Metaplanet’s bitcoin income generation unit is projected to generate roughly $55 million in revenue for 2024.

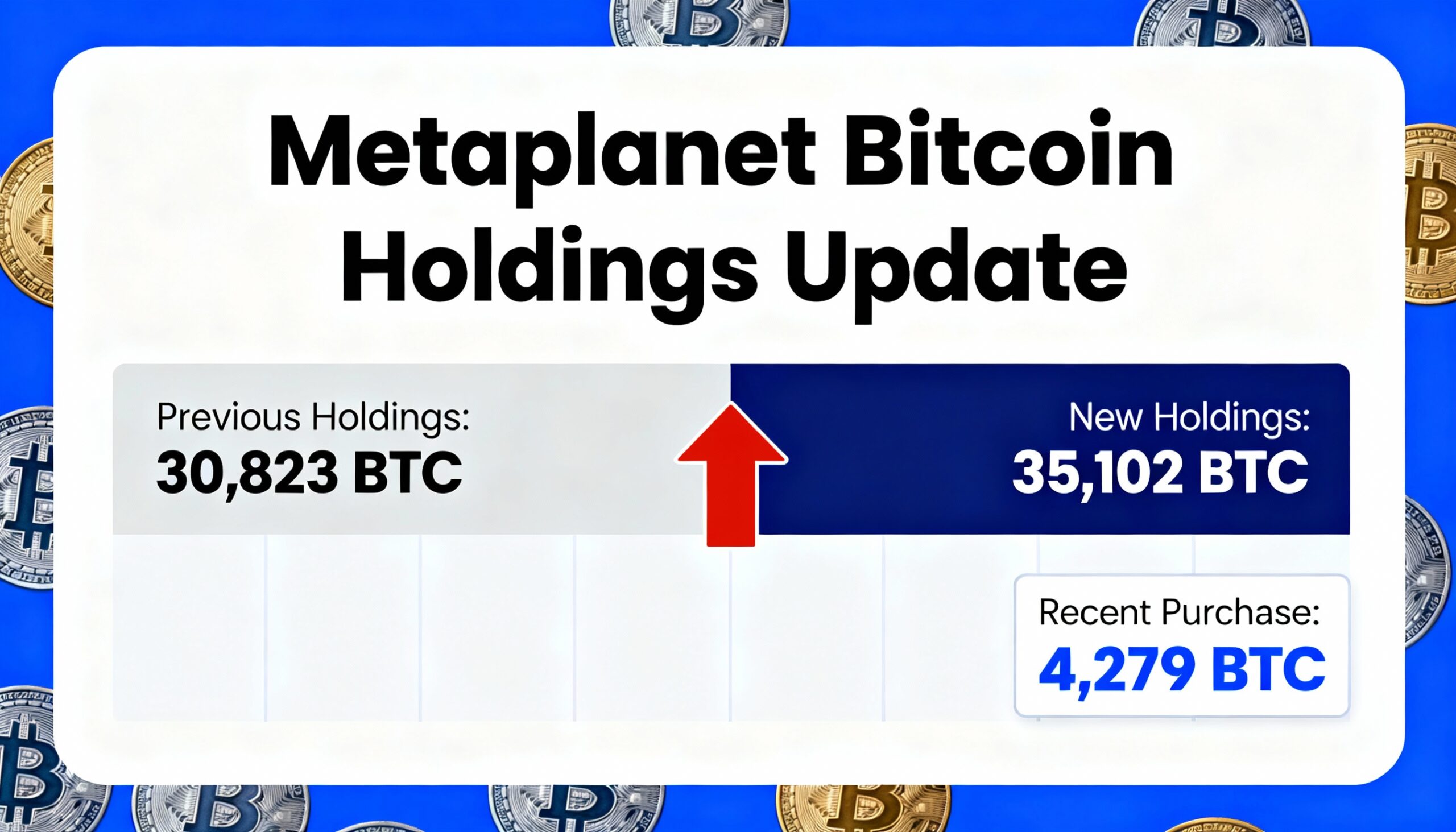

The Tokyo-listed investment and operating company, which specializes in bitcoin treasury management, purchased an additional 4,279 BTC in the fourth quarter, spending approximately $451 million, the firm said in a post on X. The acquisition, at an average price of $105,412 per bitcoin, brings Metaplanet’s total holdings to 35,102 BTC, making it the fourth-largest public corporate treasury by bitcoin holdings. The company has set a target of 210,000 BTC by the end of 2027.

Since initiating its bitcoin accumulation strategy, Metaplanet has spent roughly $3.78 billion at an average price of $107,607 per coin, according to the company’s dashboard. Its shares have gained 8% this year, closing at 405 yen ($2.60), though they remain down roughly 80% from the all-time high recorded in June.

In addition to accumulating bitcoin, Metaplanet has developed a derivatives-based income generation business designed to produce recurring revenue while supporting its long-term bitcoin holdings. The company anticipates the unit will deliver around $55 million in revenue for the full fiscal year.

Metaplanet’s multiple to net asset value (mNAV) — a metric comparing enterprise value to bitcoin net asset value, calculated as market capitalization plus total debt divided by bitcoin NAV — currently sits just above 1, reflecting the company’s valuation relative to its bitcoin treasury.