Metals Surge as Dollar Slides, While Crypto Remains Under Pressure

Metals and other hard assets continue to hit record highs as the U.S. dollar weakens, but cryptocurrencies have largely remained in a downtrend.

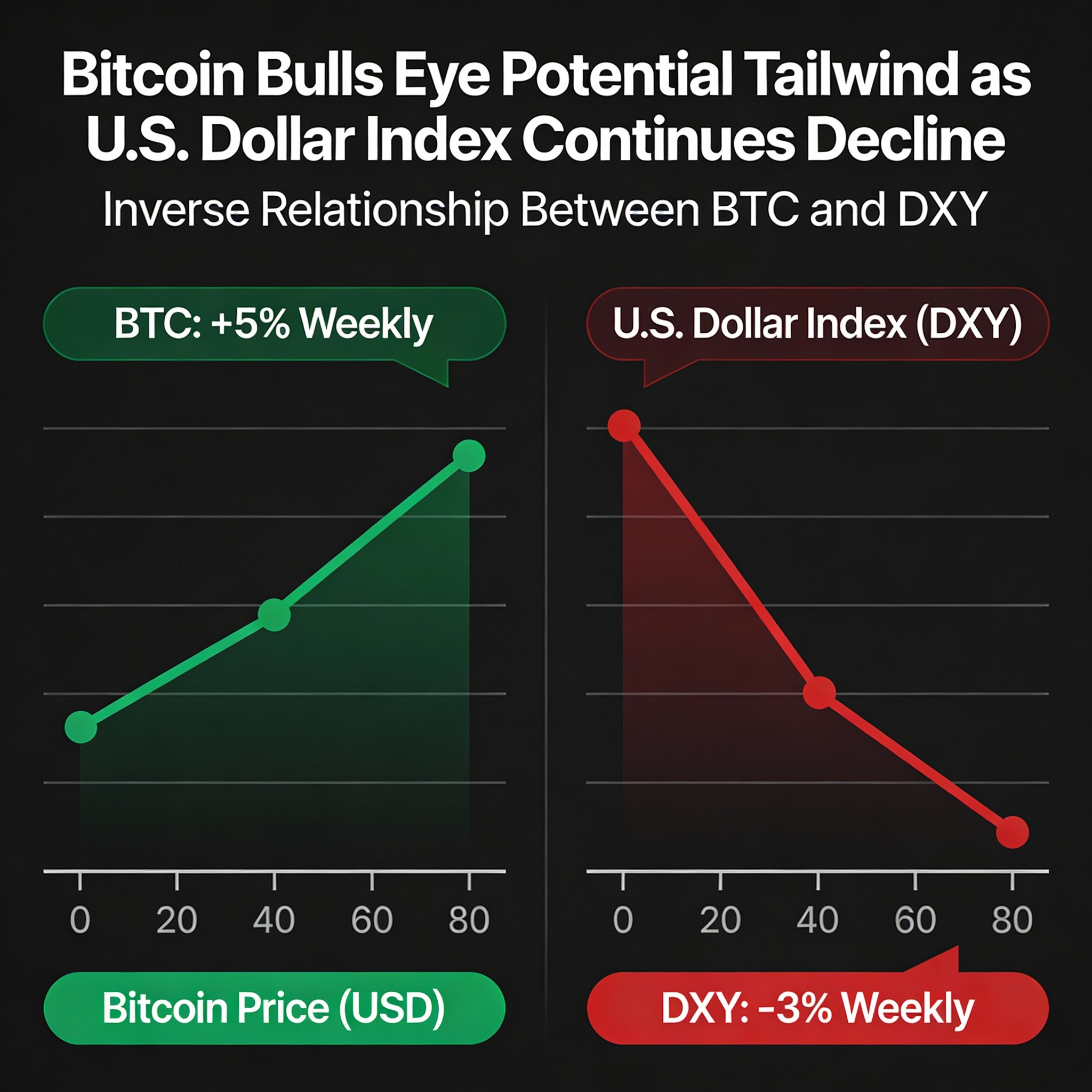

The U.S. dollar index (DXY) fell again Tuesday, trading just above its 2025 low. After a post-election rally following Donald Trump’s November 2024 victory, the dollar declined sharply in the first half of 2025 and has since remained volatile near multi-year lows. Early in the year, this weakness lifted stocks, gold, and Bitcoin (BTC $87,288.23) to new highs.

Since October, however, the story has diverged. Stocks and hard assets continue to climb—gold, silver, and copper all set fresh records Tuesday—while Bitcoin and the broader crypto market have faced steep declines.

Dollar Outlook

The DXY sits near a long-term support level dating back to the 2008 financial crisis, tested multiple times this year. With foreign central banks tightening policy and the U.S. Fed facing pressure to cut rates, the dollar could break below this key floor.

Such a move may finally provide Bitcoin with the catalyst needed to reverse its prolonged downtrend.