Bitcoin Fades From Multiweek Peak as Altcoins and Memecoins Take the Lead

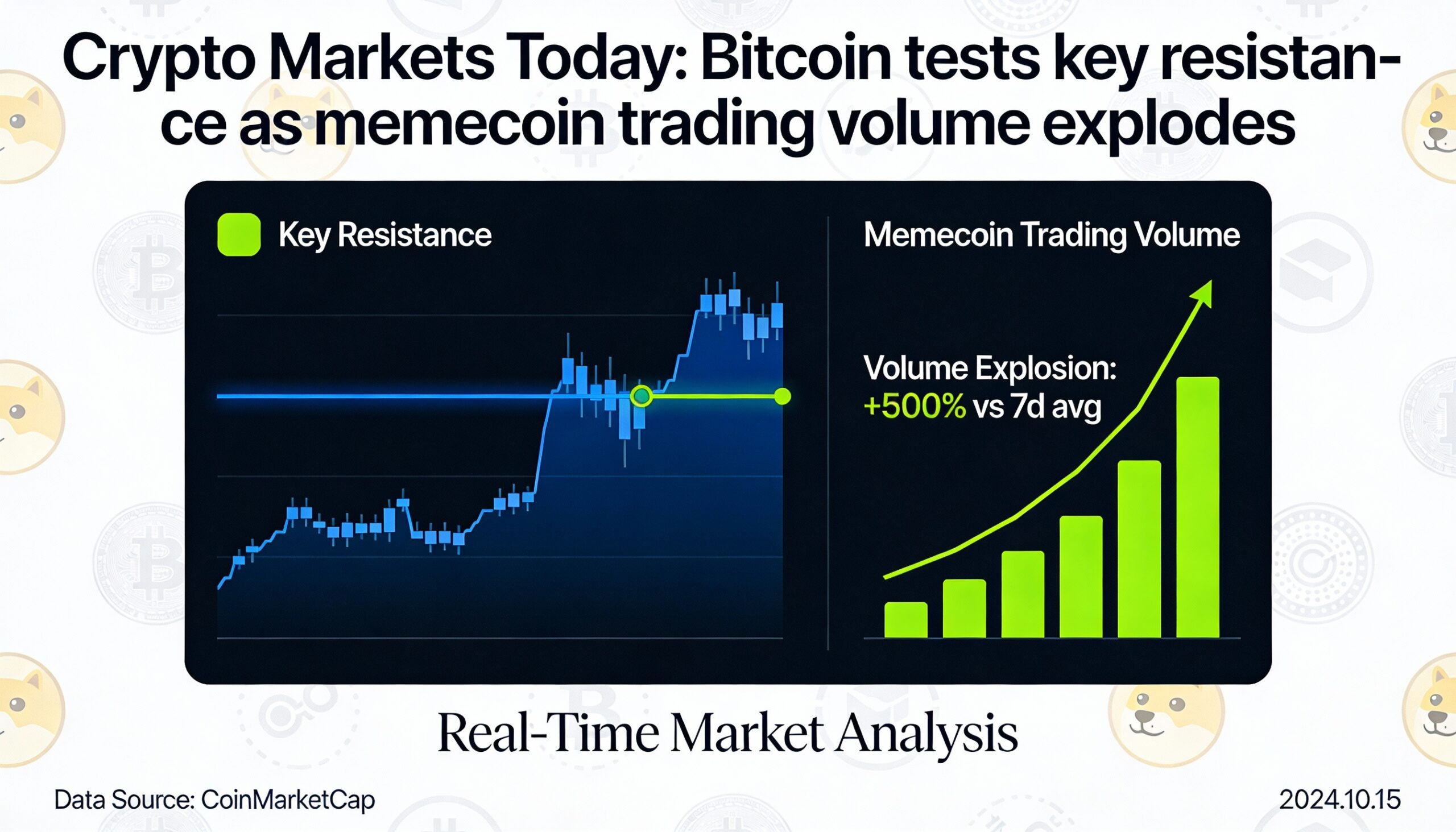

Bitcoin (BTC $91,901) pulled back after briefly reaching its highest level since mid-November, once again hesitating near a price zone that capped rallies in early December. The level has emerged as a near-term technical hurdle, with some traders positioning for a rejection while others look for a breakout that could target the $98,900 area — a key former support range from mid-2025.

Even as bitcoin stalled, appetite for risk surfaced elsewhere in the market.

Altcoins Gain Ground

Sui (SUI) extended its advance, rising more than 3% since midnight UTC and roughly 16% over the past 24 hours. XRP continued its strong start to the year, climbing nearly 29% since Jan. 1 and reaching its highest levels in weeks.

Speculative interest also picked up in memecoins. Daily trading volume on Solana-based token generator Pump.fun surged to a record $1.27 billion, signaling renewed retail participation. The CoinDesk Memecoin Index (CDMEME) added 1.5%, pushing its year-to-date gain to 19%.

Derivatives Show Short Covering

More than $400 million in crypto futures positions were liquidated over the past 24 hours, with the bulk of losses coming from short positions — evidence that many traders entered 2026 positioned defensively.

Bitcoin’s global futures open interest held steady near 660,000 BTC, while XRP open interest jumped to 2 billion XRP, the highest since Oct. 11, pointing to fresh leverage entering the XRP market as prices pushed higher.

Funding rates across major tokens remained mildly positive, consistent with a bullish bias. However, negative funding in assets such as SOL, TRX, ZEC, SHIB and UNI suggests that bearish positioning is still building in select names.

Market volatility remains subdued. Volmex’s BVIV index, which tracks 30-day implied volatility for BTC, slipped back toward 44% after a brief spike earlier in the session. On Deribit, downside hedging in BTC and ETH continued to ease, with traders favoring call options. Block trades featured BTC and ETH call spreads alongside BTC strangles.

Memecoins and Token-Specific Catalysts

After a bruising 2025 that saw widespread drawdowns, memecoins are back in focus. In addition to Solana-based activity, traders have also rotated into BNB Chain tokens, particularly Chinese-language projects grouped under the “Four Meme” theme popularized by Binance founder Changpeng Zhao.

Beyond the memecoin space, Sui attracted fresh interest after Mysten Labs released research on privacy-preserving blockchain transactions, sparking speculation that the network could eventually support enhanced privacy features.

CoinMarketCap’s altcoin season index climbed to 27 out of 100 — still firmly in bitcoin-dominated territory, but well above December’s low of 14, suggesting early signs of broader market participation. Still, elevated relative strength indicators across several altcoins point to the risk of near-term consolidation or profit-taking.