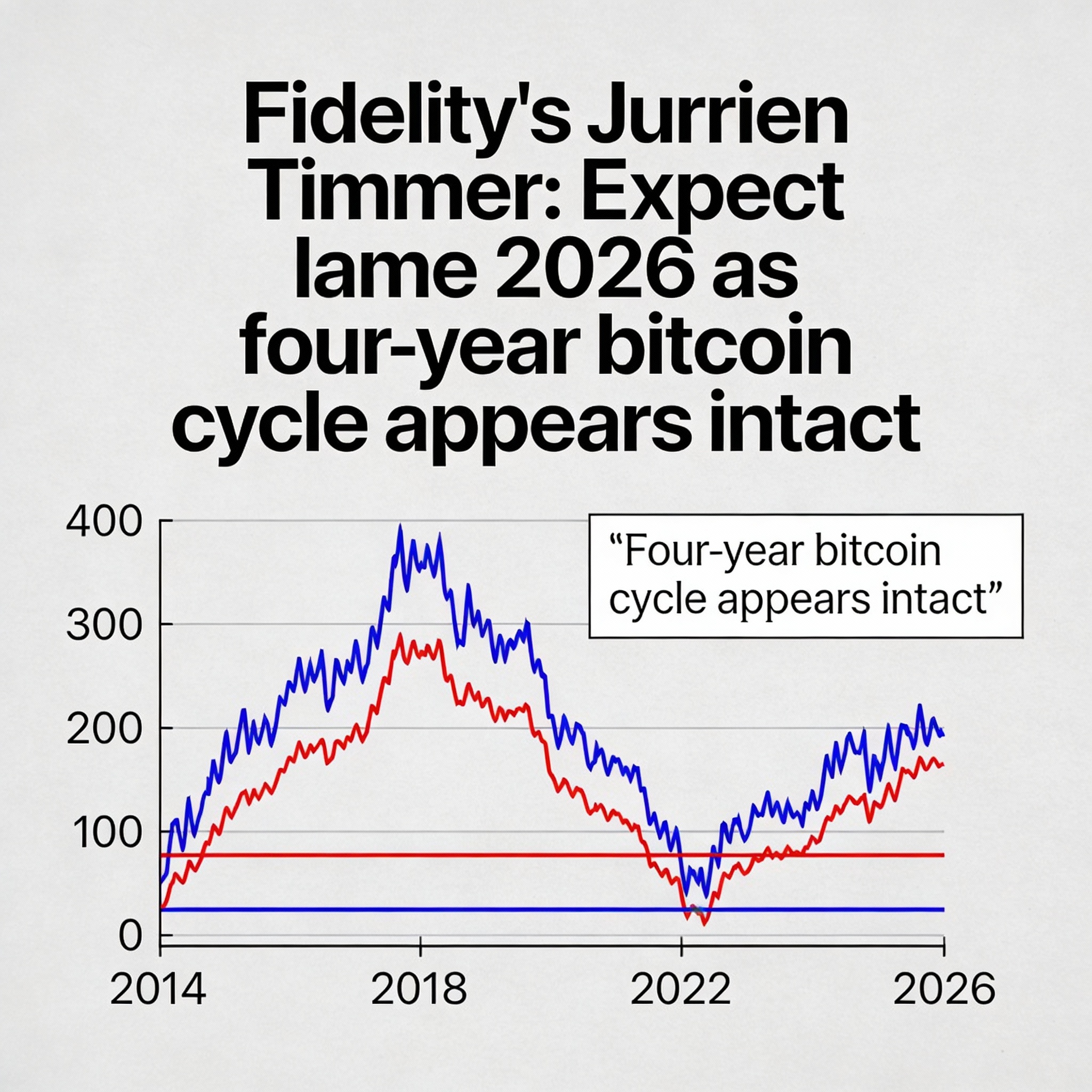

The four-year cycle, linked to Bitcoin’s halving events, has historically driven major price surges. Each halving reduces the mining reward by 50%, creating a supply shock that often sparks a rally. Following these peaks, Bitcoin typically experiences declines of roughly 80% before gradually climbing toward the next halving.

Looking at past cycles—2012, 2016, and 2020—the pattern has largely held. The 2024 halving saw Bitcoin peak at $125,000 in October 2025, followed by the current bear market.

Timmer, an early Bitcoin advocate in traditional finance, sees no sign that the cycle is broken. “If we line up all the bull markets, the October high of $125,000 after 145 weeks of rallying fits what one might expect,” he said.

Looking ahead, he predicts a consolidation phase. Historically, post-halving bear markets last about a year. “My sense is that 2026 could be a ‘year off’ for Bitcoin,” Timmer noted, adding that support levels are likely in the $65,000-$75,000 range.