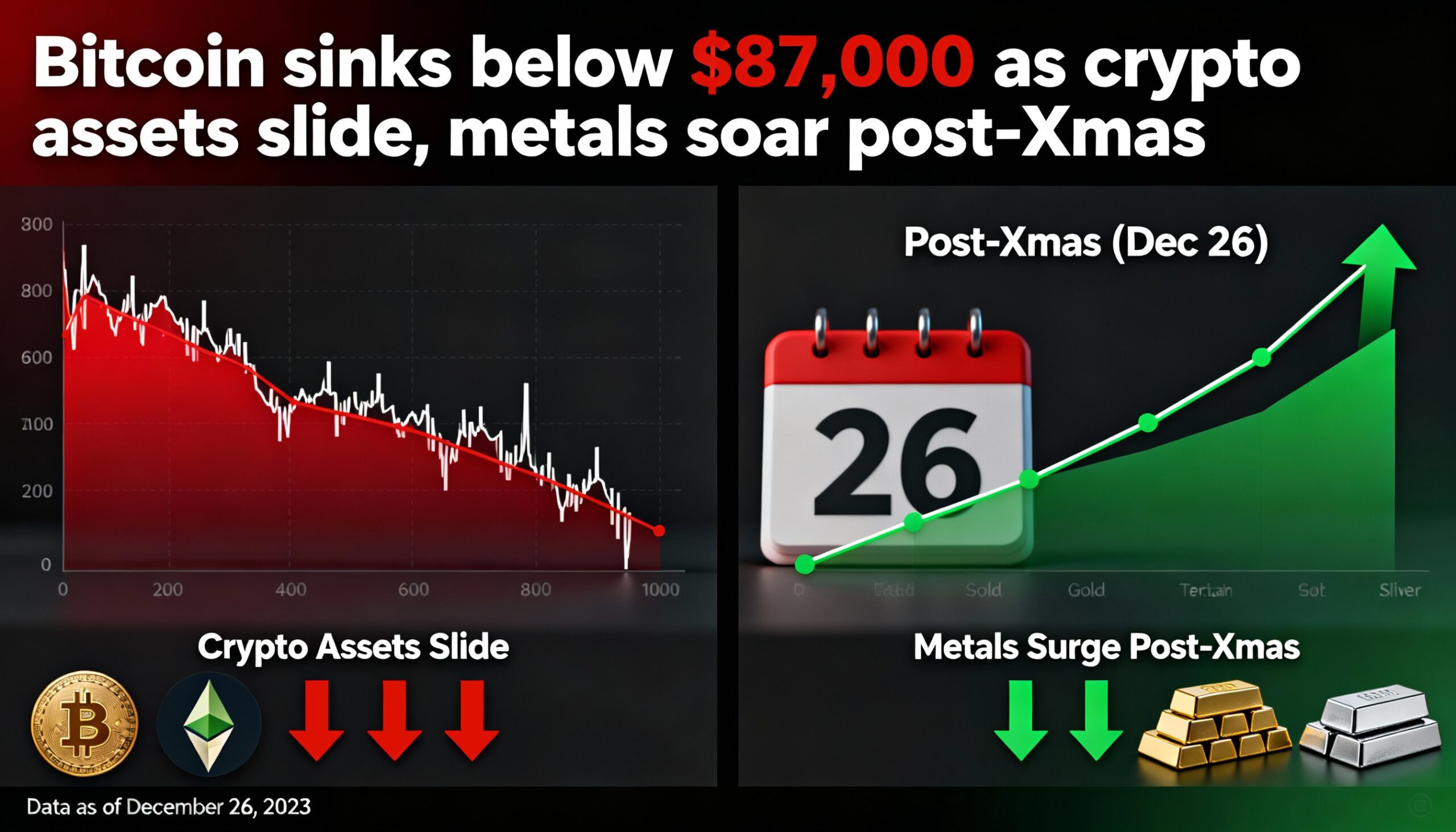

Precious and industrial metals surged to fresh record highs on Friday, drawing capital away from bitcoin as investors favored hard assets amid currency debasement concerns and rising geopolitical tension.

In a now-familiar pattern at the start of the U.S. trading session, the crypto market quickly erased modest overnight gains. Bitcoin briefly pushed above $89,000 while U.S. markets were closed for Christmas, but reversed sharply as American equities reopened, sliding back below $87,000.

The weakness in crypto contrasted starkly with continued strength in metals. Gold, silver, copper and platinum all reached new highs, extending a rally that has increasingly diverted capital from bitcoin within the global debasement trade. The move was further supported by heightened geopolitical risks following U.S. airstrikes on Islamic State targets in Nigeria on Christmas Day and renewed pressure on Venezuela after Washington blocked sanctioned oil tankers.

Platinum and palladium led the advance, each rising more than 10%, while silver and copper gained around 5%. Gold climbed 1.5% to $4,573 per ounce.

U.S. equities were largely unchanged in early trading, with the Nasdaq, S&P 500 and Dow Jones Industrial Average all hovering near flat.

Bitcoin fell 1.6% over the past 24 hours, while ether declined by a similar amount. Losses were heavier across major altcoins, with dogecoin down more than 4% and XRP sliding 3%, leading broader sector declines.

Crypto-related equities also traded lower. Coinbase (COIN), recently named one of the three most promising fintech ideas for 2026 by Clear Street analyst Owen Lau, outperformed peers with a relatively modest 2% decline. Gemini (GEMI) dropped 6%, Bullish (BLSH) fell 3.8% and Galaxy Digital (GLXY) slid 3.5%.

Bitcoin miners were among the hardest hit in early post-holiday trading, including companies that have shifted toward AI infrastructure. IREN (IREN), Cipher Mining (CIFR), Terawulf (WULF) and Marathon Digital (MARA) were down more than 5%. Hut 8 (HUT), which had recently outperformed on optimism around its AI strategy, led losses on Friday, falling 7.5%.