Copper-to-Gold Ratio Breakout Sends a Bullish Signal for Bitcoin

The copper-to-gold ratio is pushing higher, a move that has historically aligned with key turning points in Bitcoin’s market cycles. Widely tracked as a macro gauge of economic momentum and investor risk appetite, the ratio has shown a notable relationship with Bitcoin (BTC $91,997), according to analyst SuperBitcoinBro.

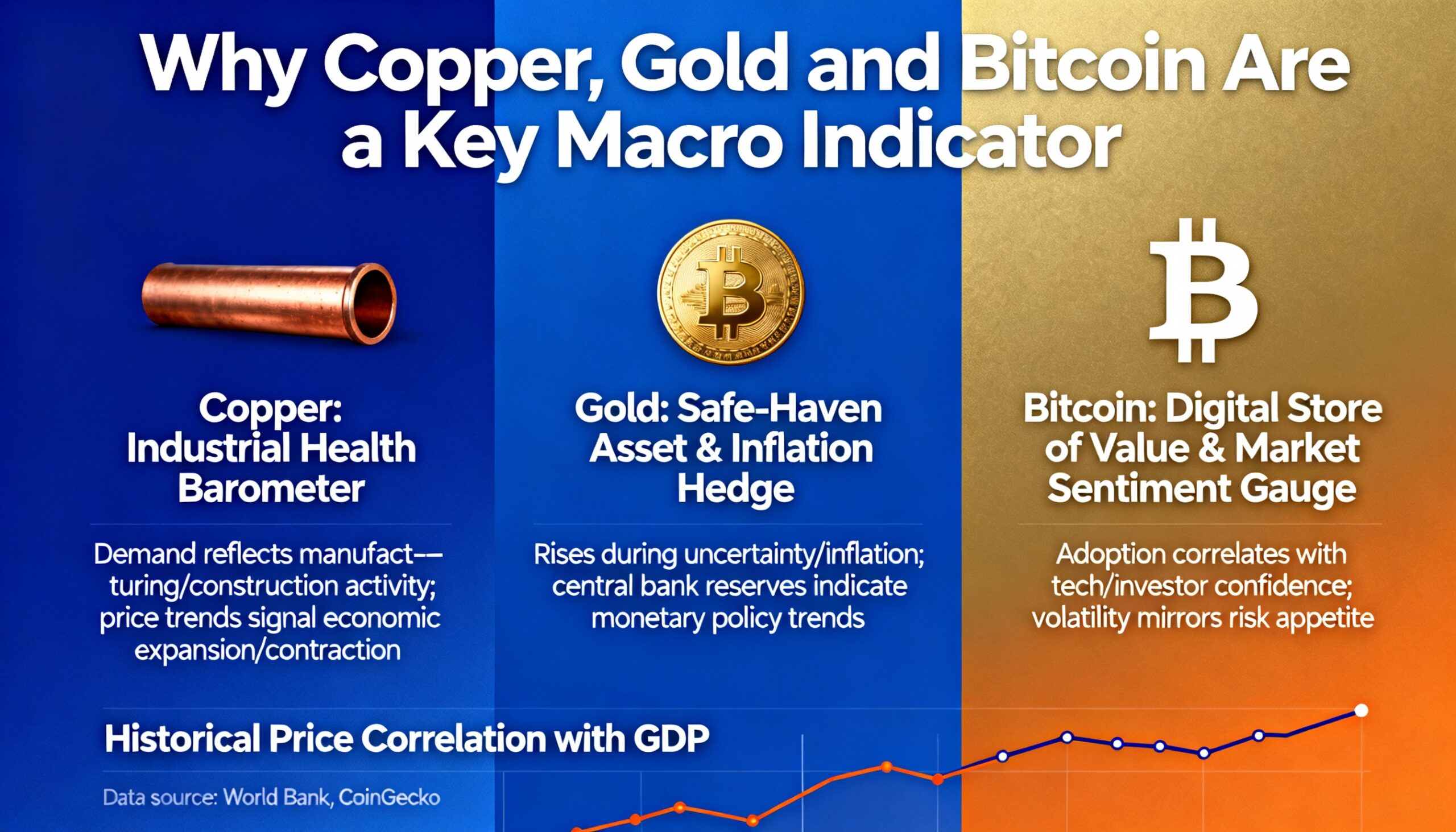

Copper prices are closely linked to industrial activity and tend to strengthen during periods of economic expansion. Gold, by contrast, serves as a defensive asset, typically outperforming when growth expectations fade and uncertainty rises. As a result, a rising copper-to-gold ratio is commonly viewed as a risk-on signal, while a declining ratio points to risk aversion.

