Gold Outperforms as Bitcoin Struggles to Prove ‘Digital Gold’ Role

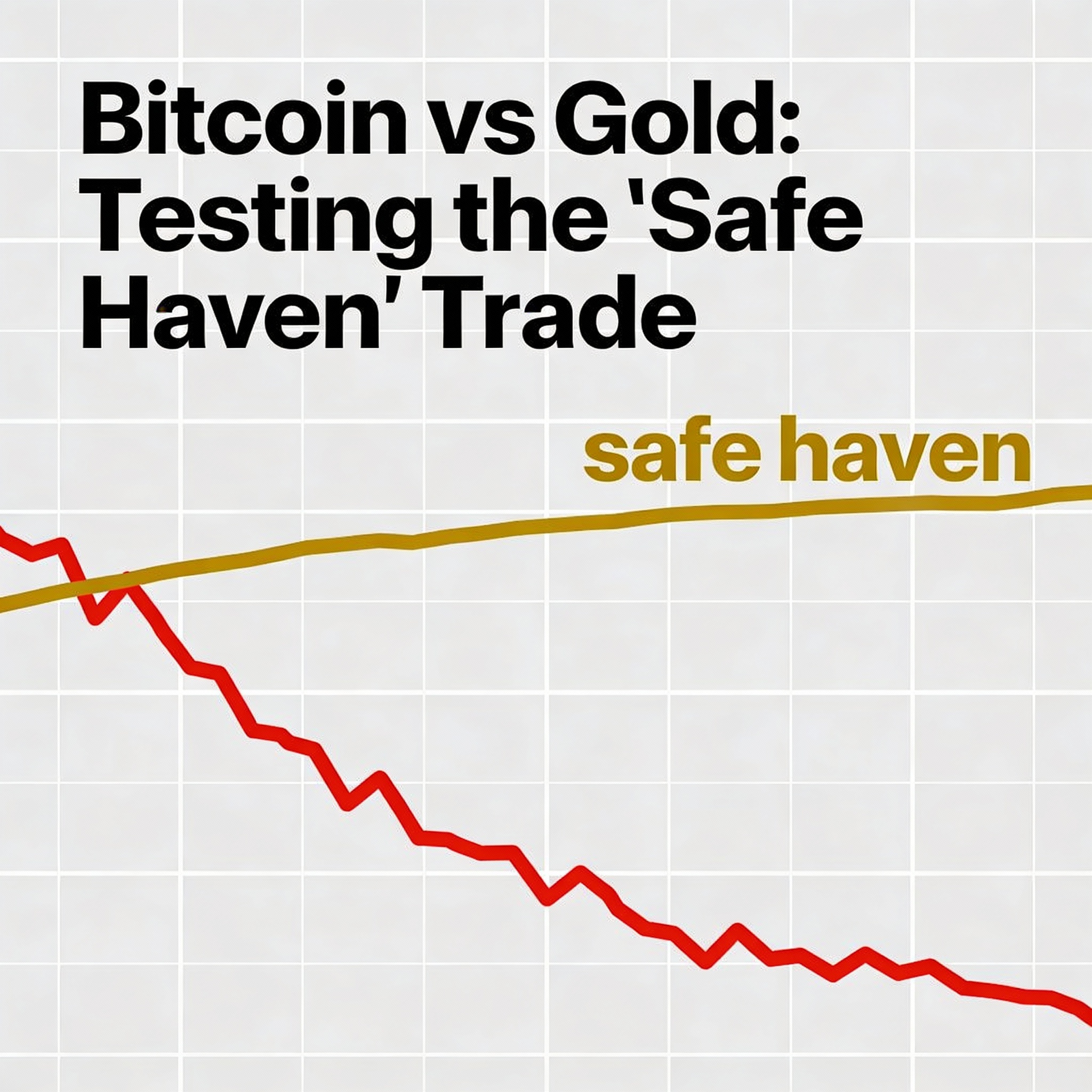

Gold is rallying on expectations of rate cuts and rising geopolitical risks, while Bitcoin continues to struggle at key psychological levels, remaining sensitive to the same forces that pressure equities and other risk assets.

The divergence raises a familiar question for crypto investors: if Bitcoin is meant to be digital gold, this is exactly the environment it should excel in—but it is not.

Gold has climbed more than 70% this year, while silver has surged roughly 150%, positioning both for their strongest annual gains since 1979. Platinum has also hit record levels, reflecting a broader rally across precious metals as investors seek protection against geopolitical uncertainty and long-term currency risks.

Bitcoin’s weakness is partly structural. Markets are still digesting extended leverage-driven trading, with rebounds frequently met by quick profit-taking. Macro factors compound the pressure: even with anticipated rate cuts, Bitcoin generally needs clear risk-on conditions, whereas gold benefits first from volatility in bond yields, dollar swings, and periods of “capital preservation.”

David Miller, CIO at Catalyst Funds and portfolio manager of the Strategy Shares Gold Enhanced Yield ETF, noted the contrast. “Gold has had a record year, up over 60%, while Bitcoin isn’t behaving like digital gold,” he said. He added that Bitcoin can still serve as a long-term hedge, but gold remains a true institutional reserve asset.

World Gold Council data shows consistent accumulation in gold-backed ETFs, with State Street’s SPDR Gold Trust rising over 20% in 2025. Wall Street analysts are bullish as well: Goldman Sachs projects gold could approach $4,900 an ounce in 2026, with upside risks skewed higher