As 2025 comes to a close, few events have been as dramatic for the crypto market as the Oct. 10 “flash crash,” when bitcoin (BTC $87,784.51) plunged nearly $12,000 — or almost 10% — in minutes. The meltdown triggered more than $19 billion in liquidations in just 24 hours, followed by a widely circulated trader “cascade warning,” and erased roughly $500 billion from total crypto market capitalization.

The crash set the stage for a prolonged slide, leaving bitcoin more than 30% below the $126,223 peak it had reached just six days earlier. This steep decline is likely to result in the first full-year loss for bitcoin since the 2022 crypto winter.

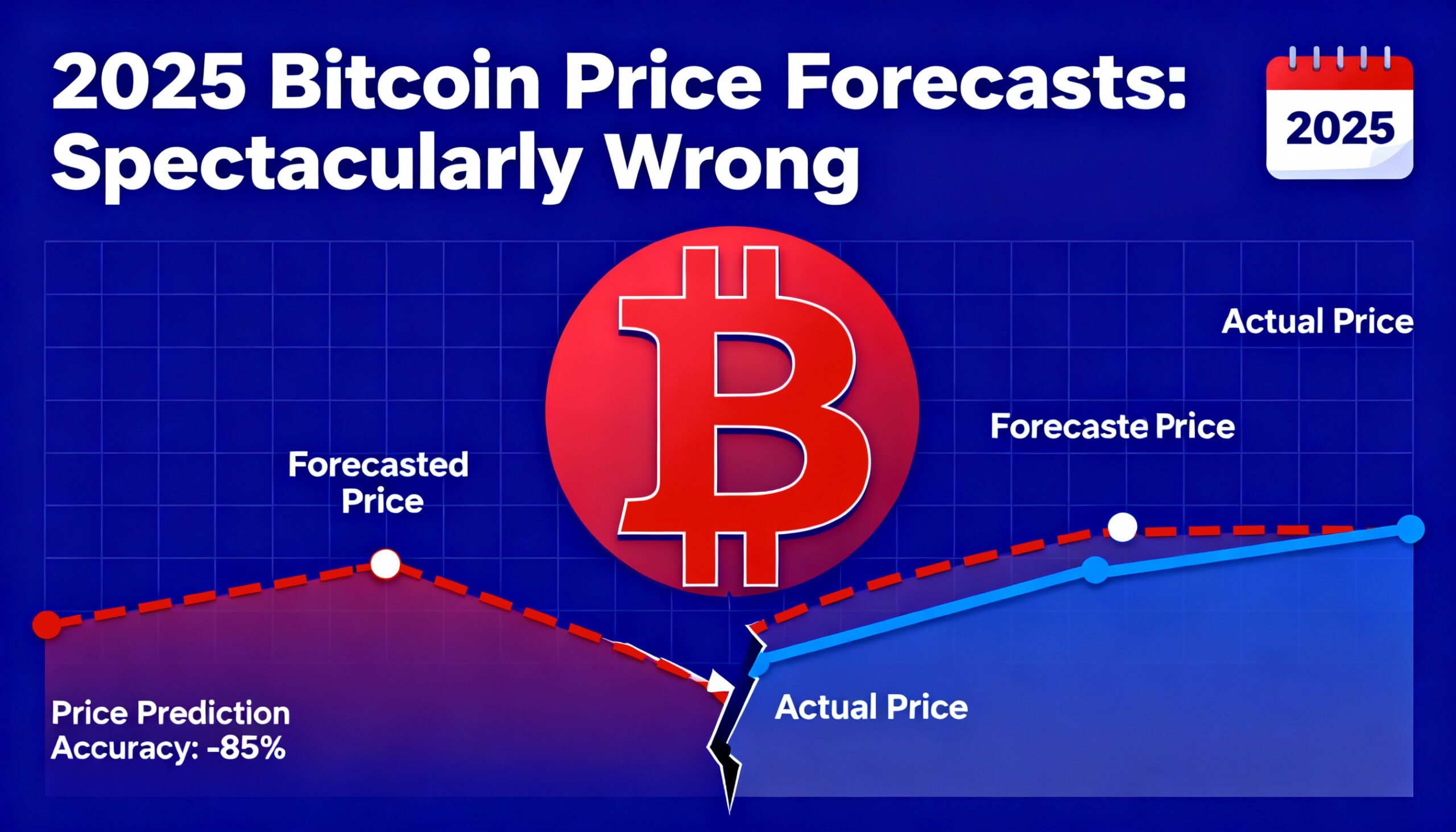

The year began with optimism. Price predictions ranged from cautious estimates to near-fantasy levels. However, after the Oct. 10 crash, most forecasts quickly lost credibility.

Some long-term projections were astronomical, such as Fidelity’s Jurrien Timmer predicting $1 billion by 2038 or BlackRock CEO Larry Fink’s $700,000 target tied to institutional adoption. Others were explosive for 2025 alone. Samson Mow, CEO of bitcoin technology firm Jan3, predicted in February that BTC could hit $1 million by year-end in a “violent” surge fueled by fiat collapse. Adam Back, Blockstream CEO, echoed bullish expectations of $500,000 to $1 million, citing ETF inflows, institutional buying, and limited supply. Venture capitalist Chamath Palihapitiya also forecast $500,000 by October.

Even more restrained predictions exceeded bitcoin’s all-time high. JPMorgan analysts raised their pre-crash October forecast to $165,000, citing growing interest in the “debasement trade” and alternative stores of value. After the crash, Michael Saylor of bitcoin treasury company Strategy (MSTR) maintained optimism, expecting BTC around $150,000 by year-end. Strategy added $1 billion of BTC in December, raising its total holdings to 671,268.

Throughout 2025, the flood of price predictions continued. VanEck’s digital asset team expected a first-quarter peak of $180,000, Bitwise CIO Matt Hougan projected $200,000, and Fundstrat’s Tom Lee maintained a $200,000–$250,000 target well into October. BitMEX co-founder Arthur Hayes stuck with a similar range as late as November.

Few adjusted their targets downward. Galaxy Digital CEO Mike Novogratz revised his $500,000 forecast to $120,000–$125,000 in October, and Standard Chartered cut its target from $200,000 to $100,000 in December.

The lesson of 2025 is clear: bitcoin humbles everyone. It defies models, breaks charts, and ignores even the boldest calls. Some predictions missed by inches, others by miles, but nearly all missed. As the year closes, the industry is left with charts to redraw, narratives to rewrite, and one undeniable truth: in crypto, predictions are easy to make — being right is rare.