Bitcoin briefly pushed above $93,000 on Monday, injecting a risk-on tone into global markets, though uneven performance among altcoins suggests traders remain cautious about the sustainability of the rally.

The largest cryptocurrency climbed to an intraday high of $93,350 — its strongest level since Dec. 11 — before paring gains to trade near $92,400. Most of the upside move occurred around midnight UTC, coinciding with the reopening of bitcoin futures trading on the CME, which left a notable price gap between roughly $90,500 and $91,550.

Such CME gaps are often filled within days, raising the likelihood that prices could revisit the lower end of that range later this week.

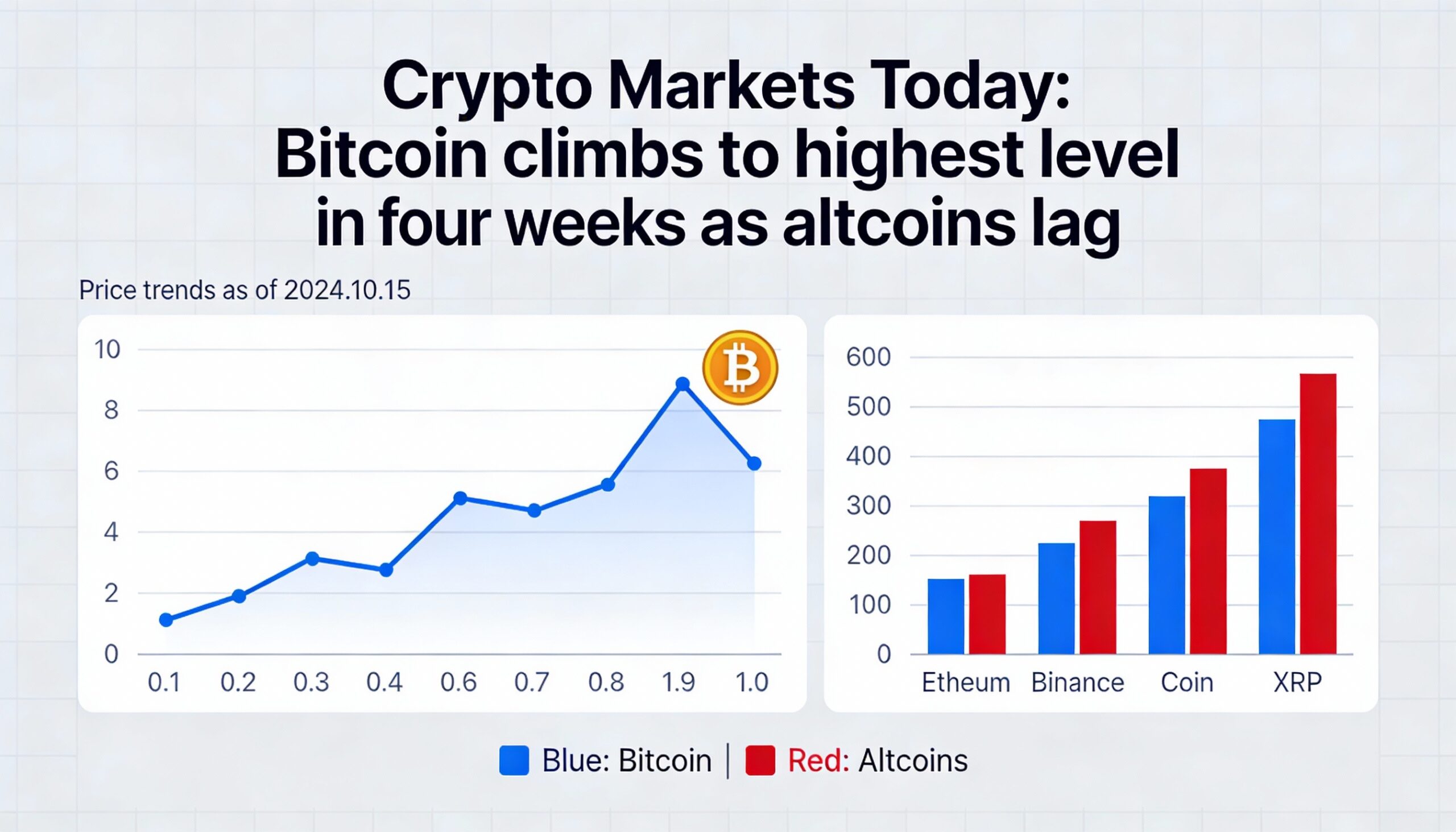

Market participation has remained heavily skewed toward bitcoin. Since midnight, BTC has gained about 1.3%, while broader altcoin benchmarks have lagged sharply. The CoinDesk Meme Index (CDMEME) slid 6.4% and the Metaverse Index (MTVS) fell 2.3% over the same period, underscoring selective risk-taking across the crypto complex.

Traditional markets echoed the risk-on mood, with equities and precious metals advancing overnight following recent U.S.-related developments involving Venezuela.

Derivatives positioning

Liquidations in leveraged crypto futures totaled roughly $260 million over the past 24 hours, with short positions accounting for the majority — a sign that bearish leverage was caught offside by the price jump.

Open interest rose between 2% and 5% in BTC, Bitcoin Cash (BCH), XRP and BNB, while ETH, SOL, DOGE and ZEC saw flat to declining open interest. The divergence points to improving risk appetite concentrated in only a handful of tokens.

With the exception of BTC, BCH, BNB and XLM, the open interest–adjusted cumulative volume delta for most top-20 cryptocurrencies has remained negative over the past day, signaling net selling pressure elsewhere in the market.

BTC perpetual funding rates have climbed above 10% on an annualized basis, reflecting growing demand for bullish exposure, while funding for several altcoins remains below zero. On Deribit, downside hedging in BTC has eased as traders increasingly target $100,000 strike calls. Block trades showed put spreads in BTC alongside call spreads in ETH.

Token talk

Despite the bitcoin-led focus, a handful of tokens outperformed on the day. Newly launched LIT, the native token of perpetual exchange Lighter, rose 3.9% since midnight, while AI-linked token FET extended its weekend rally with a 7.4% gain.

Still, warning signs persist. The average crypto relative strength index (RSI) has climbed to 58 out of 100, edging into overbought territory and raising the risk of near-term profit-taking.

Several tokens failed to benefit from the broader upswing. Zcash (ZEC) slipped 2.5%, while memecoins Dogecoin (DOGE) and Pepe (PEPE) fell 1.4% and 4.5%, respectively.

The fragmented performance across the altcoin market highlights ongoing trader indecision and a lingering lack of liquidity — conditions that have weighed on crypto markets since October’s liquidation-driven selloff.