Strategy Outperforms Amid MSCI Decision, but Crypto Weakness Keeps Gains in Check

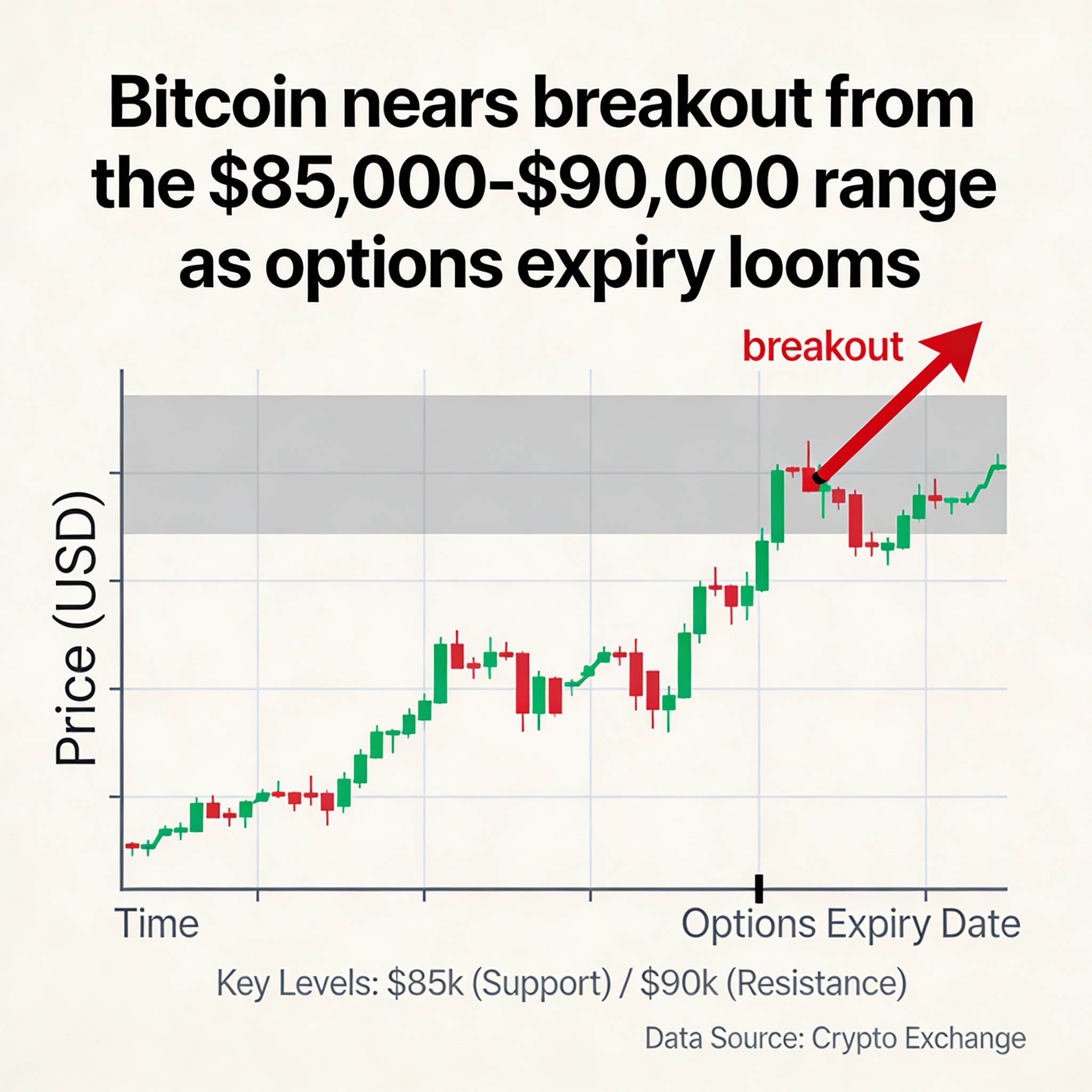

Bitcoin (BTC $91,049.15) and most major digital assets declined in U.S. trading Wednesday, extending losses from overnight. At press time, Bitcoin was down roughly 3% over 24 hours, hovering near $91,100.

The CoinDesk 20 Index, tracking the top 20 crypto assets, fell nearly 4%, with XRP leading the drop at over 8%. Ether (ETH $3,120.05) slid 3.6%, failing to gain traction despite Morgan Stanley’s recent move to offer a spot ETH ETF.

The broader crypto selloff contrasted with the Nasdaq, which gained 0.5%, while precious metals retreated from recent highs—gold fell 1% and silver lost 5%.

Digital asset treasury (DAT) stocks saw muted reactions after MSCI announced Tuesday it would not exclude Strategy (MSTR) from its indexes. While Strategy outperformed with a 1% gain, much of the sector fell, including Bitmine Immersion (BMNR) down 6%, Sharplink Gaming (SBET) off 2%, and XXI (XXI) down 5%.

On the weekly timeframe, the MSTR to iShares Bitcoin Trust (IBIT) ratio rebounded off the 3-level for the second consecutive week and is trading around 3.11. In March 2024, the ratio held at 3 as support before rallying to a peak of 9.5 in November 2024, coinciding with MSTR reaching its all-time high. Bulls will be watching to see whether the 3-level continues to act as a key support.