Spot bitcoin exchange-traded funds (ETFs) recorded their largest outflows on record in November and December, coinciding with a roughly 20% drop in bitcoin prices.

The once red-hot U.S.-listed spot crypto ETFs endured their worst two-month stretch since launch toward the end of 2025, as investors pulled billions of dollars from the products. The heavy redemptions capped a bruising year-end for funds that had been a major conduit for institutional participation in the crypto market.

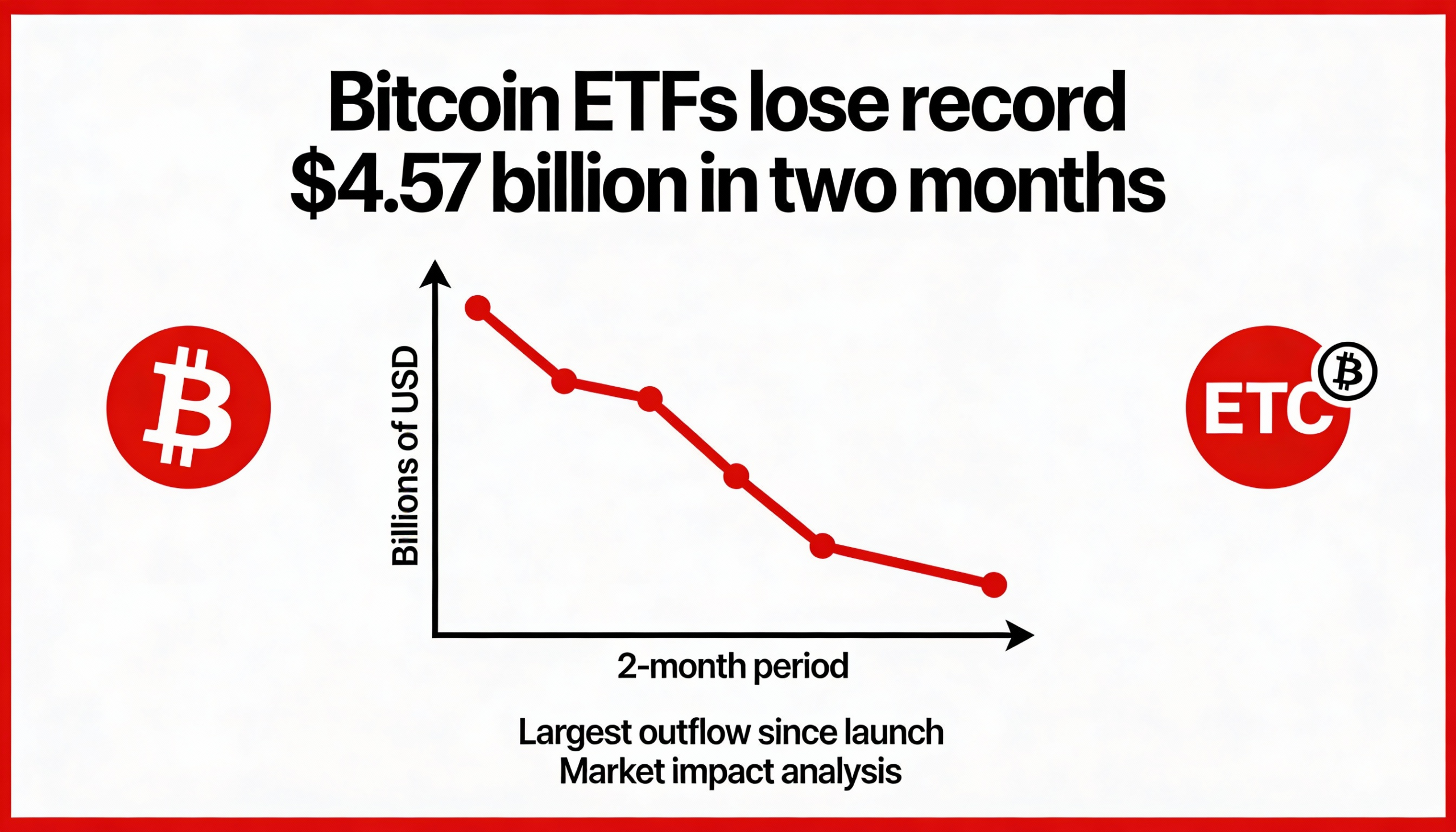

The 11 spot bitcoin ETFs saw net outflows of $3.48 billion in November, followed by another $1.09 billion in December. Together, the withdrawals totaled $4.57 billion over the two months — the largest redemption period since the ETFs debuted in January 2024, according to data from SoSoValue.

The sustained exodus points to a cooling of institutional demand for bitcoin and unfolded alongside a sharp price correction. The prior record for two-month outflows occurred in February and March, when investors withdrew a combined $4.32 billion.

U.S.-listed ether ETFs also faced significant pressure, with more than $2 billion pulled from the funds over November and December.

While the headline numbers suggest deteriorating sentiment, some market participants argue the selling does not reflect outright panic.

“ETF outflows and ongoing liquidations are weighing on sentiment, but the market structure does not resemble panic,” said Vikram Subburaj, CEO of India-based crypto exchange Giottus. “Instead, this looks like an equilibrium phase, with weaker hands exiting into year-end while stronger balance sheets absorb supply.”

Subburaj added that prices appear to be consolidating as both buyers and sellers await a return of liquidity in January.

In contrast to bitcoin and ether ETFs, funds tracking XRP attracted more than $1 billion in inflows over the two-month period, while Solana-focused ETFs drew over $500 million, highlighting a selective rotation toward alternative crypto assets.