Historically, major peaks in the ratio — seen in 2013, 2017, and 2021 — have coincided with Bitcoin cycle highs, reflecting periods of strong global growth expectations and elevated speculative activity. Just as important, however, is the ratio’s behavior following extended downturns. Past reversals have often preceded significant Bitcoin rallies, particularly when they occurred alongside Bitcoin’s halving cycles.

Bitcoin halvings, which reduce miner rewards by 50% roughly every four years, tighten supply and have historically acted as catalysts for longer-term bull markets. During the fourth halving in April 2024, the copper-to-gold ratio was still trending lower. That dynamic has since changed. After bottoming near 0.00116 in October, the ratio has rebounded to around 0.00136.

At the same time, copper prices have surged above $6 per pound to record highs, while gold trades near $4,455 per ounce, also close to its peak. Over the past three months, copper has gained roughly 18%, with gold up about 14%.

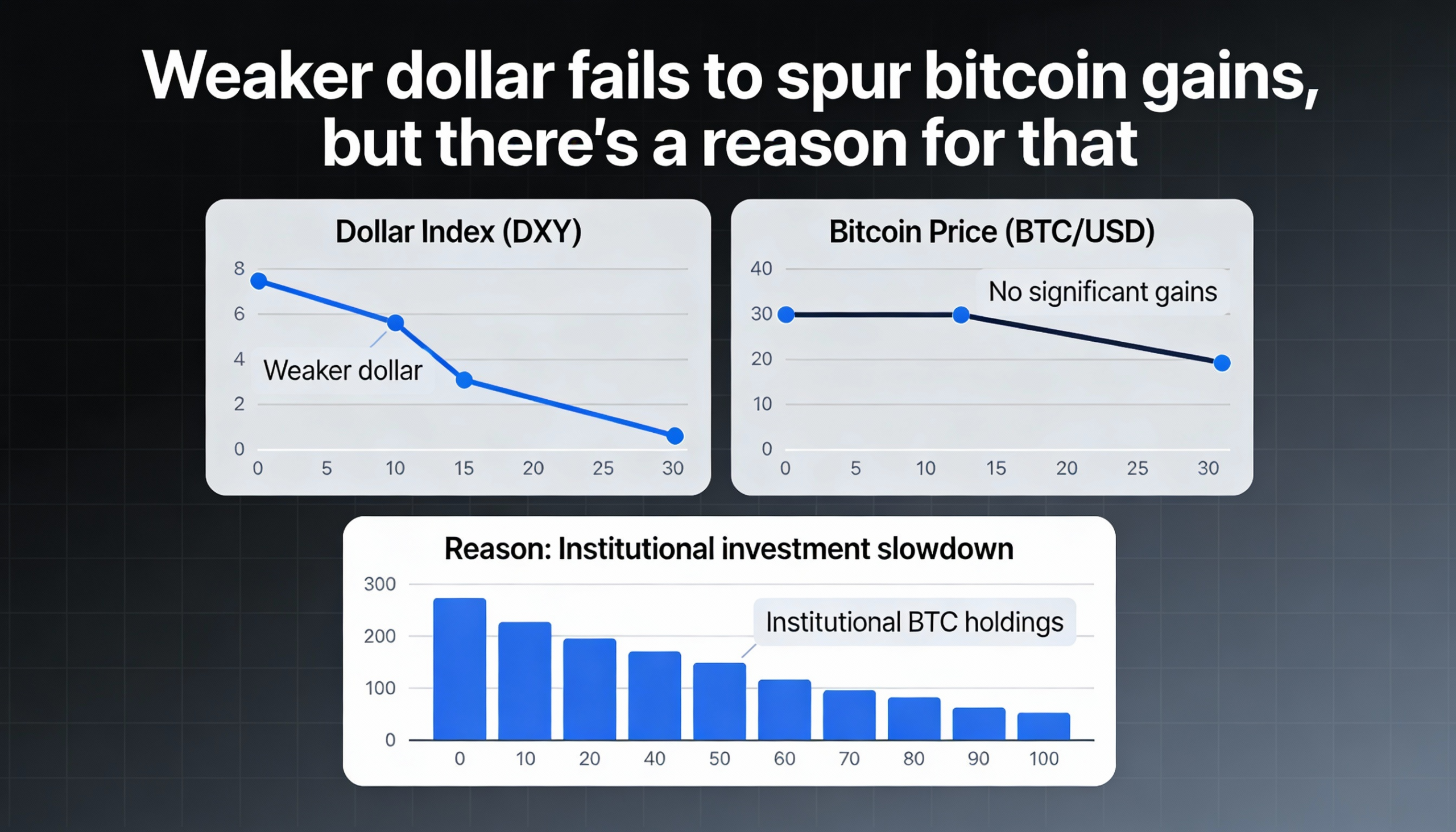

If copper’s strength reflects improving growth expectations rather than supply constraints alone, the resulting risk-on signal could provide macro support for a renewed Bitcoin rally in 2026.