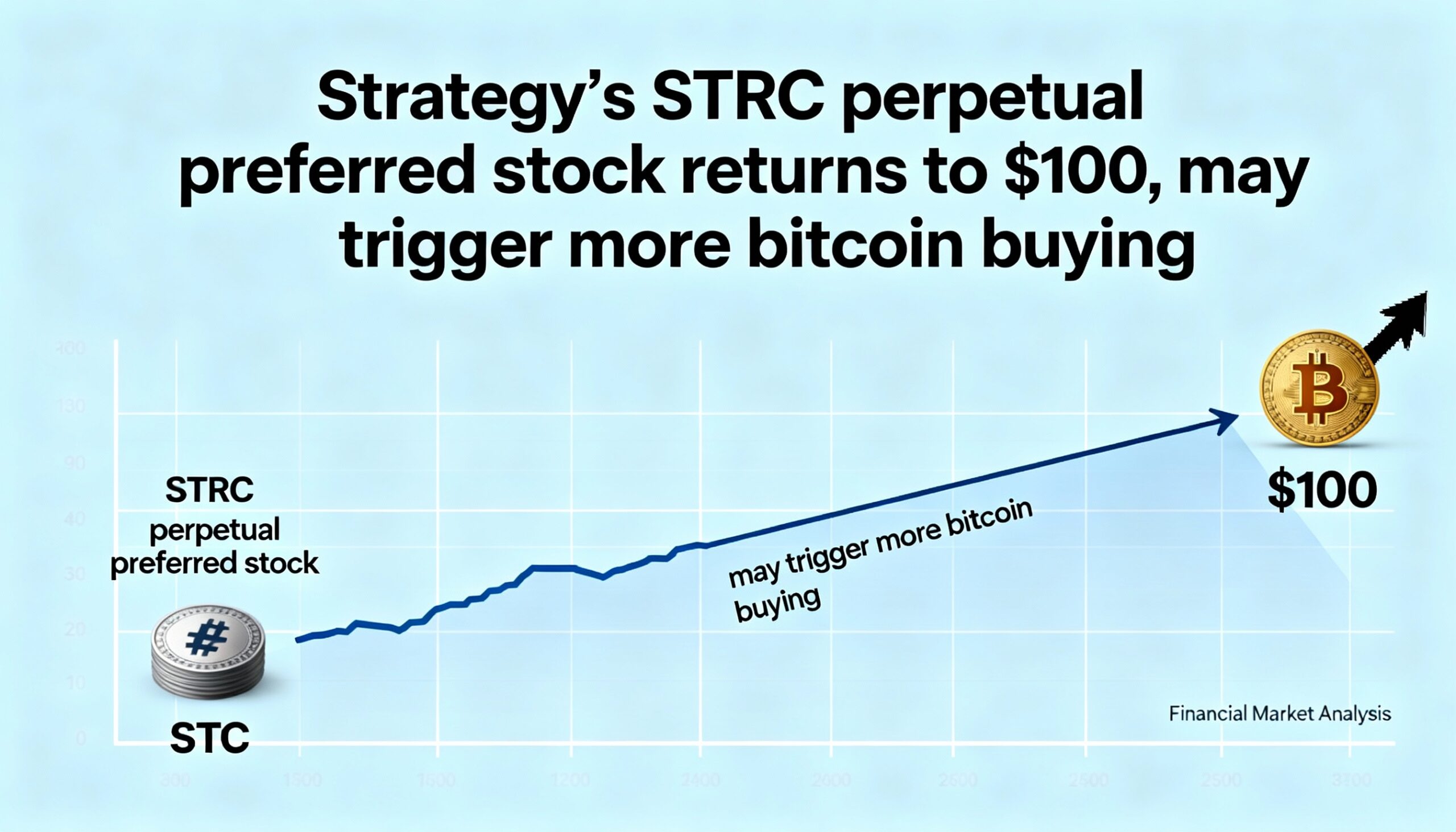

Strategy’s STRC Preferred Stock Returns to $100, Opens Path for Additional Bitcoin Purchases

Strategy’s (MSTR) perpetual preferred equity, STRC, hit $100 for the first time since early November, potentially paving the way for new sales to fund more Bitcoin (BTC $90,637) acquisitions.

The short-duration, high-yield credit product reclaimed the $100 mark in pre-market trading, a level it last reached between Nov. 4 and Nov. 13 before dipping to around $90. With STRC back at par, Strategy can now issue shares through at-the-market (ATM) offerings, providing fresh capital for Bitcoin purchases.

STRC currently offers an 11% annual dividend, distributed monthly in cash, with rates reset monthly to encourage trading around the $100 par value and reduce price volatility. Since its introduction in July, the equity has gained 16%, offering an effective yield of roughly 11%—calculated as the current dividend divided by the share price.

At the start of the year, Strategy raised the STRC dividend to 11%, marking the fifth increase since launch. Meanwhile, the company’s common stock gained 4% in pre-market trading to $165, while STRC edged up 0.03% to $100.