Attention is now turning to whether bitcoin can defend key support levels into the new year, after December’s failed rally raised questions about the market’s underlying stability.

Bitcoin and ether closed out December without the year-end surge traders typically anticipate, capping a quarter that underscored how vulnerable crypto rallies can become as liquidity thins and risk appetite fades. The widely anticipated “Santa rally” never took hold. Instead, repeated attempts by bitcoin to reclaim important technical levels were met with selling pressure, while ether and other large-cap tokens tracked lower.

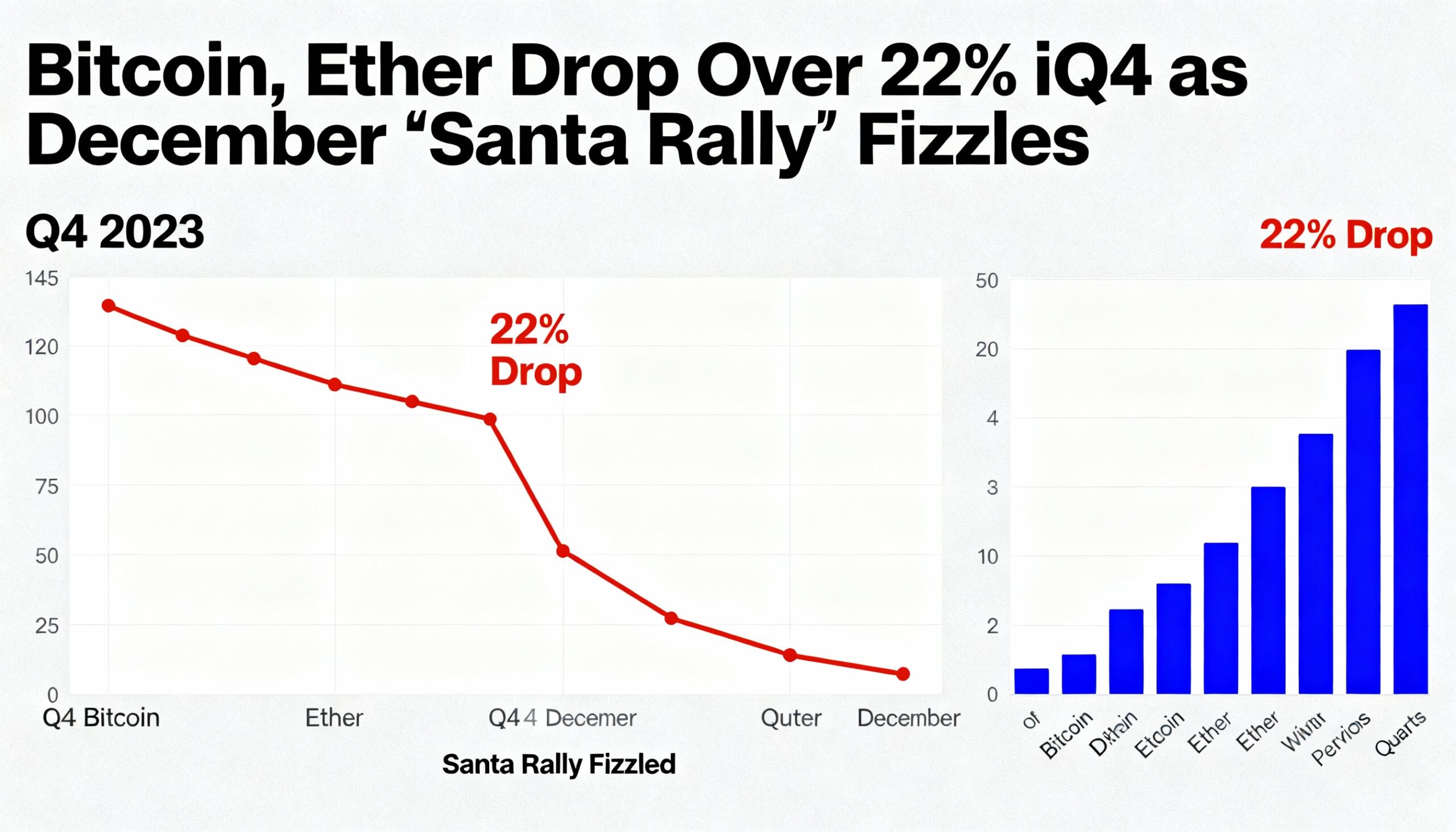

Bitcoin is on pace to finish December down roughly 22%, marking its weakest monthly performance since December 2018. Ether, meanwhile, is set to close the fourth quarter of 2025 down 28.07%, according to data compiled by CoinGlass.

The Santa rally — a seasonal tendency for markets to rise in the final week of December and early January — is typically fueled by thin liquidity, year-end portfolio rebalancing, and positive holiday sentiment. This year, however, December trading resembled a positioning reset rather than the launch of a fresh leg higher.

That matters because crypto markets have historically depended on strong late-year inflows to build momentum for the early part of a cycle. With bitcoin’s fourth-quarter performance turning decisively negative, the broader tape now reflects a risk-off environment rather than risk-on conditions.

The divergence from precious metals has been particularly striking. Gold has pushed to record highs on expectations of rate cuts and heightened geopolitical tensions, while silver has surged and platinum has also set new highs, as previously reported by CoinDesk. Sustained central bank buying and rising ETF allocations have reinforced gold’s role as a reserve-style hedge during periods of uncertainty.

Bitcoin, by contrast, has behaved more like a high-beta asset. Even as the macro backdrop points toward easier monetary policy, the cryptocurrency has struggled to hold gains in the absence of a broader bid for risk.

That pattern has defined much of late 2025, with short-lived rebounds giving way to rapid profit-taking, reduced leverage during the holiday period, and heavy selling during U.S. trading hours as funds tidy up positions. Volatile bond yields and an uneven dollar have kept investors focused on capital preservation — a backdrop that tends to favor gold first and speculative assets later.

The next critical test will be whether bitcoin can maintain its recent support zones as the calendar turns. Failure to do so could see the aborted Santa rally remembered as an early signal that the market still requires a deeper reset before a durable advance can take hold.