Dogecoin Rally Gains Momentum as Volume Surges, Key Support in Focus

Dogecoin (DOGE) rose to $0.1516 as buyers pushed the token through a key technical band, supported by trading volume running well above its 30-day average. The move reflects renewed speculative interest in meme coins, even as the broader crypto market remains range-bound.

Meme Coin Context

The early-2026 meme coin rally was led by Dogecoin and PEPE, with traders leaning into “meme season” positioning. DOGE jumped roughly 11% on the day, while PEPE climbed about 17%. Other dog-themed tokens also advanced: Shiba Inu rose around 8%, Bonk gained nearly 11%, and Floki added close to 10%.

Smaller-cap meme tokens outperformed larger names as well. Mog Coin surged about 14% on the day and 37% over seven days, while Popcat rose nearly 9% and over 17% on the week. Analysts note that these flows often indicate speculative capital spilling from large-cap tokens into smaller, higher-beta names as liquidity returns.

CoinGecko’s GMCI Meme Index showed a total market value of roughly $33.8 billion with $5.9 billion in 24-hour trading volume, confirming the rally was broad-based. Bitcoin’s range-bound trading and uneven post-holiday liquidity likely contributed to traders seeking fast-moving, high-beta risk plays in the meme sector.

Technical Analysis

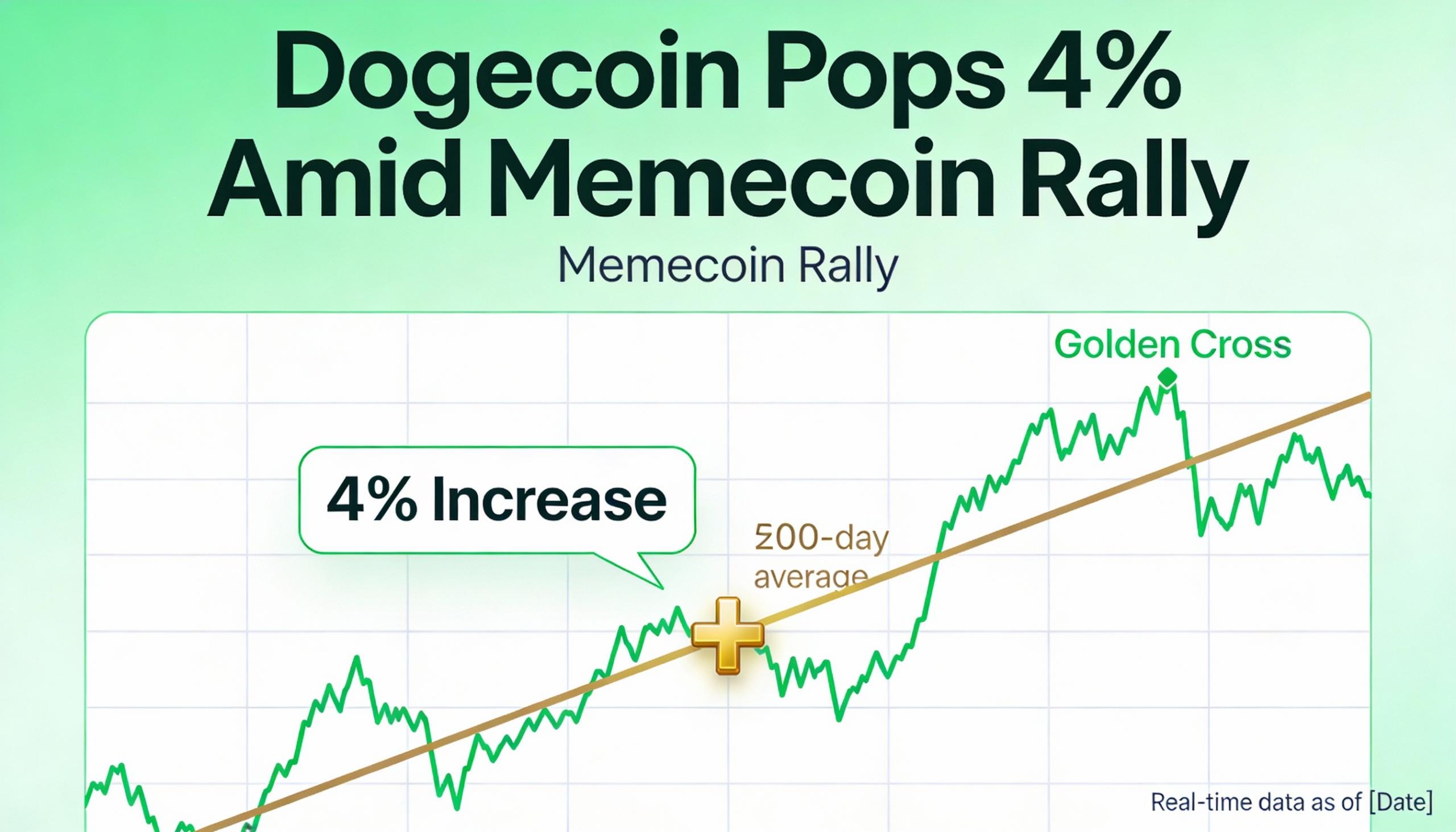

DOGE rose 4.36% to $0.1516 over the 24-hour period ending Jan. 4, decisively outperforming the broader market. Volume was a key confirmation: 24-hour trading activity ran approximately 40% above the 30-day average, signaling that the breakout is supported by genuine participation.

Price action flipped late in the session as DOGE broke out of the $0.1422–$0.1431 consolidation range and built a new base above $0.1463. The next resistance cluster sits around $0.1520–$0.1530, where sellers could reappear.

Short-term momentum indicators also improved. An hourly “golden cross” — the 9-period SMA crossing above the 26-period SMA — appeared, adding confirmation to the breakout in conjunction with rising volume.

Key Levels and Outlook

- Support: $0.1463 is now a critical level; holding it increases the odds of targeting $0.1520–$0.1530.

- Resistance: $0.1520–$0.1530 marks the next supply zone to monitor.

- Bull Case: Consolidation above $0.1500 and a hold of $0.1463 may drive momentum toward $0.1520–$0.1530 and beyond.

- Bear Case: A drop below $0.1463 would suggest the breakout is weakening, with prior range around $0.1432 likely to act as the next support.

Takeaway for Traders

This is a volume-confirmed momentum move within a broader meme coin rebound. Meme tokens often act as a “temperature check” on speculative appetite: they can continue rallying even when bitcoin is range-bound, but liquidity thinning or broader market wobble can quickly unwind gains. The immediate test for DOGE is whether $0.1463 holds, as it will determine if the rally can sustain its momentum.