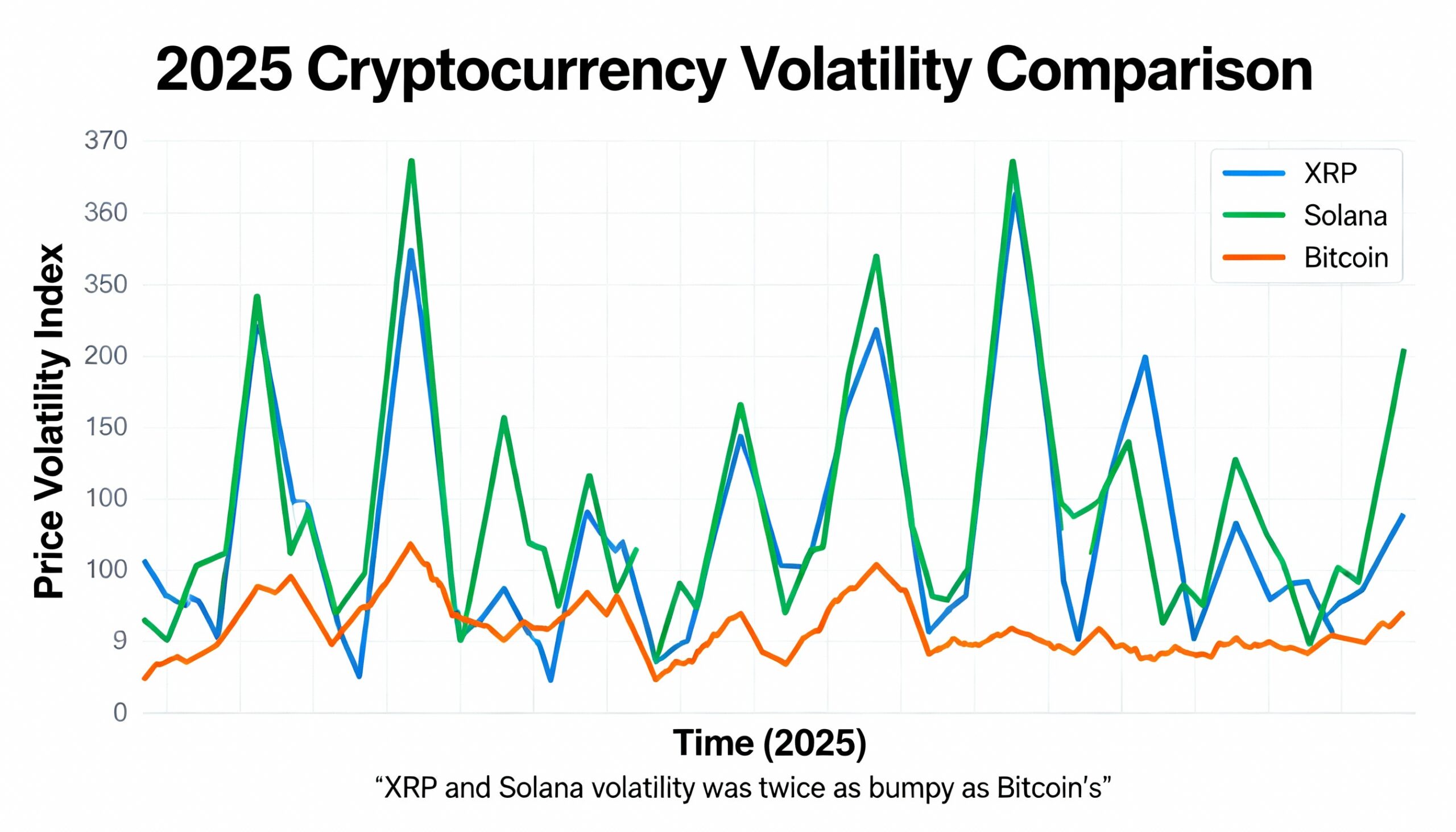

Trading XRP at $1.8616 and Solana at $124.25 proved twice as volatile as Bitcoin at $87,872.22 in 2025, challenging hopes that the crypto market might stabilize beyond the largest digital asset.

Over the past 12 months, realized volatility reached 87% for Solana and 80% for XRP, compared with Bitcoin’s relatively calm 43%, according to CoinDesk Indices. Other major tokens tracked include BNB at $856.58 with 55% volatility, and Ether at $2,978.08 with 77%.

While altcoins have historically been more volatile than Bitcoin, the latest data highlights a growing gap for institutional products. Exchange-traded funds and other investment vehicles tied to XRP and Solana require deeper liquidity to approach the stability seen in BTC markets.

Among the top four cryptocurrencies by market capitalization (excluding stablecoins), only BNB lacks CME futures or U.S.-listed spot ETFs serving as proxies for institutional participation. Since their launch in November, XRP ETFs have drawn over $1 billion from investors, while Solana ETFs—still relatively new—have accumulated $763.91 million, according to SoSoValue.

Sustained demand for these ETFs in the coming year could help temper price swings, as seen with Bitcoin. Bitcoin spot ETFs, which debuted in January 2024, have attracted $56.96 billion in net inflows. This influx has supported more advanced products, such as covered calls, contributing to a noticeable decline in BTC volatility throughout 2025.

Similarly, Ether ETFs, which began trading in July 2024, have seen $12.4 billion in net inflows, reflecting growing institutional appetite and a stabilizing effect on the token’s price.