Tom Lee Predicts New Bitcoin High in January, Warns of Volatile 2026

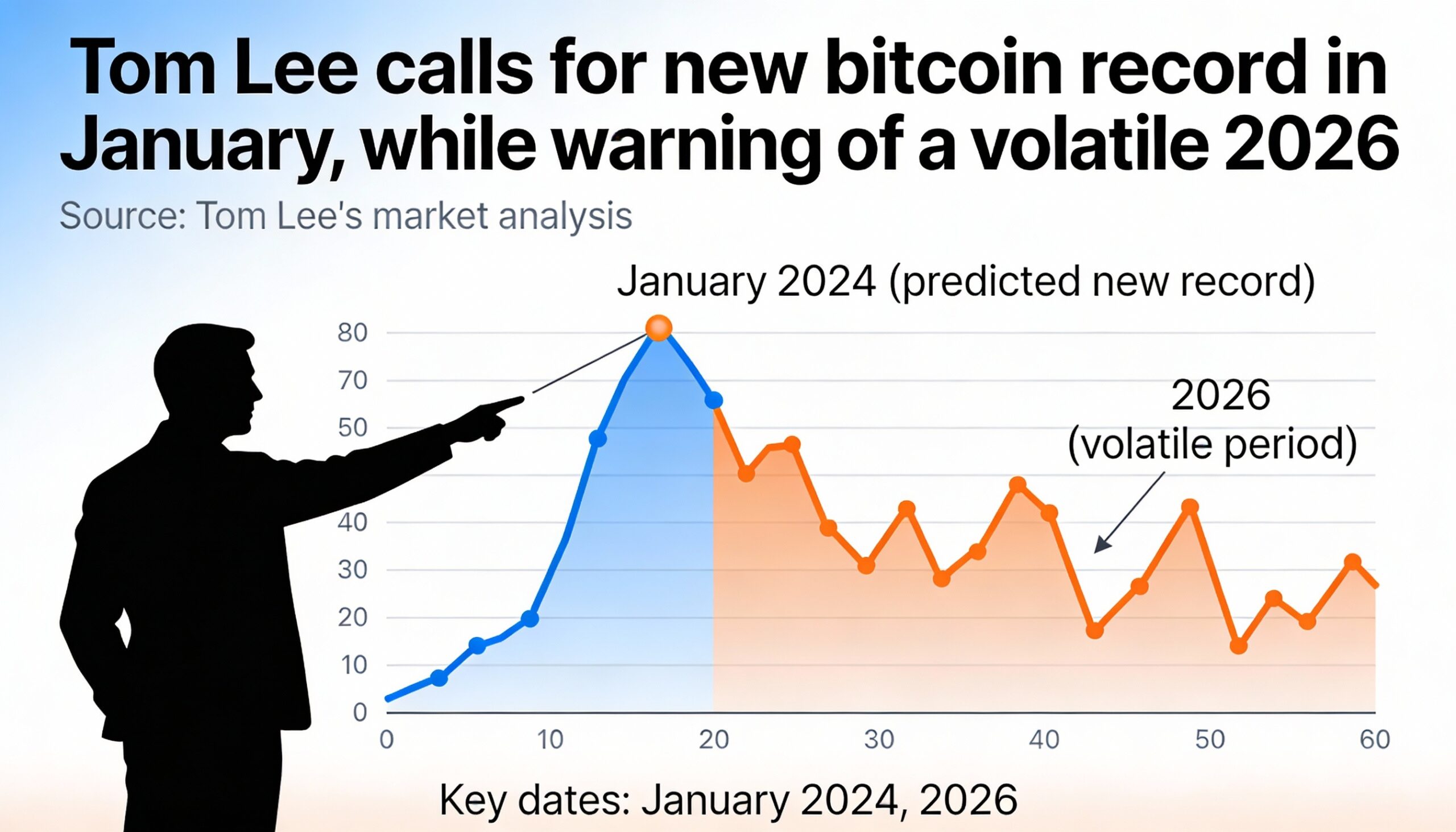

Fundstrat Global Advisors co-founder Tom Lee said Monday that bitcoin (BTC $92,248.07) has not yet reached its peak and could set a new all-time high as early as January, reiterating a bullish outlook for both crypto and equities during an appearance on CNBC’s Squawk Box.

“I don’t think bitcoin has peaked yet,” Lee said. “We were overly optimistic about hitting the high-water mark before December, but I believe bitcoin can reach a new all-time high by the end of January 2026. We should not assume that bitcoin, ethereum, or other cryptocurrencies have already peaked.”

Lee’s comments come after a late-2025 pullback in digital assets, positioning January as a potential breakout month. In August, he had predicted bitcoin would surpass $200,000 before year-end. Bitcoin ultimately reached a record north of $126,000 in October, far below that forecast, and traded near $88,500 on Dec. 31, 2025.

Looking ahead, Lee said 2026 will be volatile but ultimately constructive. “The first half may be challenging due to institutional rebalancing and a strategic reset in crypto markets, but that volatility sets the stage for a massive rally in the second half,” he explained. He stressed that this reset is a normal digestion phase following years of outsized gains.

Lee also highlighted ether (ETH) as entering a multi-year expansion similar to Bitcoin’s 2017–2021 cycle. Despite 2025’s high of $4,830 falling short of his $15,000 forecast, he remains bullish. His crypto mining firm, Bitmine Immersion Technologies, has increased its ether holdings to 4.14 million. “Ethereum is dramatically undervalued,” Lee said. “ETH exposure is a strategic necessity for any modern treasury.”

Beyond crypto, Lee projected an aggressive equity outlook, forecasting the S&P 500 could reach 7,700 by year-end 2026, citing resilient corporate earnings and AI-driven productivity gains. “Any pullbacks in 2026 should be seen as opportunities. There’s a lot to be optimistic about,” he concluded.