XRP continues to trade within a narrow $1.85–$1.91 range, with persistent selling pressure near $1.90 and steady demand around $1.86, setting the stage for a potential decisive breakout.

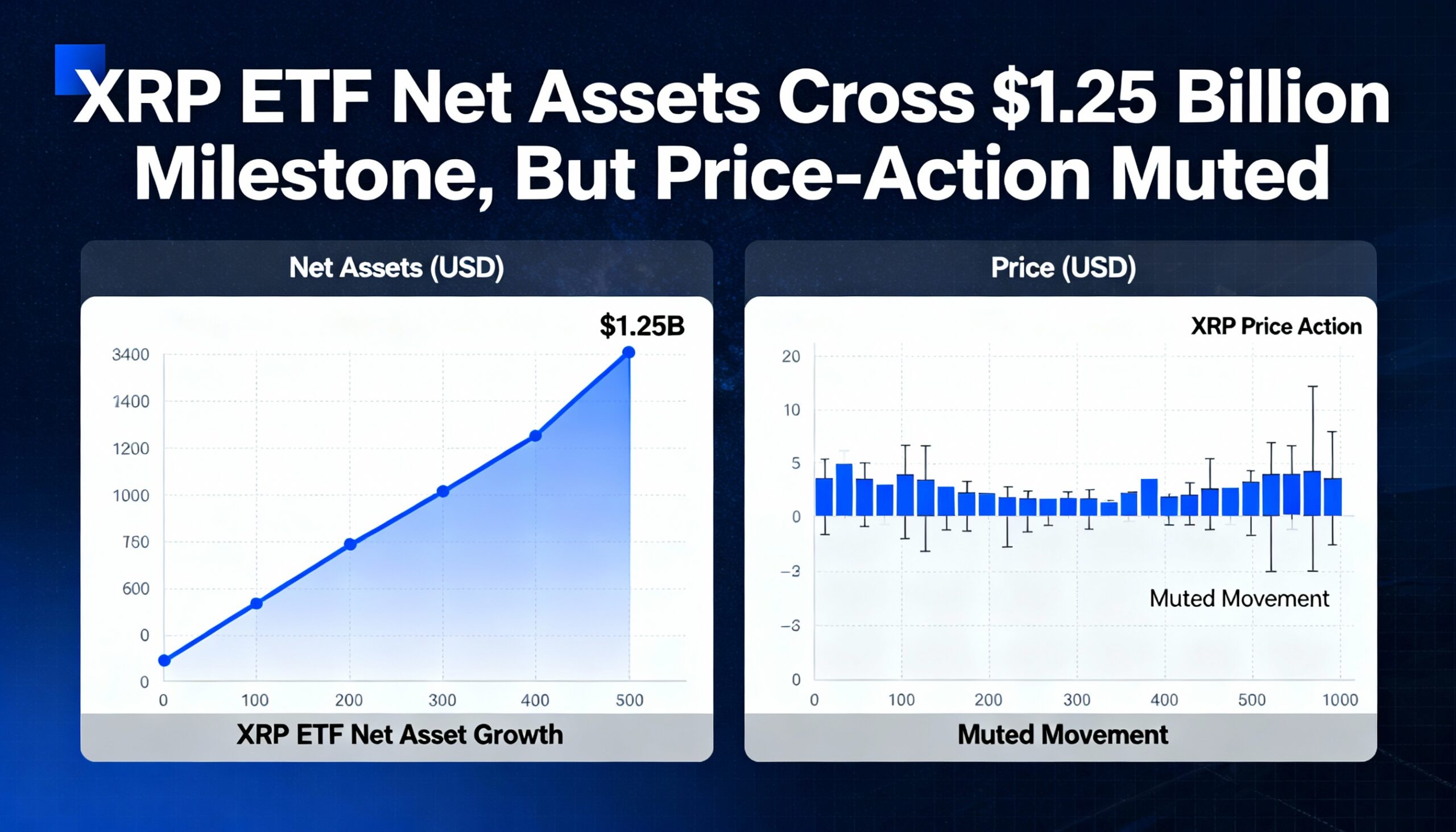

The token dipped to $1.86 as traders repeatedly sold into rallies, even as spot ETF demand remained firm and total ETF-held assets rose to $1.25 billion. The divergence suggests the market is still absorbing supply at key technical levels despite improving longer-term positioning.

News background

Institutional demand for XRP exposure continues to build through exchange-traded funds, with investors adding $8.19 million over recent sessions. That pushed total ETF net assets to $1.25 billion, reinforcing the view that professional investors are accumulating exposure via regulated products rather than chasing short-term spot momentum.

The trend reflects a broader shift in institutional crypto allocation, as portfolio managers increasingly favor structured vehicles that ease custody and compliance concerns. XRP’s deep liquidity across venues, combined with consistent ETF inflows, has helped underpin longer-term demand even as near-term price action remains uneven.

Across the broader market, bitcoin’s rebound attempt failed to gain traction during U.S. trading hours, leaving major tokens locked in a risk-off, range-bound environment where technical levels continue to dictate short-term direction.

Technical analysis

XRP slid from $1.88 to $1.86, remaining confined within its $1.85–$1.91 channel as sellers repeatedly defended the $1.9060–$1.9100 resistance zone. Trading activity surged during the session’s most active period, with volume reaching 75.3 million — roughly 76% above average — highlighting that the pullback was driven by genuine selling interest rather than thin liquidity.

Price briefly broke above its $1.854–$1.858 consolidation area, testing $1.862 on an activity spike of roughly eight to nine times typical intraday flow. The move, however, lacked follow-through, and XRP rotated back toward $1.86 as supply re-emerged.

The repeated rejection above $1.90 indicates that sellers continue to distribute into strength, while consistent bids in the $1.86–$1.87 region have prevented a deeper decline. The result is a tightening range that increases the likelihood of a sharp move once support or resistance gives way.

Price action summary

- XRP slipped from $1.8783 to $1.8604, remaining trapped within a $1.85–$1.91 range

- The strongest selling response emerged near $1.9061 resistance on above-average volume

- Buyers repeatedly defended the $1.86 level, limiting downside momentum

- A brief push above the prior consolidation zone failed to develop into a sustained advance

What traders should know

Two opposing forces continue to shape the market. ETF inflows provide underlying support, but short-term traders are still using the $1.90–$1.91 zone to sell rallies.

Key levels remain clear:

- If $1.87 holds and XRP can reclaim the $1.875–$1.88 area, price is likely to retest the heavy supply zone at $1.90–$1.91. A daily close above that range could trigger short covering and open the door toward $1.95–$2.00.

- If $1.86 breaks, downside risk increases toward the next demand zone around $1.77–$1.80, an area where buyers have historically stepped in and where downside sentiment typically peaks.