XRP Slips to $1.85 as Key Support Breaks, Technical Bias Remains Defensive

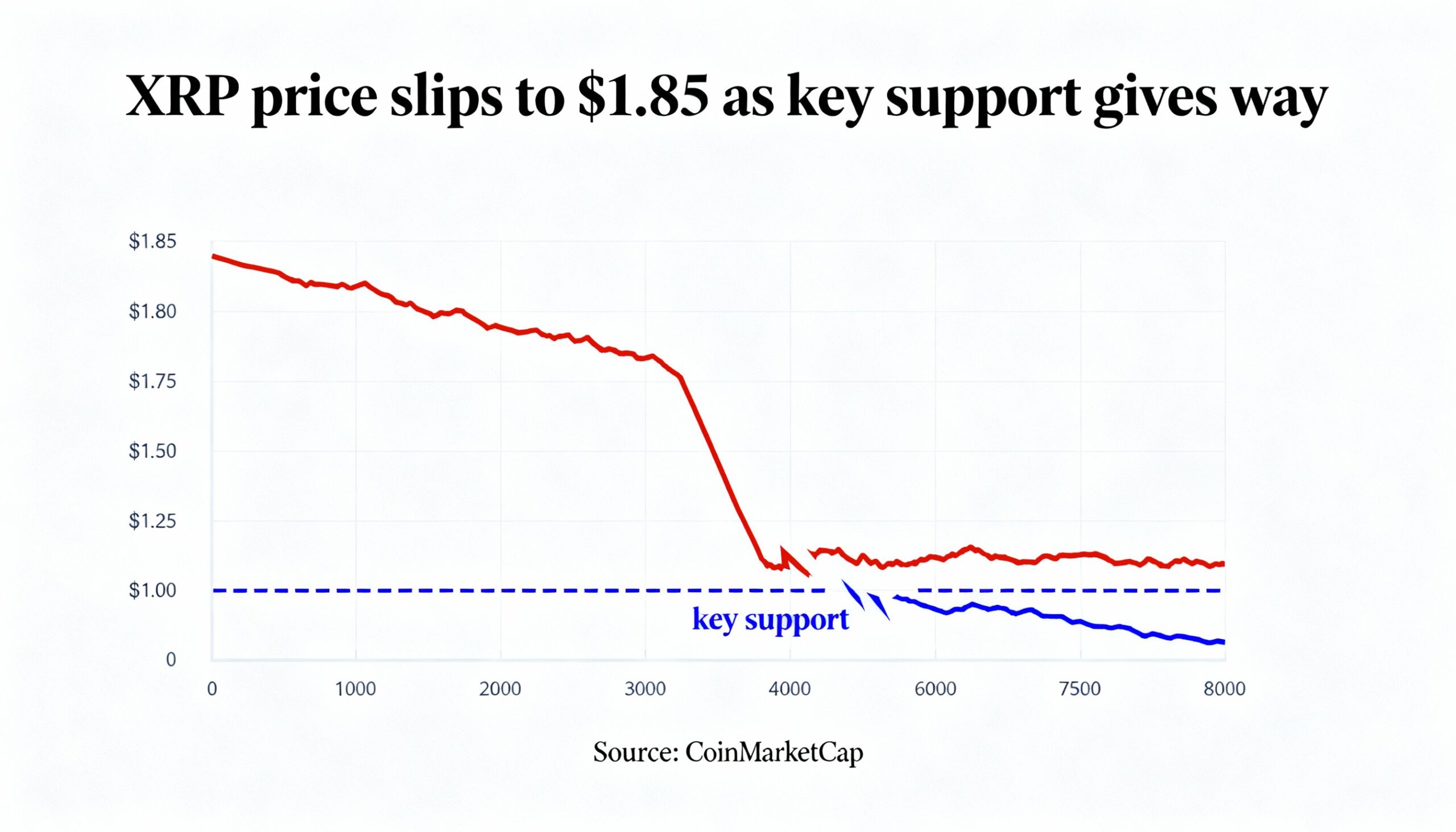

XRP fell to $1.85 after breaking the $1.87 support zone, with heavier exchange inflows suggesting renewed distribution. Momentum indicators show oversold conditions, but attempts to reclaim resistance levels have stalled, reinforcing a cautious market stance. Bitcoin’s stalled rebound and muted risk appetite in the broader crypto market have left XRP and other secondary majors more exposed to supply-driven pressure.

Market Context

Institutional demand for XRP remains structurally supportive via ETFs, yet near-term flows indicate holders are selling into rallies rather than accumulating. On-chain data shows daily exchange inflows ranging from 35 million to 116 million XRP since mid-December—a notable uptick from prior periods of balance. This behavior typically reflects defensive repositioning or profit-taking.

With Bitcoin struggling to regain traction during U.S. trading hours and Ether failing to sustain momentum, XRP has become more sensitive to supply pressure, limiting upside potential.

Technical Analysis

XRP declined from $1.89 to $1.85, decisively breaking the $1.87 support area that had held during recent consolidation. Selling volume peaked at approximately 68 million XRP—77% above the 24-hour average—confirming the breakdown was not due to low liquidity.

Shorter-term charts show a tentative double bottom near $1.846–$1.848, but rebounds have repeatedly stalled near $1.85, turning that level into near-term resistance. The broader structure remains a descending channel, and failed bounce attempts indicate persistent selling pressure. Momentum indicators suggest oversold conditions, but until XRP reclaims meaningful resistance, the technical outlook remains defensive.

Price Action Summary

- XRP slid from $1.89 to $1.85 over 24 hours, breaking $1.87 support

- Selling peaked during the breakdown, with volume ~77% above average

- Price stabilized briefly near $1.846 but failed to reclaim $1.85

- Rebounds capped, reinforcing a lower-high structure

Key Levels for Traders

Exchange inflows suggest ample supply is pressuring rallies, despite ongoing ETF demand. Key levels to watch:

- Downside: Breach of $1.85 opens the door toward $1.84 and the $1.77–$1.80 demand zone

- Upside: Reclaiming $1.87, particularly a close above $1.90, could indicate easing selling pressure and target $1.95–$2.00

For now, XRP remains in a consolidation phase under distribution pressure. ETF flows may buffer sharp declines, but without renewed momentum in Bitcoin, XRP is likely to remain vulnerable to further probing of support rather than staging a clean recovery.