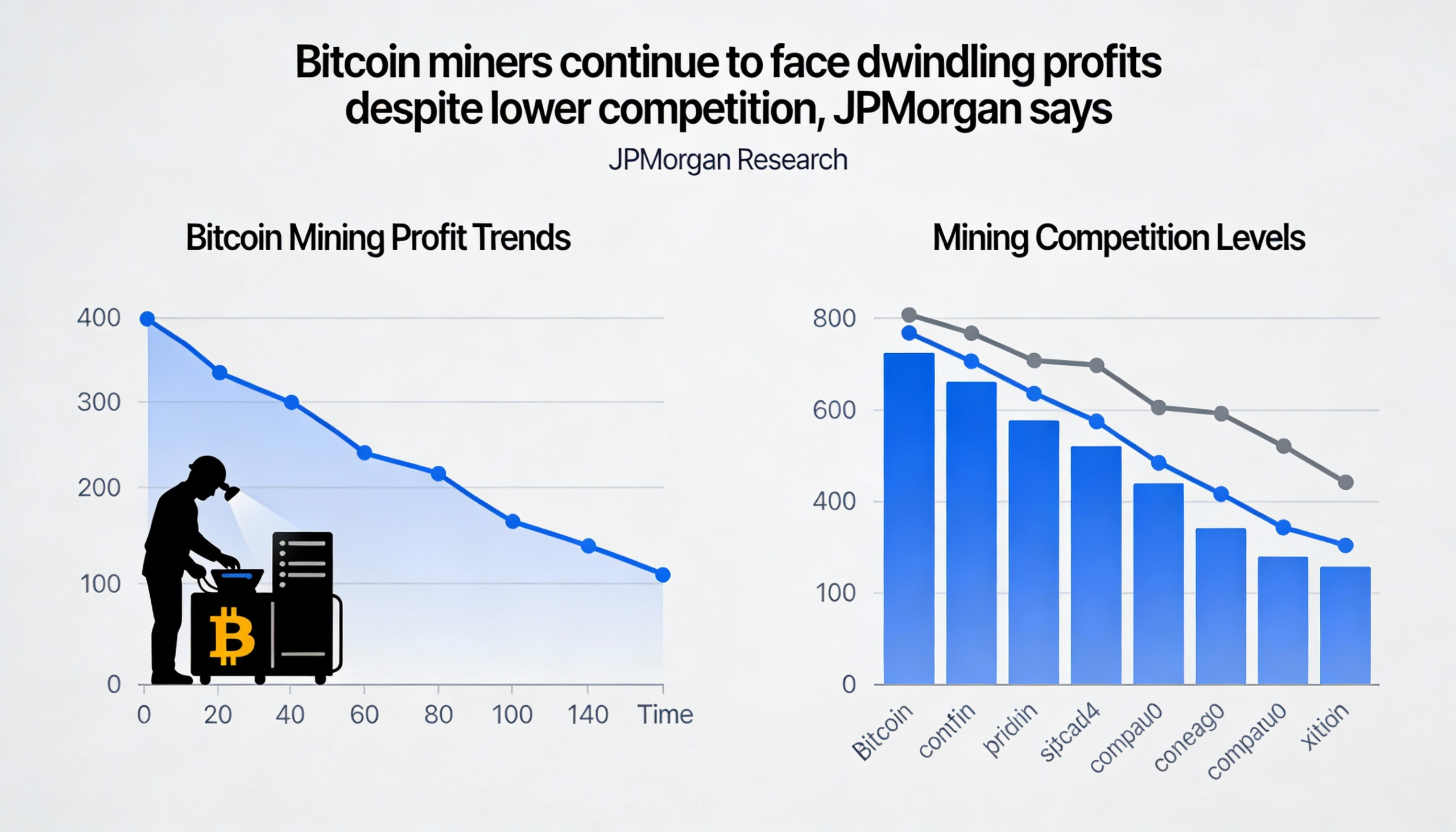

The Bitcoin network’s hashrate, a key measure of mining competition, fell for a second straight month in December, according to a report from JPMorgan (JPM) released Monday.

“The monthly average network hashrate, a proxy for industry competition, declined 30 EH/s (-3%) month-over-month to 1,045 EH/s in December,” analysts Reginald Smith and Charles Pearce wrote. The hashrate represents the total computational power used to mine and process transactions on a proof-of-work blockchain, measured in exahashes per second.

Despite the drop in competition, mining profitability also declined. JPMorgan estimated that miners earned an average of $38,700 per EH/s in daily block reward revenue last month, down 7% from November and 32% year-over-year, marking the lowest level on record. Daily block reward gross profit also fell 9% to $17,100 per EH/s.

The report did not specify the exact reasons for the profit squeeze, but analysts noted that falling bitcoin prices since October likely contributed, compounding pressure from the most recent halving and higher energy costs.

Not all metrics were negative. The combined market capitalization of 14 U.S.-listed bitcoin miners and data center operators tracked by the bank rose to $48 billion by year-end, a 73% increase for 2025. Hut 8 (HUT) led the group last month with a 2% gain, while CleanSpark (CLSK) declined 33%.

Over the full year, nine of the 14 companies outperformed bitcoin, led by IREN (IREN) and Cipher Mining (CIFR), although only two exceeded bitcoin in December, JPMorgan noted.